TLDR

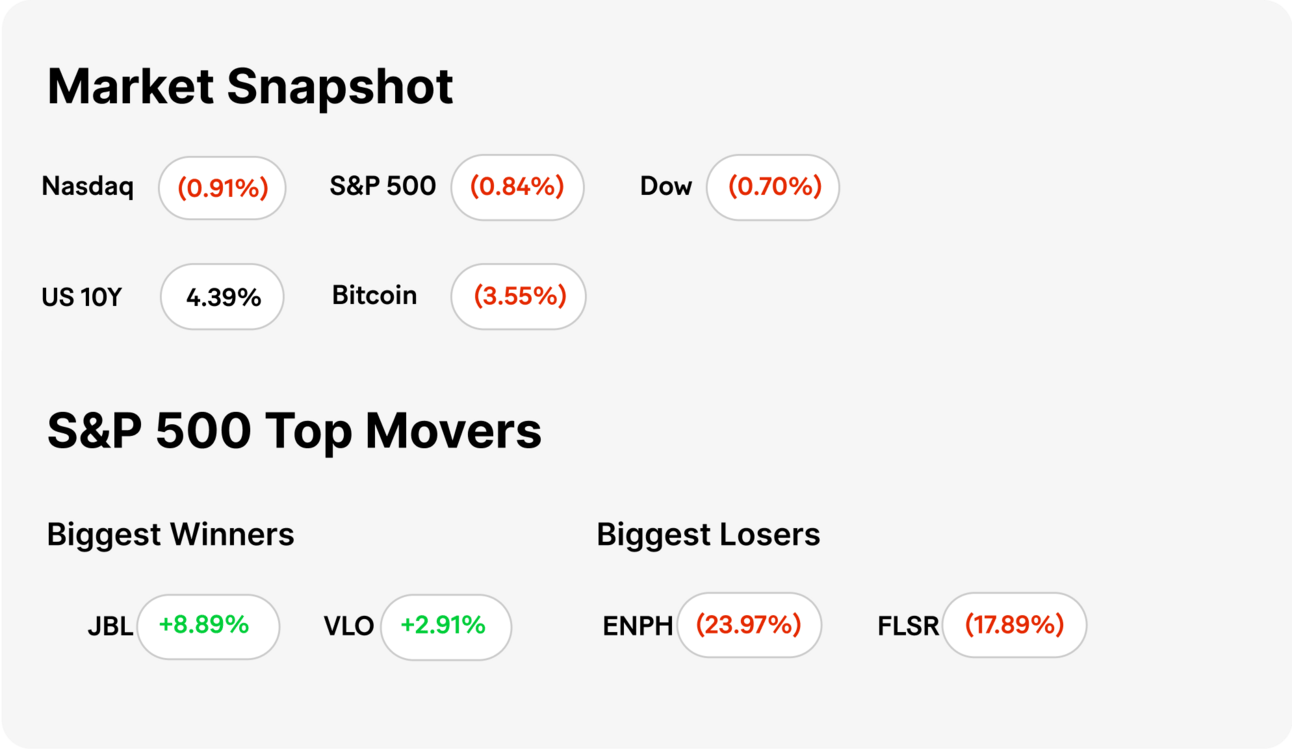

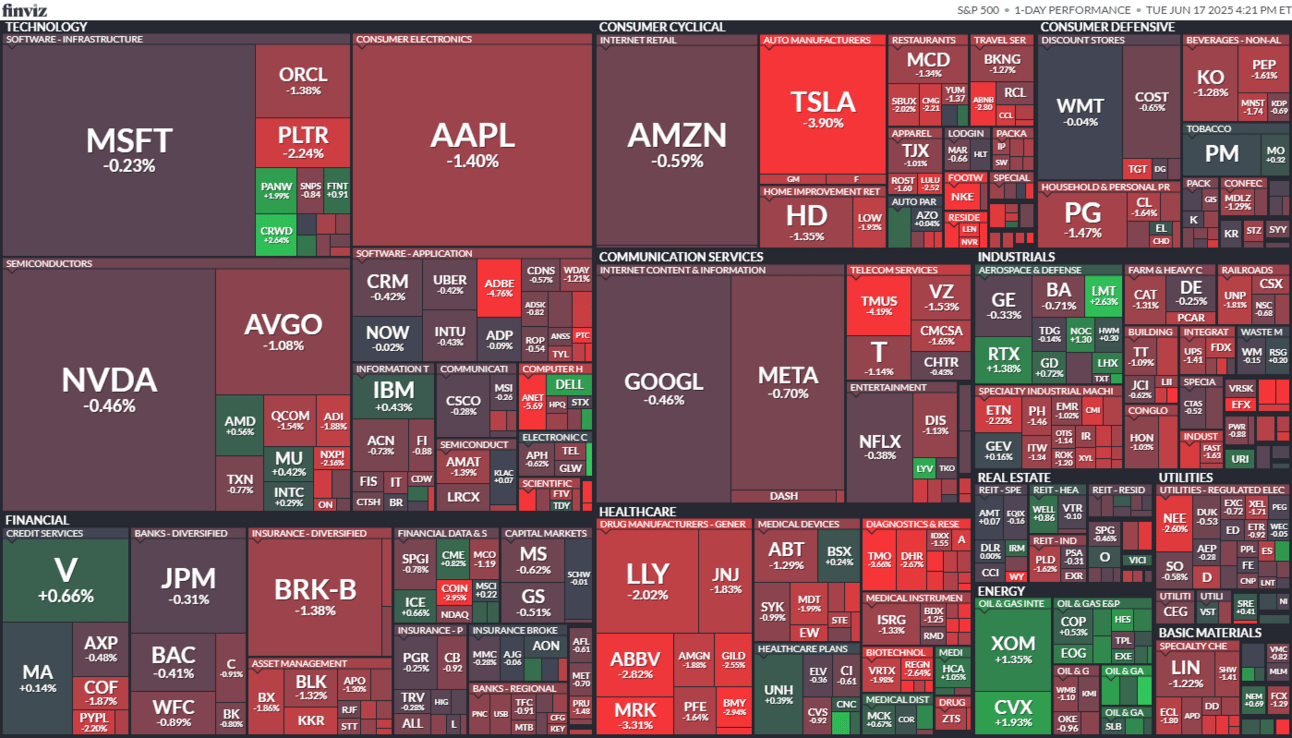

MARKET RECAP → Stocks lowered throughout Tuesday as investors took into account recent developments in the Middle East, as conflict between Israel and Iran continues. In the crypto realm Bitcoin (BTC) decreased following the same rationale as stocks. $BTC.X ( ▲ 0.88% )

TRUMP THREATENS IRAN, BACKS ISRAEL: Markets flinched after Trump demanded Tehran’s surrender and backed Israel’s strikes. Oil jumped—then cooled—as Wall Street tried to price in peace or more chaos.

RAMP'S $16 BILLION LEAP → Ramp raised $150 million at a $16 billion valuation, led by Peter Thiel’s Founders Fund, as it doubles down on growth and expands beyond corporate cards.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

POLL OF THE DAY

Politics

Trump Escalates Iran Threat

source DALL-E

Trump Issues Tehran Ultimatum. Former President Donald Trump called for Iran’s “unconditional surrender” and urged civilians to evacuate Tehran, warning that Ayatollah Khamenei is “not off-limits forever.” While stopping short of ordering U.S. strikes, Trump backed Israel’s military actions and left the door open for diplomacy.

Middle East Escalation Rattles Nerves. Israel’s airstrikes on Iranian nuclear and drone sites—and the killing of a top commander—drew Trump’s support but raised fears of broader regional conflict. Despite talk of potential peace envoys, including JD Vance or Steve Witkoff, tensions remain high.

Markets Watch, Oil Reacts. Oil prices spiked nearly 3% on fears surrounding Tehran and the Strait of Hormuz, then cooled slightly. Markets slipped as investors balanced geopolitical risk with hopes the situation won’t spiral further.

TECH

Ramp's $16 Billion Leap

source DALL-E

Ramp just locked in a $16 billion valuation. The corporate card and spend management startup raised $150 million in a deal led by Peter Thiel’s Founders Fund, with existing investors including Sequoia Capital, Khosla Ventures, and Thrive Capital participating. The new valuation marks a significant jump from its $8 billion valuation in 2023, defying the broader fintech funding slowdown.

Rapid growth, but profitability still out of reach. Ramp’s annualized revenue has doubled over the past year, according to CEO Eric Glyman. But like many high-growth fintechs, Ramp isn’t yet profitable, as it continues to invest heavily in expansion and product development.

Expanding beyond cards into full financial stack. Ramp now offers procurement tools, bill payments, and accounting integrations, aiming to become a complete finance automation platform. The fresh funding will help it fend off competitors like Brex and traditional players such as AmEx (AXP) while scaling its product suite.

KEEP READING

AI will shrink Amazon’s workforce in the coming years, CEO Jassy says (CNBC)

NYC mayoral candidate Brad Lander handcuffed by ICE (CNBC)

Tesla stock slips after report EV maker is pausing Cybertruck and Model Y production (CNBC)

Meta to release smart glasses with Oakley and Prada, extending Luxottica partnership (CNBC)

Senate tax bill includes $1,000 baby bonus in ‘Trump accounts’ — here’s who qualifies (CNBC)

TSA PreCheck Cost Guide: Benefits & Is It Worth It? (ML)

How Much is Paramount Plus? 2025 Plans and Pricing Guide (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.