TLDR

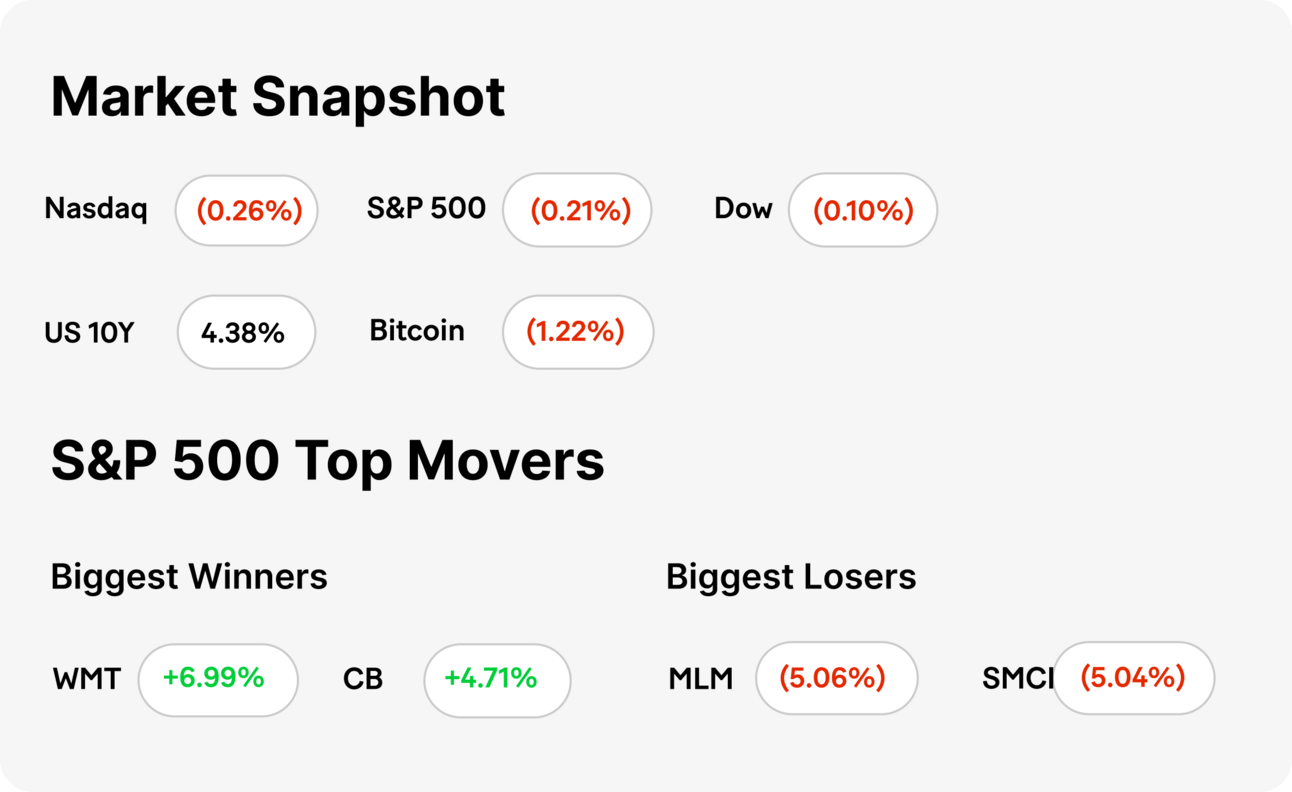

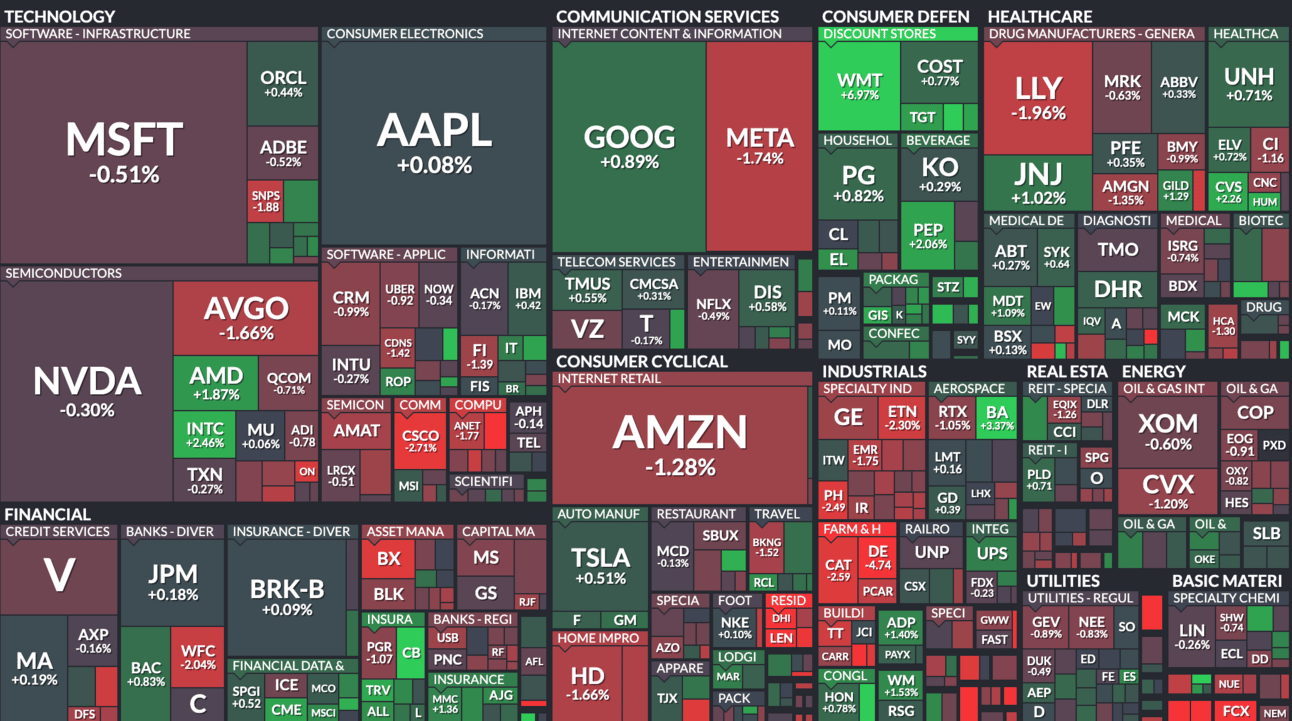

MARKET RECAP → The Dow (DIA) closed slightly lower on Thursday after briefly topping 40,000 for the first time. The surge was driven by optimism that inflation would ease and interest rates would drop.

CPI RELEASE MISHAP→ 🕒 Due to a U.S. Bureau of Labor Statistics (BLS) error, CPI data slipped out 30 minutes early, triggering an internal investigation but barely nudging markets, which reacted more to the modest 0.3% monthly CPI increase.

UNDER ARMOUR FACES TOUGH QUARTER → 📉 Under Armour reported a sharp Q4 decline with net income plummeting to $6.6M from $170.6M, amid a 10% drop in North American sales and a costly restructuring initiative as it aims for a strategic pivot under founder Kevin Plank's renewed leadership.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

CPI Release Mishap

🕒 Early Release Error: The Bureau of Labor Statistics (BLS) inadvertently published parts of the critical consumer price index (CPI) data approximately 30 minutes early. This slip-up was due to an operational error in uploading files to the BLS website ahead of the scheduled public release.

🔍 Investigation and Oversight: Following the premature release, the BLS has initiated a thorough investigation into its data security and control procedures to prevent future incidents. They have also informed the Office of Management and Budget and the department's Office of the Inspector General about the mishap.

📉 Market Impact and Data Details: Despite the early release, there was minimal unusual activity in the stock markets prior to the official announcement, indicating that the data leak did not significantly affect trading. The CPI data itself showed a monthly increase of 0.3%, slightly below expectations, contributing to a rise in stock prices once officially released.

TODAY’S TOP NEWS

Under Armour Faces Tough Quarter

📉 Significant Financial Decline: Under Armour reported a sharp decline in its Q4 earnings, with a drastic drop in net income to $6.6 million from $170.6 million a year earlier. Adjusted earnings were 11 cents per share, marginally beating the expected 8 cents, amid a backdrop of falling sales and restructuring plans.

🏢 North America Struggles and Restructuring: Sales in North America fell by 10% to $772 million, underperforming expectations. The company announced a restructuring plan expected to cost between $70 million and $90 million, aiming to stabilize its financial footing and focus on enhancing brand value through premium positioning.

🔄 Leadership and Long-term Strategy: Following the recent CEO turnover, founder Kevin Plank has reassumed leadership. Under Armour is adjusting its strategy to reduce promotions and focus on high-margin products, anticipating a revenue decline in the low-double-digit percentage for the current fiscal year but expecting slight improvements in gross margins.

KEEP READING

Walmart earnings beat as discounter wins over more high-income shoppers, e-commerce sales jump (CNBC)

Wayfair to open its first large store, as physical locations make a comeback (CNBC)

The biggest risk corporations see in gen AI usage isn’t hallucinations (CNBC)

Roche says weight loss drug shows promising results in early trial (CNBC)

Auto incentives are back — but high interest rates weaken deals for buyers (CNBC)

China has teased how it might fix its property crisis. Markets are loving it (CNN)

Roblox shares slide as metaverse giant reports player spending has slowed (CNN)

Trump Media says it will delay quarterly filing due to auditor change (CNN)

MoneyLion: On a Mission to Become the Expedia of Financial Services (PYMNTS)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

Vimcal — Lightning-fast calendar and AI scheduling assistant

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.