TLDR

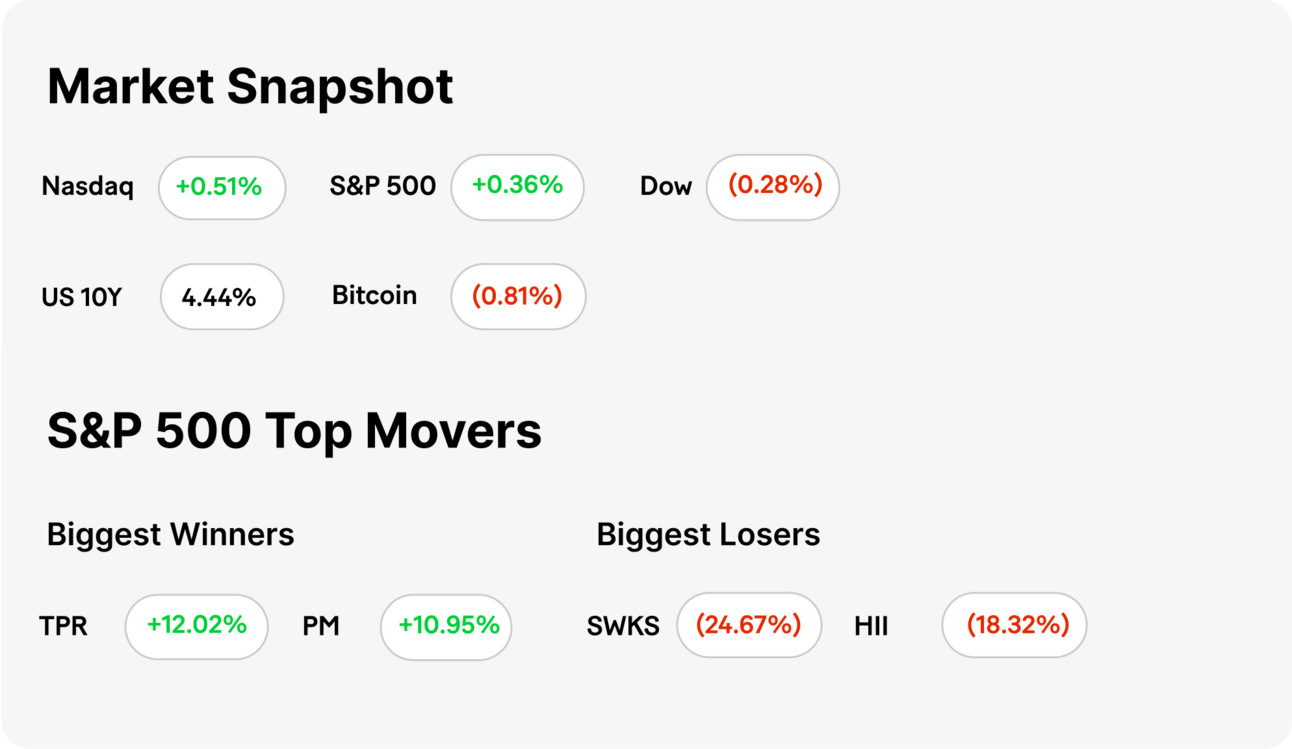

MARKET RECAP → The S&P 500 (VOO) rose for the third consecutive session on Thursday as investors digested the latest round of corporate earnings reports.

PELOTON'S Q2 REVENUE BEATS EXPECTATIONS → 📊 Peloton (PTON) reported Q2 revenue of $673.9 million, exceeding forecasts, and raised its full-year adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) outlook to $300 million–$350 million.

ROBLOX FANS GAMING INDUSTRY GLOOM → Roblox’s (RBLX) weak 2025 outlook sent shares tumbling 26%, fueling concerns about a gaming industry slowdown. Despite projecting 20% growth, daily active users dipped, and bookings missed estimates. Regulatory challenges and inflation-weary consumers added pressure. 🎮

Was this email forwarded to you? Sign up for free here.

On the move? Subscribe to our daily podcast here.

MONEYLION NATION: SUPERBOWL POLL

Source: Created using OpenAI's DALL·E via ChatGPT (2025).

Who is going to win Super Bowl LIX?

A MESSAGE FROM OUR PARTNER

There’s a reason 400,000 professionals read this daily.

Join The AI Report, trusted by 400,000+ professionals at Google, Microsoft, and OpenAI. Get daily insights, tools, and strategies to master practical AI skills that drive results.

TODAY’S TOP NEWS

Peloton's Q2 Revenue Beats Expectations

Financial Highlights: 📊 Peloton (PTON) reported a 9.4% year-over-year decline in Q2 revenue to $673.9 million, surpassing analyst expectations of $653.3 million. The company posted a loss of 24 cents per share, slightly below the anticipated 19 cents.

Strategic Partnerships and Initiatives: 🤝 A new partnership with Costco (COST) significantly boosted Bike+ sales, making Costco the top third-party retailer for Peloton this quarter. Under CEO Peter Stern, Peloton is focusing on cost-cutting and reducing subscription attrition.

Revised Outlook: 📈 Peloton raised its full-year adjusted EBITDA forecast to $300 million–$350 million, up from $240 million–$290 million. The company also narrowed its revenue guidance to $2.43 billion–$2.48 billion, with the midpoint slightly higher than previous estimates.

REFERRAL PROGRAM

TODAY’S TOP NEWS

Roblox Fans Gaming Industry Gloom

🎮 Roblox’s (RBLX) 2025 outlook disappointed investors, sending shares plummeting 26% in premarket trading. The company projected annual bookings between $5.2 billion and $5.3 billion, falling short of expectations. This fueled broader concerns about the gaming industry’s slowdown, following weak results from Electronic Arts (EA).

📉 Despite a projected third consecutive year of 20% growth, key engagement metrics slipped. Daily active users dropped to 85.3 million from 88.9 million in the prior quarter, while Q4 bookings of $1.36 billion narrowly missed estimates. Outgoing CFO Michael Guthrie cited tough year-over-year comparisons due to Roblox’s PlayStation launch in 2023.

🚨 Regulatory and market challenges added pressure. The platform’s suspension in Turkey over child safety concerns contributed to declining engagement, while inflation-weary consumers tightened gaming-related spending. Roblox continues expanding into older demographics and new revenue streams, but investor confidence remains shaky.

KEEP READING

Trump administration agrees to restrict DOGE access to Treasury Department payment systems (CNBC)

Trump’s tax cuts are ‘stuck in the mud’ as Republicans split over spending (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

A MESSAGE FROM OUR PARTNER

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media - NEW

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.