TLDR

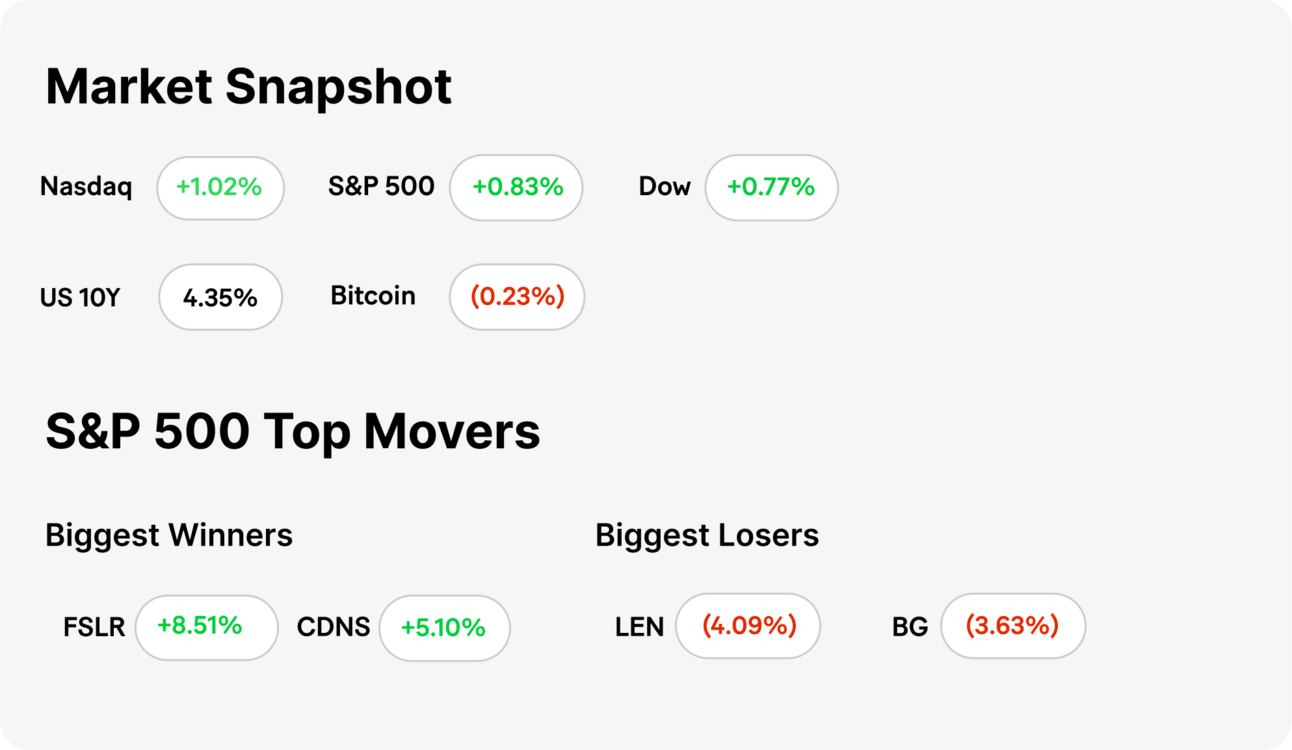

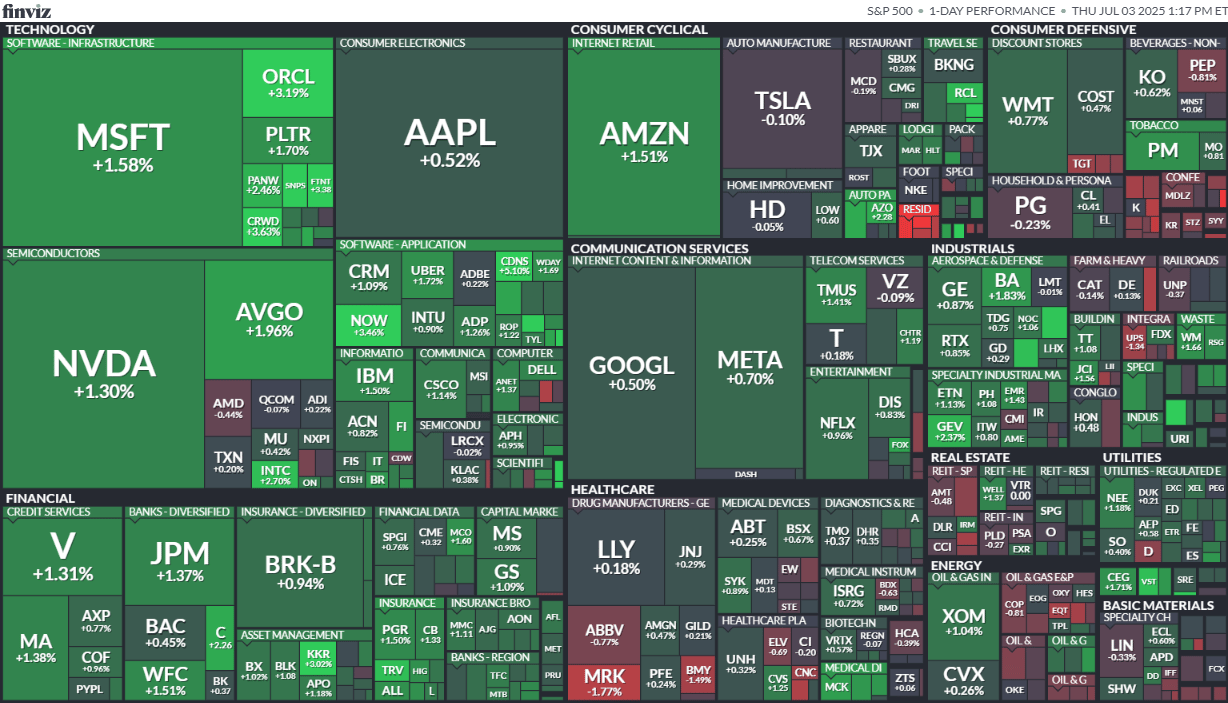

MARKET RECAP → Markets on Thursday increased with fresh record highs being set. The growth was fueled by a new job report release creating optimism in the U.S. economy, despite recent geopolitics and rapid updates trade policy.

WALL STREET SOARS ON JOBS REPORT→ Strong payroll data from the Labor Department sent the Dow higher and pushed the S&P 500 to a new record as recession fears eased.

BAIDU SHARPENS ITS SEARCH → Baidu is now defaulting to AI-powered search using its Ernie model, taking aim at rivals like Alibaba and ByteDance. Despite leading China’s search market, it’s under pressure to evolve fast. Investors, however, remain unconvinced as its stock lags.

Markets will be closed tomorrow in observance of July 4th. We will be back Monday July 7th with all the market updates.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

What’s Your Summer Money Move?

Finance

Wall Street Soars On Jobs Report

source DALL-E

Dow Jumps 350 Points On Jobs Beat: A stronger-than-expected June labor report sent markets into overdrive. The S&P 500 notched yet another record, while the Nasdaq followed suit as investors embraced signs of economic resilience.

Labor Market Strength Calms Recession Fears: Payroll gains came in above estimates, quelling concerns about a slowdown and reinforcing optimism about a soft landing. Wage growth stayed moderate, giving the Fed room to maneuver.

Broad-Based Gains Across Sectors: Financials, tech, and consumer discretionary stocks led the charge as bond yields stabilized and investors rotated back into growth and cyclical plays.

Tech

Baidu Sharpens Its Search

source DALL-E

AI upgrade is now the default: Baidu is embedding its Ernie large language model into its main search engine by default, marking a shift from its separate “AI search” tab. This gives users summarized answers with sources, similar to what Microsoft (MSFT) and Google (GOOG) are rolling out globally—except Baidu’s strategy is tailored to China’s unique internet ecosystem.

The search wars intensify: The move is a direct response to growing competition from Alibaba’s Quark and ByteDance’s Douyin, which are gaining ground among younger users. While Baidu still commands over 50% of China’s search market, CEO Robin Li isn’t taking that for granted, aiming to “redefine” the search experience through generative AI.

Wall Street isn’t impressed—yet: Baidu shares are down nearly 14% year to date despite its AI push, reflecting investor skepticism amid slow LLM adoption and macroeconomic headwinds in China. The company’s pivot toward AI mirrors global trends, but it remains to be seen whether it will translate into real market share or revenue gains.

KEEP READING

U.S. lifts chip software curbs on China in sign of trade truce (CNBC)

Apple’s China iPhone sales grows for the first time in two years (CNBC)

Trump to speak with Putin after U.S. pauses some weapons shipments to Ukraine (CNBC)

The June jobs report showed a bigger-than-expected increase in employment. The Fed’s rate cuts are on hold for now (MarketWatch)

A Group of Young Cybercriminals Poses the ‘Most Imminent Threat’ of Cyberattacks Right Now (Wired)

What is a Money Order? How a Money Order Works (ML)

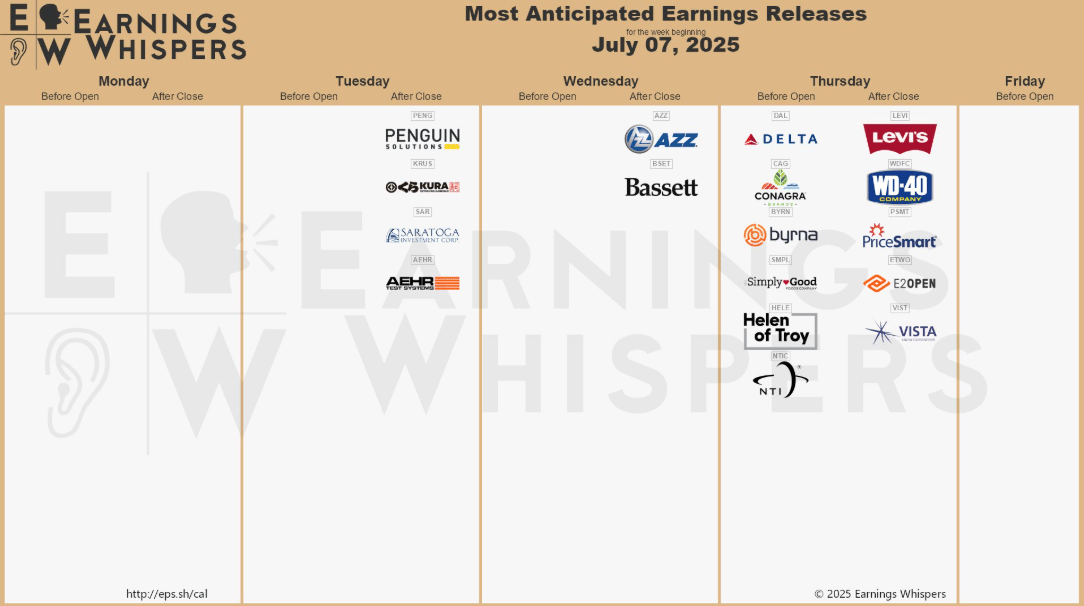

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.