TLDR

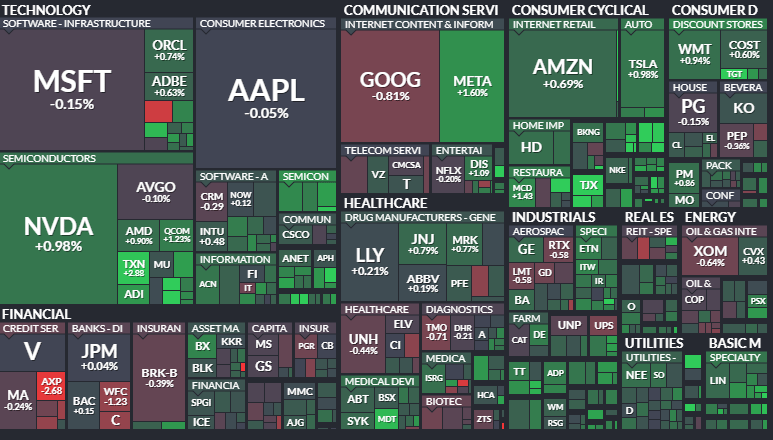

MARKET RECAP → The S&P 500 rose Wednesday after the July Fed minutes suggested a higher likelihood of a rate cut in September.

FED'S JULY MINUTES SHOW MIXED VIEWS → 📊 The Fed's July minutes revealed a split on the economic outlook, with members cautious and emphasizing the need to watch economic data closely before making further decisions.

PAYROLL GROWTH TAKES A HIT → 📉 The Labor Department revised nonfarm payroll growth down by 818,000 jobs, revealing a weaker job market than initially reported and raising concerns about the strength of the economic recovery.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

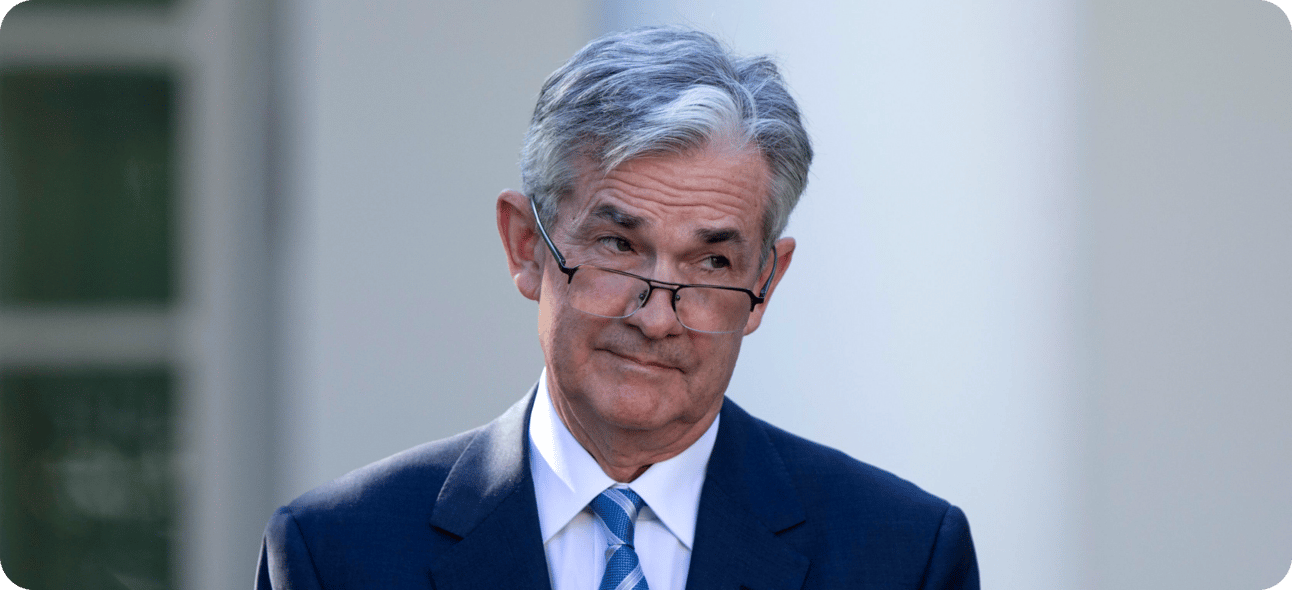

Fed's July Minutes Show Mixed Views

📊 The Federal Reserve's July minutes revealed that officials were divided on the economic outlook, with some concerned about ongoing inflation while others pointed to signs of slowing economic growth.

🔍 The minutes reflected uncertainty within the Fed, with members highlighting the need to be cautious and data-dependent in future policy decisions, focusing on a balanced approach to managing risks.

📉 The overall sentiment was one of watchfulness, as the Fed planned to monitor upcoming economic data closely before taking any further actions.

TODAY’S TOP NEWS

Payroll Growth Takes a Hit

📉 The Labor Department revised down nonfarm payroll growth by 818,000 jobs, a significant adjustment that highlighted weaker-than-expected employment gains over the past year.

🔍 This revision suggested that the job market was not as robust as initially reported, raising concerns about the strength of the economic recovery.

🏛️ The downgrade may influence future monetary policy decisions, as it reflects a more fragile labor market than previously understood.

KEEP READING

Starbucks’ new CEO will supercommute 1,000 miles from California to Seattle office instead of relocating (CNBC)

U.S. job growth revised down by the most since 2009. Why this time is different (CNBC)

44-year-old’s garage side hustle brings in $148,600 a year: ‘You don’t have to have business experience’ (CNBC)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.