TLDR

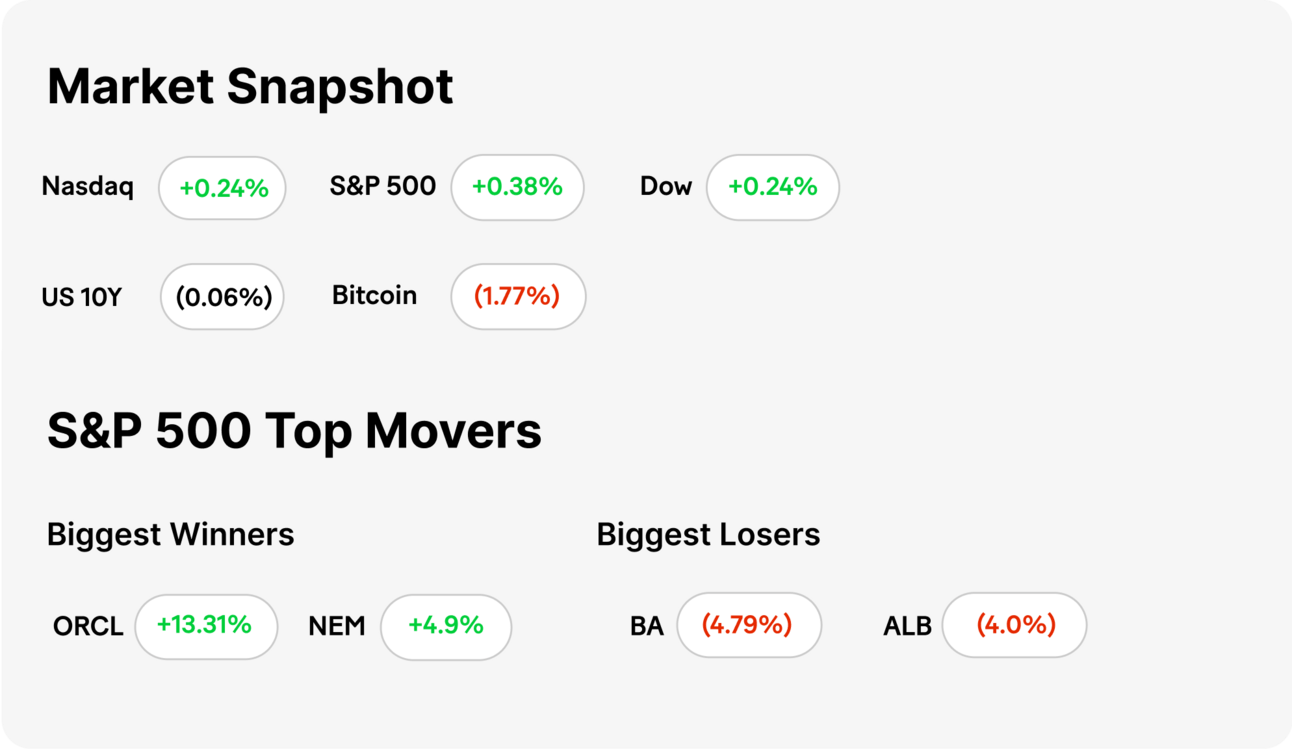

MARKET RECAP → Stocks closed higher on Thursday as a bounce in Oracle (ORCL) raised investors' hopes, leading to a rise in the big tech sector. In the crypto world, Bitcoin (BTC) dipped again but still hovers just under its all-time high near $111K. $BTC.X ( ▲ 0.88% )

TRUMP–POWELL RATE RIVALRY → ⚖️ Trump slammed Jerome Powell as a “numbskull” and called for drastic rate cuts to juice the economy and cut deficits—sparking fears he’s turning Fed independence into election-year theater.

AMD'S AI AMBITIONS GO NUCLEAR → 🧠 AMD (AMD) unveils its MI400 chip for 2026, directly challenging Nvidia’s (NVDA) AI dominance. OpenAI's Sam Altman cheers the move, citing a need for more hardware options. Major cloud players are already on board, as demand for AI chips shows no signs of slowing.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

POLL OF THE DAY

What trend do you think will most influence the economy in the coming year?

FINANCE

Trump vs. Powell Rate Rivalry

source DALL-E

🔻Political Pressure on the Fed: Trump unleashes insults, calling Fed Chair Jerome Powell a “numbskull” as he pressures for interest-rate cuts—claiming he’ll "force something" if the Fed doesn't act, while maintaining he won’t actually fire Powell . This comes amid cooler inflation data, setting the backdrop for the president’s aggressive tone.

📉 Economic Stakes and Arguments: The administration argues inflation has softened enough to justify a full-percentage-point rate cut, citing May’s CPI running at just 2.4%, with core CPI flat month-over-month. Trump says such a cut could slash the federal deficit by hundreds of billions—a bold economic claim wrapped in political optics.

🏦 Fed Independence vs. Political Shoves: Despite Trump’s pressure, experts warn against undermining the Fed’s credibility. The central bank is expected to hold rates steady at its June 17–18 meeting, opting for a cautious "data-first" approach while tariff uncertainty lingers. Powell is expected to weather the storm—his term runs through May 2026—and any attempt to dismiss him preemptively could spark legal and market chaos.

TECH

AMD's AI Ambitions Go Nuclear

source DALL-E

🧠 AMD unleashes new AI chip to rival Nvidia: AMD (AMD) just unveiled its next-gen MI400 AI accelerator, aiming to challenge Nvidia's (NVDA) dominance in the red-hot AI chip market. CEO Lisa Su announced the MI400 will launch in 2026 and is tailored for generative AI workloads, boasting improved compute performance and memory bandwidth. The reveal came at AMD's annual AI event, where Su made clear that the company is “just getting started.”

🤖 OpenAI throws weight behind AMD: OpenAI CEO Sam Altman made a surprise appearance to voice support for more competition in the AI chip space, a not-so-subtle nod to Nvidia's market grip. Altman praised AMD’s progress and emphasized the need for multiple suppliers to ensure innovation and stability in AI infrastructure. It’s a major public show of support from one of the biggest names in AI.

📈 AI chip demand still exploding: Demand for AI chips remains sky-high as hyperscalers and startups alike race to build and deploy generative AI models. AMD said its MI300 line is already being adopted by industry heavyweights like Microsoft (MSFT), Meta (META), and Oracle (ORCL). The MI400 signals AMD’s intent to stay competitive—and potentially grab more market share—in an AI-driven future.

KEEP READING

Google cloud and other internet services are reporting outages (CNBC)

Chime opens at $43 in Nasdaq debut after pricing IPO above expected range (CNBC)

Hundreds feared dead after Air India jet crashes after takeoff (CNBC)

Coinbase beefs up subscription plan by offering it with American Express credit card (CNBC)

Trump wanted an Iran nuclear deal fast. Now he may get military confrontation (CNBC)

Financial Stress: Ways to Cope and Regain Control (ML)

Summer Travel Trends 2025: 10 Ways Smart Travelers Are Saving Money and Avoiding Crowds (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.