TLDR

MARKET RECAP → The S&P 500 closed higher on Monday boosted by strong corporate earnings.

💼 EARNINGS DEFY GRAVITY → Third-quarter earnings crushed expectations as margins held firm and profits stayed resilient, fueling hopes the Fed can pull off a soft landing.

💻 PALANTIR POWERS AHEAD → Palantir (PLTR) beat Q3 expectations, logged its sixth straight profit, and raised guidance as AI adoption fuels breakout growth across its platforms.

Was this email forwarded to you? Sign up for free here.

MARKETS

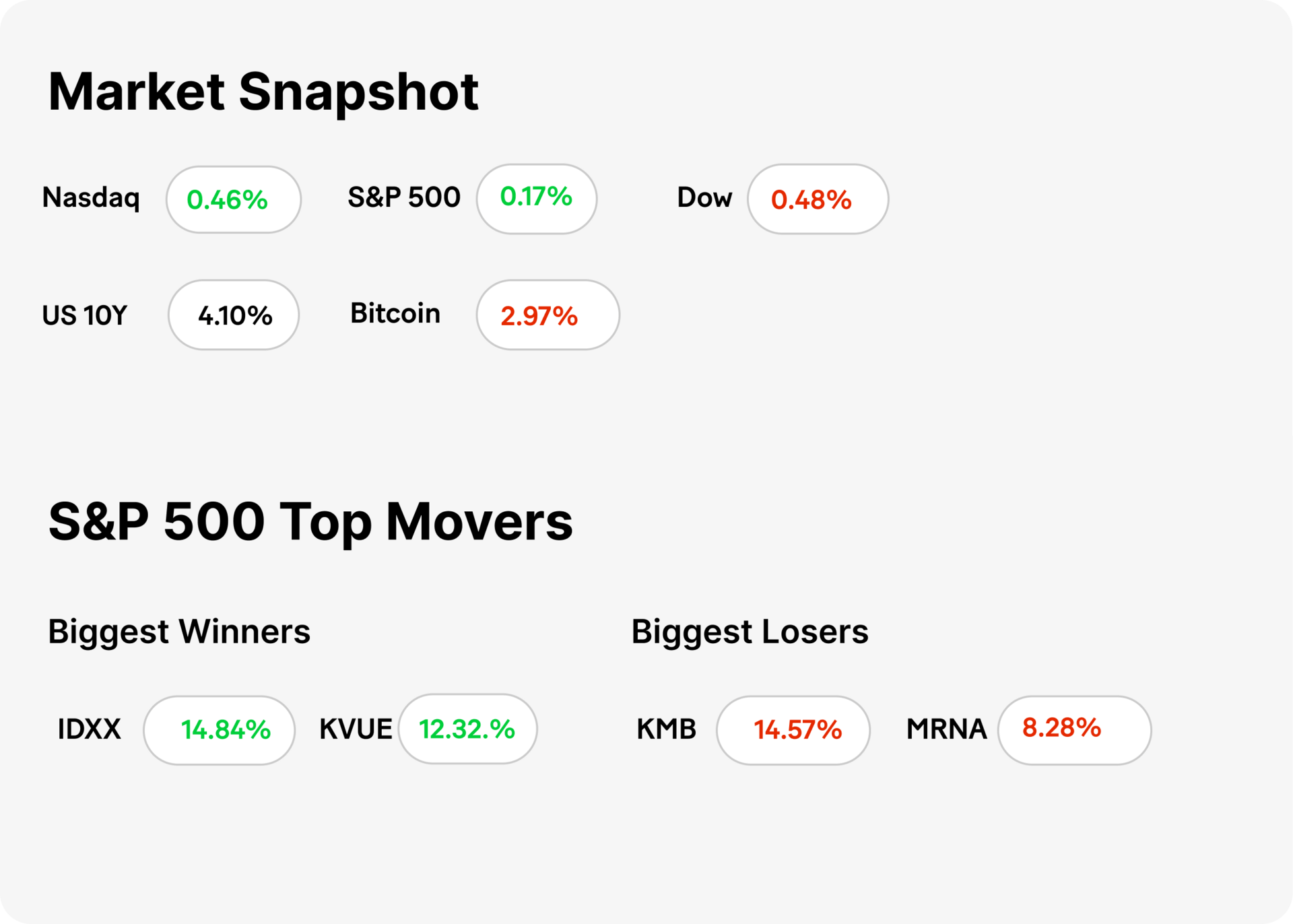

Market Snapshot

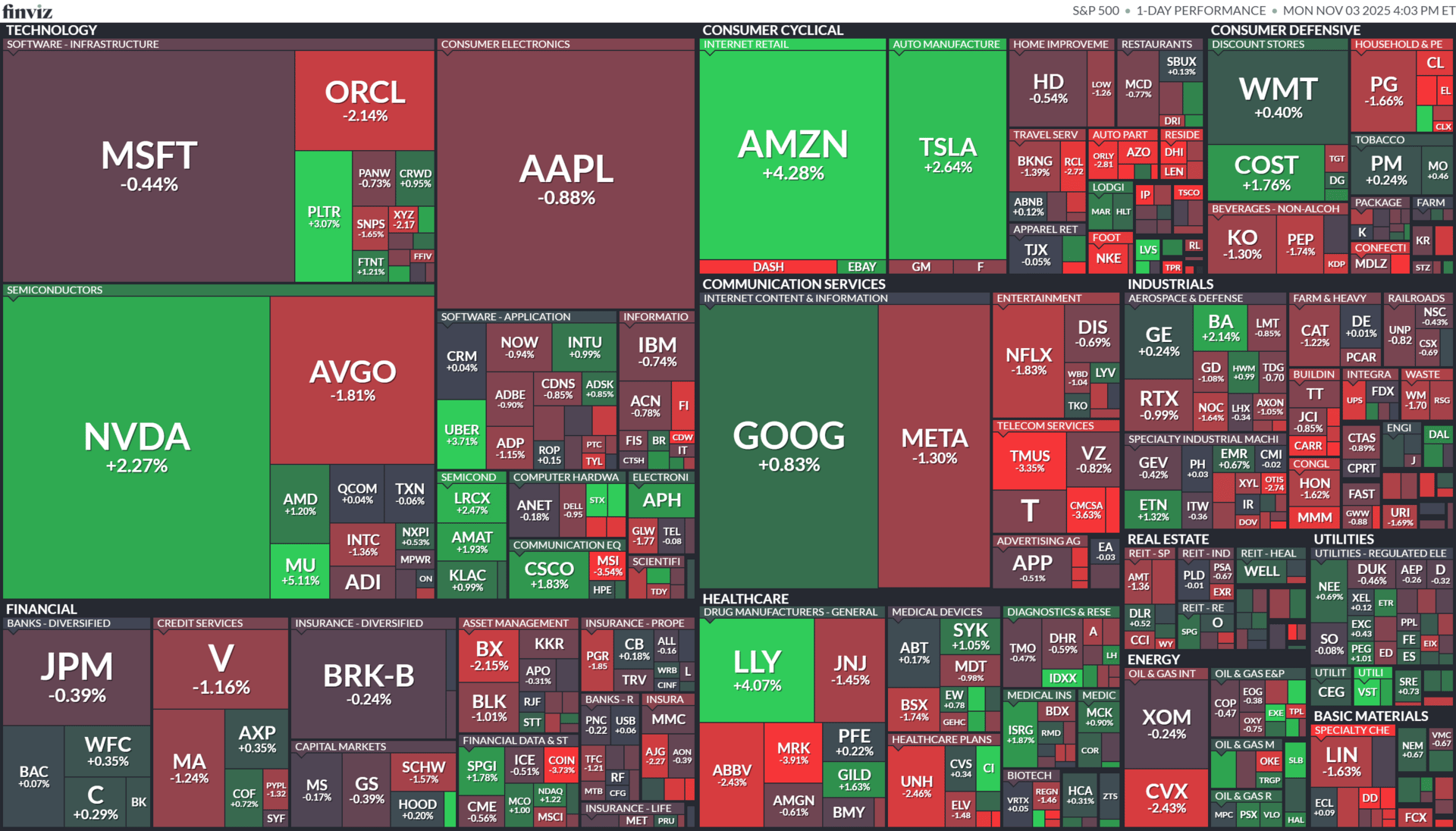

Today’s S&P 500 Heatmap

Notable Earnings Next Week

For the week beginning November 3, 2025

TECH

Earnings Defy Gravity

Gemini

💼 Corporate America stays strong. With over 75% of S&P 500 companies reporting, third-quarter earnings beat expectations by roughly 7% on average, led by tech, financials, and industrials. Analysts say profit resilience is outpacing slowing GDP growth.

📊 Margins hold up. Despite higher wages and borrowing costs, many firms kept margins steady through cost cuts, pricing power, and AI-driven efficiency gains. The results signal that U.S. companies are adapting faster than economists expected.

⚖️ Markets eye Fed next. Investors are now watching whether the Federal Reserve’s rate cuts—paired with still-solid profits—can engineer a true soft landing instead of a delayed downturn.

TECH

Palantir Powers Ahead

💻 Earnings crush expectations. Palantir (PLTR) reported Q3 revenue of $777 million, up 21% year over year, topping Wall Street estimates as demand for its AI-driven software surged across both commercial and government clients.

🧠 AI leads the charge. CEO Alex Karp said Palantir’s Artificial Intelligence Platform (AIP) is driving record adoption, with U.S. commercial revenue jumping over 50%, marking the company’s fastest growth segment.

📈 Profits and outlook rise. Palantir posted its sixth consecutive profitable quarter and raised full-year guidance, sending shares up more than 9% in after-hours trading. Analysts said Palantir is becoming “a pure-play AI winner.”

KEEP READING

Layoffs are mounting, making it a ‘challenging time to be unemployed,’ expert says. Here are 4 money moves to make(CNBC)

Ether falls 7% following a multimillion dollar hack of a decentralized finance protocol(CNBC)

Russia looks to cosy up with China after Trump’s meeting with Xi (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

SHARE OUR NEWSLETTER FOR SWAG!

OUR FAVORITE TOOLS & RESOURCES

Gamma.app — AI Powerpoint Slide Generator.

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.