TLDR

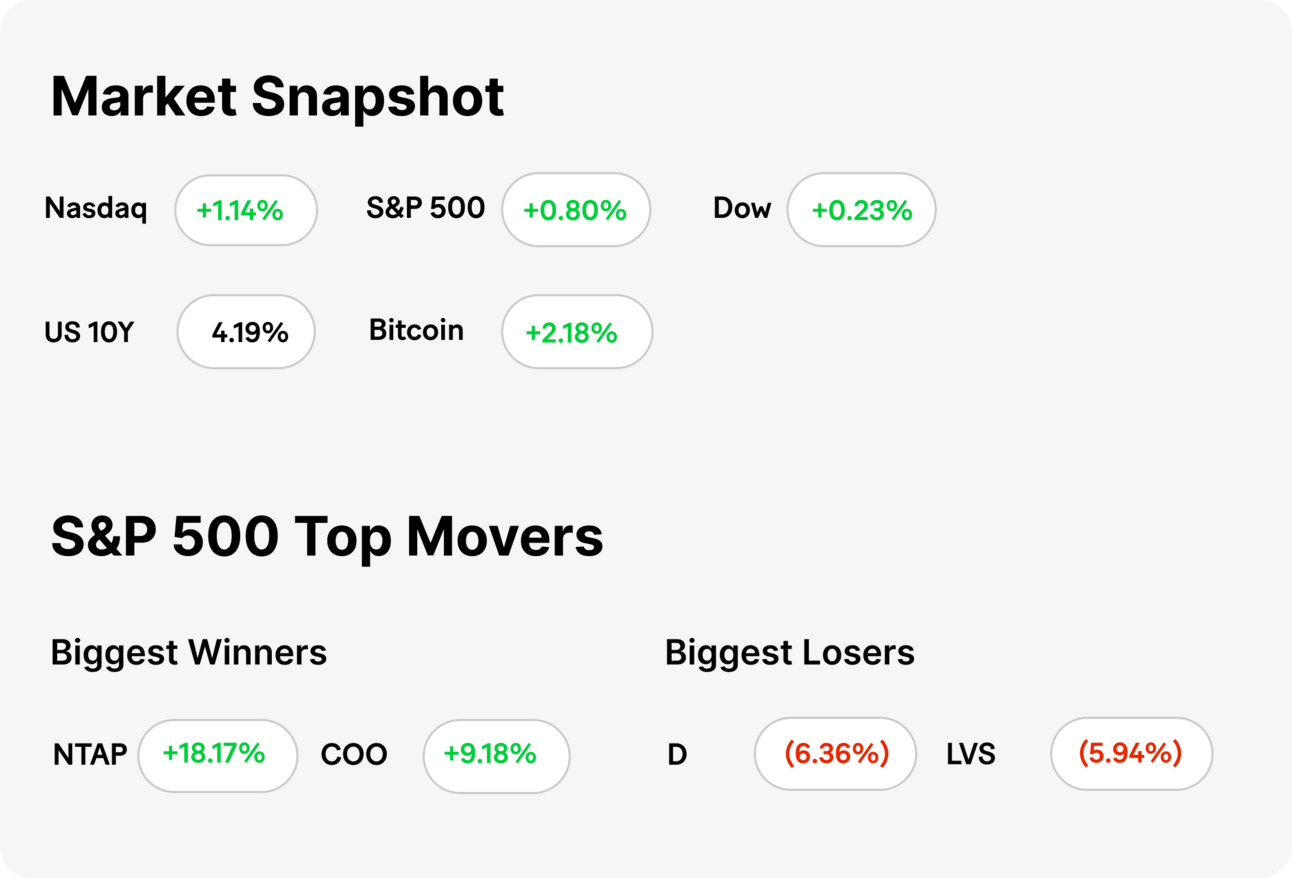

MARKET RECAP → The Nasdaq Composite (QQQ) rose to an all-time high Friday, exceeding its 2021 record levels, as the markets continue to pile into large-cap tech stocks. Meanwhile, Bitcoin (BTC) continues to absolutely rip, up over 22% this week, trading over $62K Friday afternoon.

MUSK VS. OPENAI → 🤖 Elon Musk sues OpenAI, alleging a betrayal of their humanitarian mission for AI, in a high-stakes legal drama that underscores the tech titans' clash over the soul of artificial intelligence.

ANIMAL SPIRITS SOAR → 🚀 Amid Fed rate-cut hopes, markets echo 2021's speculative rush with Bitcoin's (BTC) surge, SPACs revival, and meme stock mania, driving record highs and a bold leap into riskier assets.

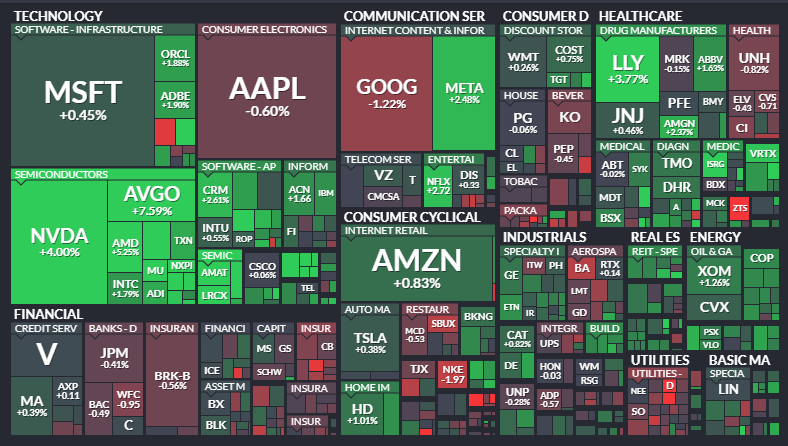

Today’s S&P 500 Heatmap

Today’s Top News

MUSK VS. OPENAI

🚀 Founding Vision Feud: Elon Musk filed a lawsuit against OpenAI and CEO Sam Altman, claiming they veered off the nonprofit's original mission of developing AI for humanity's broad benefit. Musk, a co-founder who stepped down from the board in 2018, alleges OpenAI has become a profit-driven entity under Microsoft's (MSFT) influence, contradicting its founding principles.

💼 Partnership Pivot: The lawsuit criticizes OpenAI for prioritizing profit generation for Microsoft over its commitment to benefiting humanity, marking a significant departure from the vision Musk and others had when founding the AI research lab. This shift has sparked Musk's legal action to realign OpenAI with its original, altruistic goals.

🌐 Tech Titans Tangle: This legal battle pits two of the tech world's most influential figures against each other amidst the AI boom, with Musk's ventures spanning from Tesla (TSLA) to Neuralink, and Altman's rocky tenure at OpenAI, including a brief ouster. The lawsuit emerges as AI's potential and ethical implications are hotly debated, highlighting the growing tensions over the direction and control of influential AI entities.

ANIMAL SPIRITS SOAR

📈 Party Like It’s 2021: A Federal Reserve rate-cut signal ignited a rally, with speculative activities reminiscent of 2021 surging, from Bitcoin's (BTC) leap to $64,000 to SPACs' comeback and chatroom trading's resurgence. This enthusiasm has driven S&P 500 (VOO) and Nasdaq (QQQ) to record highs, echoing the pandemic-era investment fervor.

🌍 Risk On: Emerging market distressed debt saw a notable 25% increase from its lows, highlighting investor appetite for risk amid expectations that inflation will hit the Fed's target without triggering a recession. This shift towards high-risk investments reflects a broader confidence in the market's direction, spurred by the anticipated Fed rate cuts.

🎮 Return of Retail: Retail traders on platforms like Reddit's "WallStreetBets" have reignited their passion for meme stocks and new tech favorites, with sentiment reaching its most bullish level since June 2021. The return of "YOLO" investing and a spike in SPAC IPOs illustrate a widespread euphoria in U.S. equities.

Keep Reading

Yum China CEO says consumers are growing more ‘rational’ as rising costs cut dining budgets (CNBC)

Death of shipping CEO Angela Chao under ‘criminal investigation,’ Texas sheriff says (CNBC)

Snowflake’s Slootman says he’s not worried about employee exodus: ‘This is not a personal cult’ (CNBC)

Some transportation sector giants have ‘cash to burn’ in freight recession rebound (CNBC)

Why China, Japan and the Fed are shaking up the $26 trillion U.S. Treasury market (CNBC)

Stanley cup maker has a plan to make its product launches less chaotic (CNN)

Dude, you’re not getting a Dell. So why is its stock soaring? (CNN)

Notable Posts

What We’re Watching

Our Favorite Tools & Resources

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — crypto market data

Finviz — financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more.

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link.

We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.