TLDR

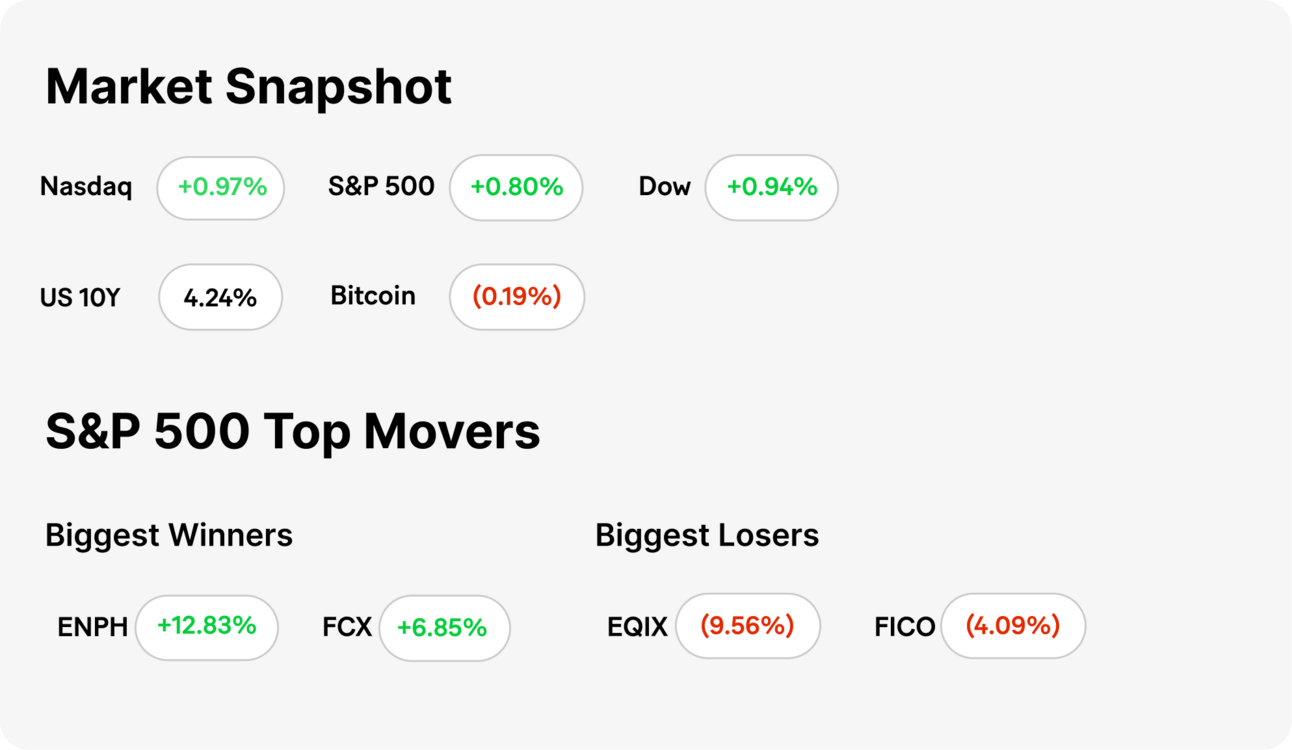

MARKET RECAP → Stock rose Thursday, with the S&P 500 only a hair off from a new record. Markets comeback from lows hit in April as they overcome the negative expectations from tariffs, wars, and sticky inflation rates.

WALL STREET CLIMBS THROUGH CHAOS → The S&P 500 keeps climbing past records thanks to AI optimism and resilient earnings, even as risks like inflation, geopolitics, and Fed limbo loom large.

CHINA’S ZHIPU AI ENTERS THE CHAT → OpenAI just named Chinese firm Zhipu AI, backed by Beijing, as one of its top global rivals, marking a rare public acknowledgment of China’s growing AI prowess. The move also strengthens OpenAI’s case against UK antitrust scrutiny by emphasizing international competition.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

What’s Your Investing Style?

Finance

Wall Street Climbs Through Chaos

source DALL-E

New Highs, Same Fears: The S&P 500 hit a fresh record despite a backdrop of stubborn inflation, Fed uncertainty, global conflicts, and political risk. What’s driving the rally? A resilient economy, corporate profits holding steady, and optimism around AI-fueled productivity gains.

Big Tech, Big Fuel: Mega-cap tech stocks, especially Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL), shoulder much of the rally. Their growth narratives around AI and cloud computing have kept investors hooked, even as rate cuts remain elusive.

Investors Shrug Off Risks: Geopolitics, election drama, and lingering inflation haven’t scared investors away. Instead, markets are pricing in soft-landing hopes, slower inflation ahead, and central banks eventually easing. Translation: bad news keeps becoming "good enough" news for stocks.

Tech

China’s Zhipu AI Enters the Chat

source DALL-E

OpenAI quietly names a top rival: In a new filing to the UK’s antitrust authority, OpenAI identified Chinese firm Zhipu AI as one of its “top competitors” globally, alongside Anthropic, Google DeepMind, and Meta (META). Zhipu, backed by Chinese state-linked investors and spun out of Tsinghua University, builds large language models like GLM-4 and openly seeks to rival GPT-4.

Geopolitics meet generative AI: While OpenAI has largely focused its competition narrative around U.S.-based firms, its decision to spotlight Zhipu signals growing concerns about China’s rapidly maturing AI sector. Zhipu raised over $340 million last year, in part from government-affiliated funds, and plays a key role in Beijing’s push for AI independence.

Why this disclosure matters now: The admission came as part of OpenAI’s effort to quash UK scrutiny of its partnership with Microsoft (MSFT), arguing that the AI market remains highly competitive. Including a Chinese rival helps OpenAI portray the market as global and fragmented, not Big Tech–dominated, potentially defusing antitrust concerns.

KEEP READING

Tesla head of manufacturing Omead Afshar fired by Elon Musk (CNBC)

Microsoft says goodbye to the Windows blue screen of death (CNBC)

Trump’s war against the Powell Fed has taken another political turn (CNBC)

Apple reveals complex system of App Store fees to avoid EU fine of 500 million euro (CNBC)

Zohran Mamdani’s victory in NYC mayoral primary leaves Wall Street ‘alarmed’ and ‘depressed’ (CNBC)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.