TLDR

🧾MARKET RECAP → On Wednesday, stocks surged as the latest ADP jobs data (Nov) bolstered investors' confidence that the Federal Reserve is set to lower interest rates in the coming week.

💡 MICROSOFT’S AI REALITY CHECK → Microsoft’s (MSFT) AI Foundry demand is real but revenue is lagging as enterprises move slower than expected; the long-term AI thesis holds, but near-term sales won’t be linear.

⏳ U.S. WON’T DROP TARIFFS → Even if the Supreme Court strikes the current version, the administration has backup legal tools to reassemble a similar tariff regime — keeping trade pressure firmly in place.

Was this email forwarded to you? Sign up for free here.

MARKETS

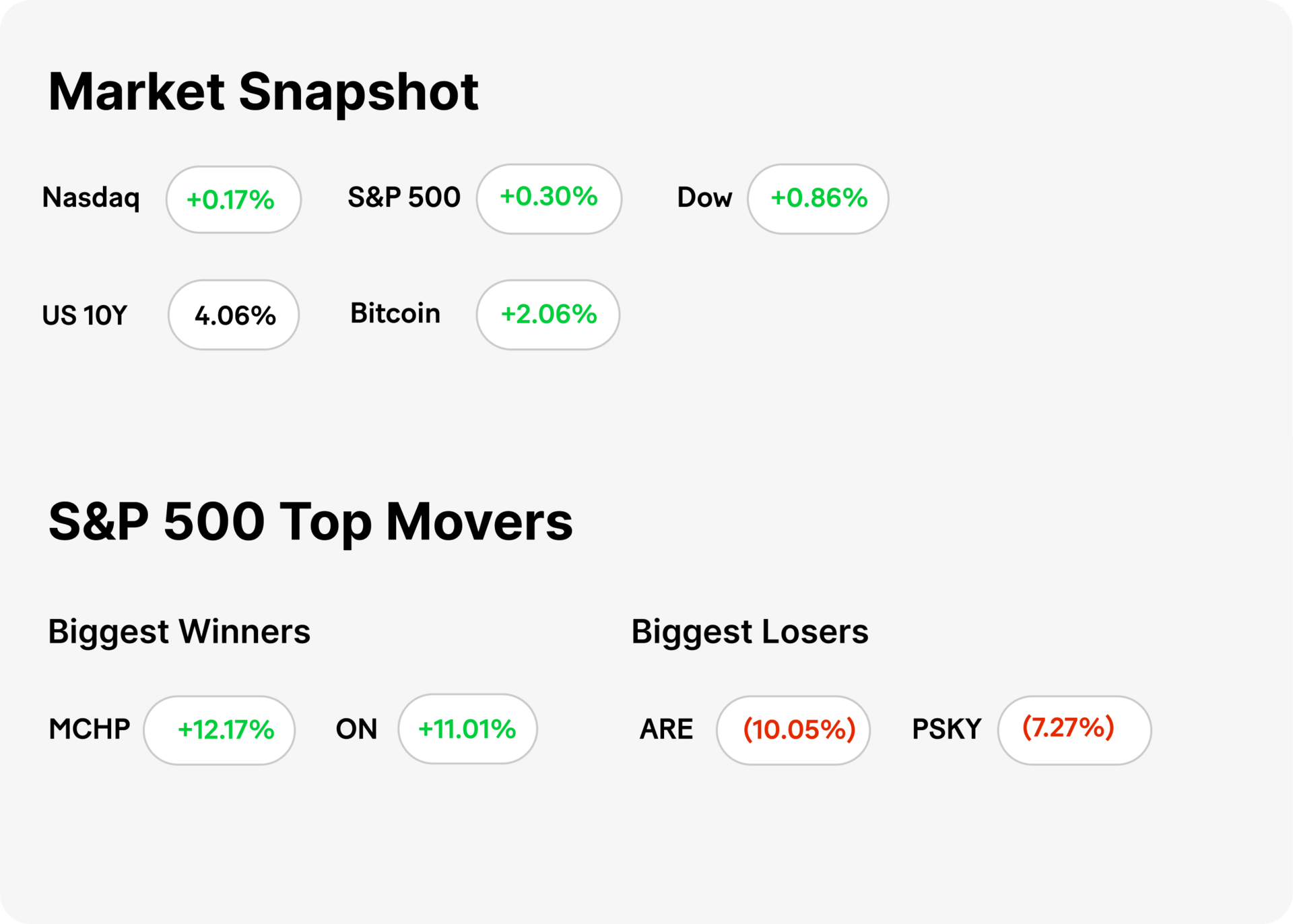

Market Snapshot

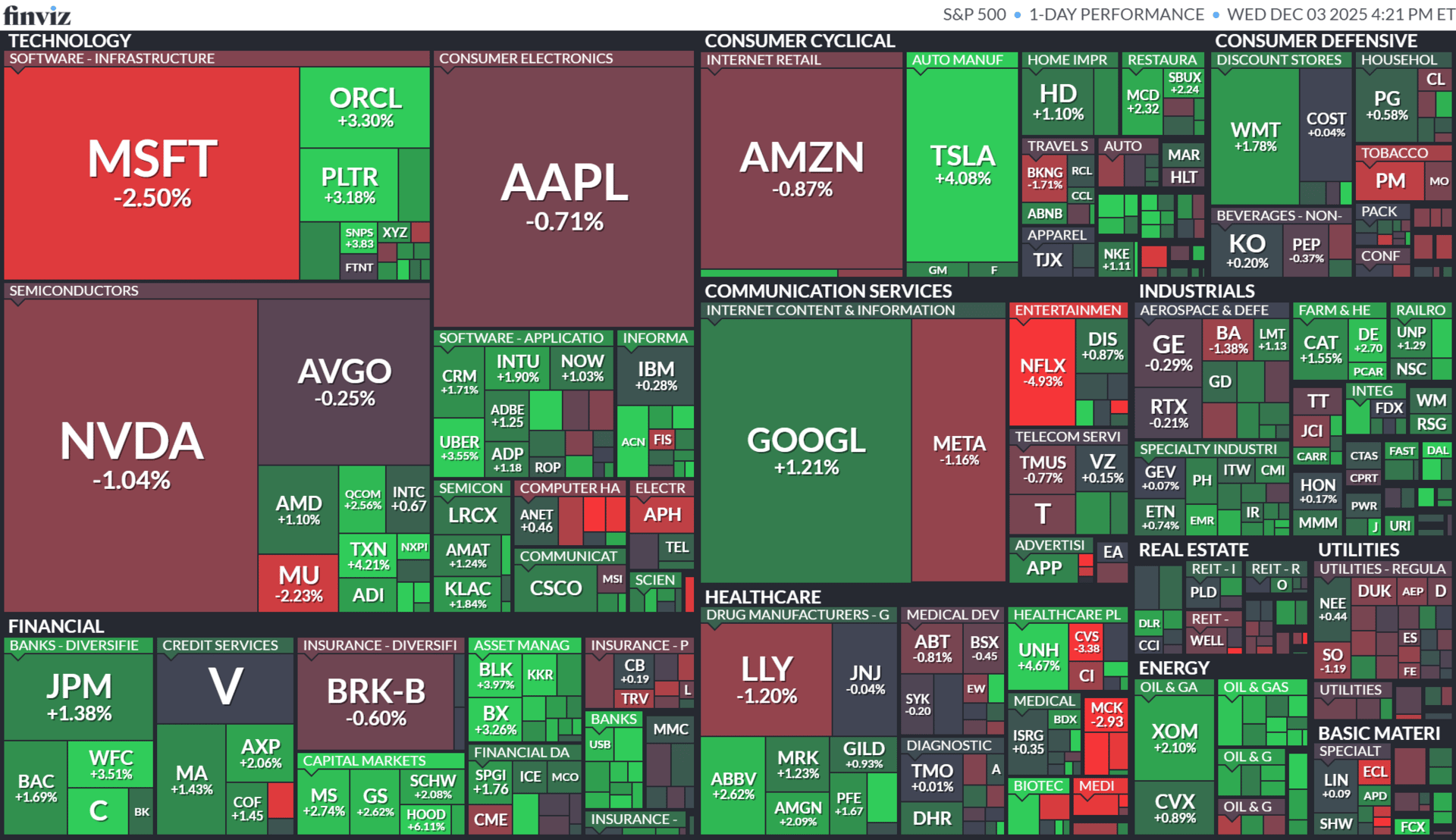

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 01, 2025

AI

Microsoft’s AI Reality Check

Gemini

💸 AI Foundry isn’t printing money (yet): Microsoft (MSFT) is seeing softer-than-expected revenue from its AI Foundry business, the unit that helps enterprises build custom AI models. Early customer enthusiasm hasn’t fully converted into sales, signaling that big AI budgets are taking longer to materialize than the hype cycle suggested.

🏗️ Enterprises want results, not experiments: Companies are still kicking the tires — testing prototypes, evaluating ROI, and worrying about compute costs — which slows adoption. The promise is massive, but most customers haven’t scaled past pilot programs, leaving Microsoft with a slower revenue ramp while it invests heavily in infrastructure and model support.

⚡ The long game is still intact: Despite the near-term drag, Microsoft’s broader AI ecosystem — Azure, Copilot, enterprise integrations — remains strong. For investors, this is a reminder that AI monetization happens in waves: early hype, slow digestion, and then meaningful revenue once enterprises industrialize AI workflows.

TRADE

U.S. Won’t Drop Tariffs

Gemini

🔁 Scott Bessent bets on backup plans: Scott Bessent argues the U.S. can effectively recreate its tariff regime even if the Supreme Court tosses the current emergency-powers framework. The takeaway: tariff policy isn’t hinging on one legal pillar — Washington has multiple pathways to keep trade pressure intact.

📜 Alternative trade laws on standby: If the ruling goes against the government, officials can pivot to other tools like the Trade Act of 1974 or the Trade Expansion Act of 1962. These options may differ in speed and scope, but together they can rebuild most of the same duties currently applied to imports.

⚠️ Implications for markets and supply chains: Hopes for an immediate tariff unwind look misplaced. Businesses could still face renewed duties under different statutes, meaning lingering uncertainty for import-heavy industries, inflation-sensitive goods, and multinational supply chains.

KEEP READING

Bad jobs report caused by shutdown, deportations — not tariffs, Lutnick says (CNBC)

Bessent says Trump admin will be able to replicate tariffs even if it loses Supreme Court decision (CNBC)

Delta says government shutdown cost it $200 million, but forecasts strong travel demand into 2026 (CNBC)

Putin threatens Europe with war if it wants one, as Ukraine peace talks falter (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.