TLDR

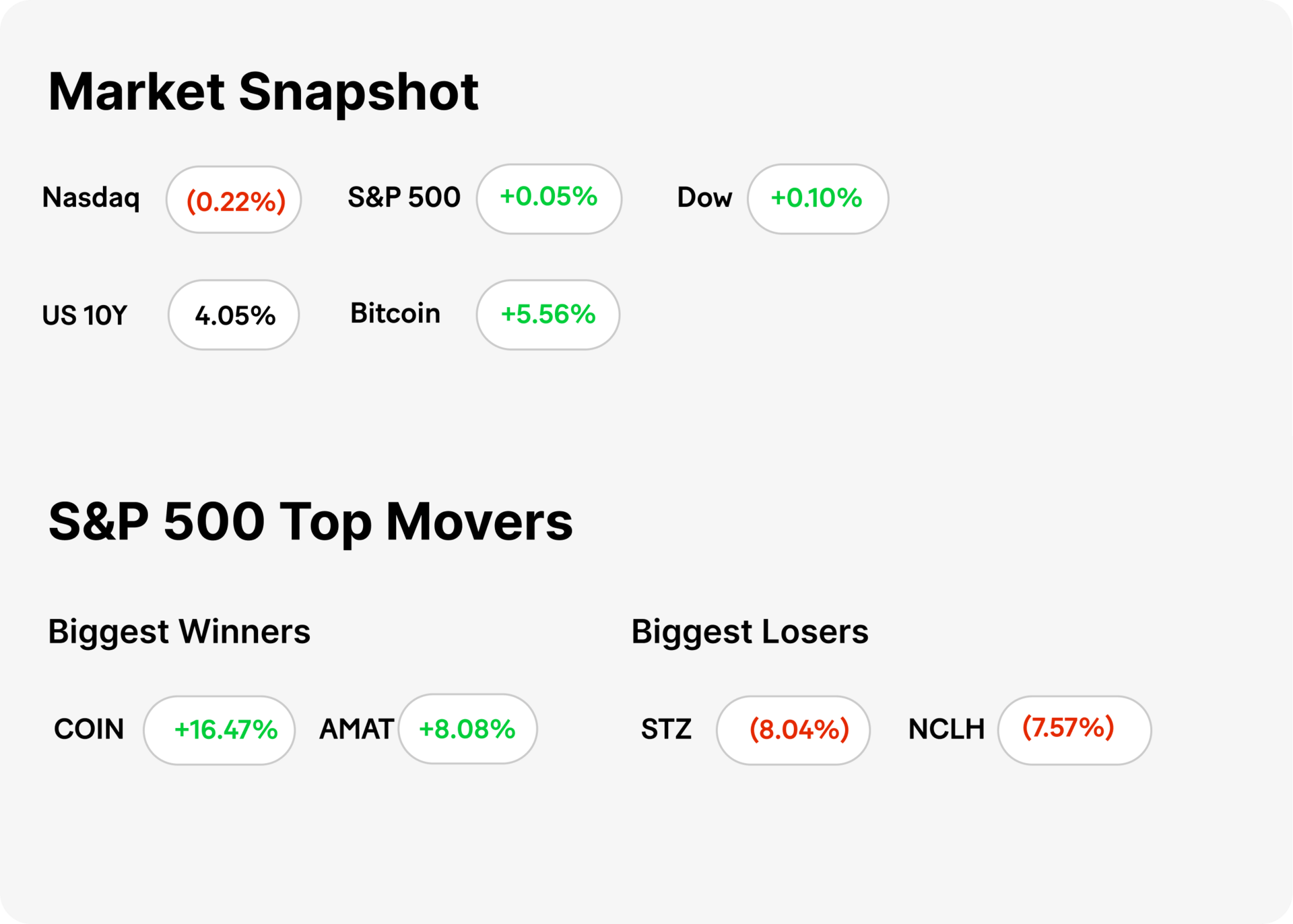

⚡ MARKET RECAP → The S&P 500 (VOO) finished little changed Friday as a soft inflation report failed to spark enthusiasm.

📺 ROKU’S PREMIUM POP → Roku (ROKU) delivered a beat-and-raise quarter, a surprise profit, and its biggest-ever haul of premium subscription net adds — turning the stock sharply higher and sharpening the bet that Roku can be both the ad-supported gateway and the subscription bundle broker for the streaming era, not just another device maker.

📊 GAS EASES, SHELTER STICKS → January CPI rose 0.2% on the month and 2.4% on the year, with cheaper gas and used cars doing most of the cooling while rents and other services keep core at 2.5%; it’s exactly the kind of slow, grinding disinflation that lets the Fed stay patient while investors keep betting on cuts later in 2026.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning February 9, 2026

TECH

Roku’s Premium Pop

Gemini

📺 Roku (ROKU) just posted a classic beat-and-raise and the stock ripped. Q4 revenue grew mid-teens to about $1.39 billion, EPS landed nearly double Street expectations, and net income swung solidly positive. Shares jumped high-single to low-teens percent as Roku also guided 2026 revenue and EBITDA ahead of consensus.

💳 The real star: premium subscriptions. Management said it was Roku’s biggest quarter ever for premium subscription net adds, helped by holiday promos and better discovery. The company is leaning into that momentum with plans to bundle multiple paid services on the Roku platform, turning the home screen into both a FAST hub and a premium-sub checkout lane.

📈 Investor angle: more tollbooths on the stream. Platform revenue (ads + subscriptions + rev share) now overwhelmingly drives the model, and premium subs deepen engagement while adding higher-quality, recurring economics. The upside case is that Roku becomes the default operating system and bundle broker for streaming households; the risk is that giants like Amazon (AMZN), Apple (AAPL), and smart-TV OEMs don’t let Roku own that relationship without a fight.

PERSONAL FINANCE

Gas Eases, Shelter Sticks

Gemini

📉 Headline inflation finally looks boring again. January CPI rose 0.2% on the month and 2.4% from a year earlier, the lowest annual rate in nearly five years. Core prices excluding food and energy climbed a still-firm 0.3% and 2.5% year over year, so underlying pressure isn’t fully gone even as the headline number cools.

🛢️ Gas and used cars are doing the disinflation dirty work. Pump prices dropped sharply, used vehicles got cheaper, and grocery inflation was mild, with some staples actually declining. The biggest remaining pain comes from shelter and other services, which now do most of the lifting in the index and keep core running a touch above target.

🏦 For the Fed, this is “progress, not victory.” With headline at 2.4% and core at 2.5%, policymakers can say they’re closing in on 2% without feeling pressured to cut rates immediately. For markets, that reads like a setup where mid-2026 cuts stay on the table, but only if this mix — softer goods, sticky services — keeps drifting in the right direction.

KEEP READING

Venezuela oil sales top $1 billion, funds won’t go to Qatar account anymore, Energy Secretary says (CNBC)

Amazon’s Ring cancels Flock partnership amid Super Bowl ad backlash (CNBC)

FTC tells Tim Cook to look into reports Apple News is censoring conservatives (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.