TLDR

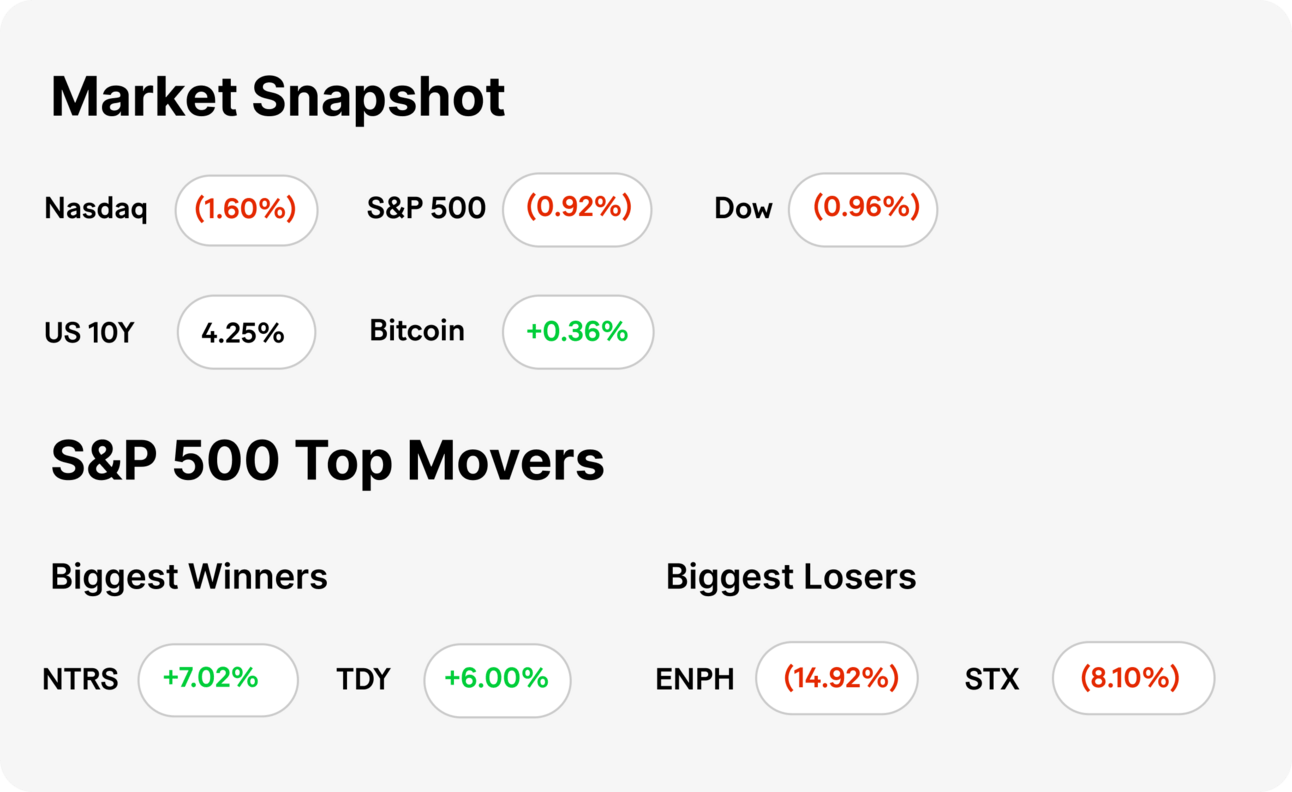

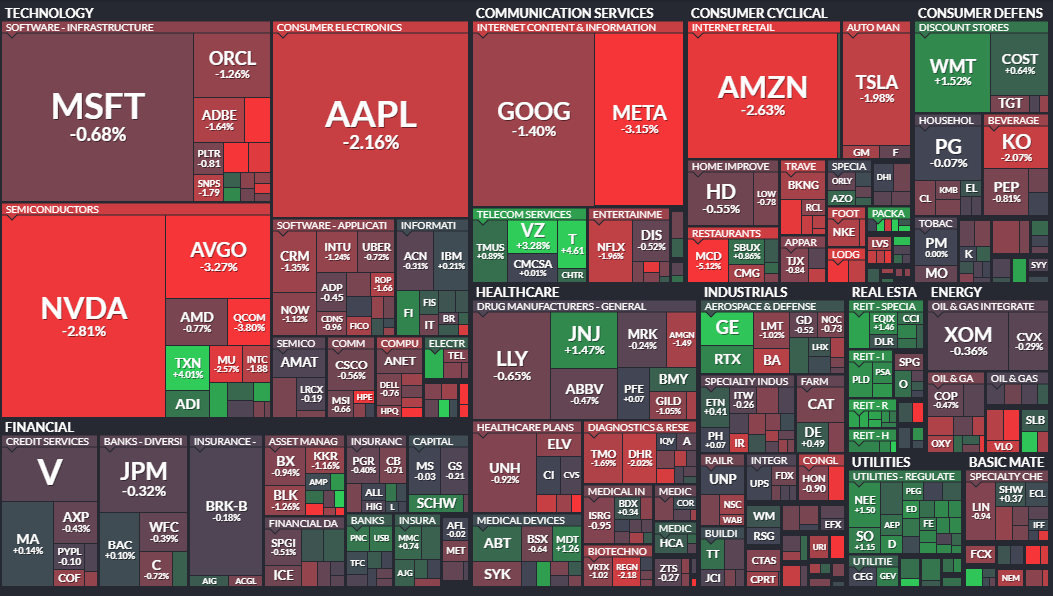

MARKET RECAP → Stocks dropped Wednesday, with the Dow Jones (DIA) posting its worst day in over a month as interest rates continued to creep higher.

COCA-COLA BEATS EARNINGS ESTIMATES, BOOSTED BY PRICE HIKES → Coca-Cola's (KO) quarterly earnings surpassed expectations, driven by higher prices offsetting weaker demand. EPS reached 77 cents, beating forecasts, while global volume dipped by 1%.

MCDONALD’S SHARES FALL AFTER E. COLI OUTBREAK → McDonald's (MCD) stock fell after the CDC linked an E. coli outbreak to its Quarter Pounders, resulting in 10 hospitalizations and one death. 🍔

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Coca-Cola Beats Earnings Expectations, Thanks to Price Hikes

🍹 Coca-Cola (KO) exceeded earnings expectations despite sluggish demand, thanks to price increases that offset weaker sales.

💡 Earnings per share came in at 77 cents, beating the 74-cent forecast, while revenue hit $11.95 billion.

📉 Volume was flat in North America but fell 1% globally, driven by lower demand in international markets. Despite this, Coke's strong pricing strategy led to a 10% revenue growth outlook for 2024.

TODAY’S TOP NEWS

McDonald's Shares Drop After E. Coli Outbreak

🍔 McDonald’s (MCD) shares dropped after the CDC linked an E. coli outbreak to its Quarter Pounder burgers, resulting in 10 hospitalizations and one death.

🧅 The outbreak is suspected to be tied to slivered onions from a single supplier, prompting McDonald’s to temporarily stop serving Quarter Pounders in certain states.

🚨 McDonald’s stated that other beef products like the Big Mac and cheeseburgers remain unaffected, emphasizing the company’s commitment to food safety.

KEEP READING

New Boeing CEO sets sights on ‘leaner’ future as quarterly loss tops $6 billion (CNBC)

AT&T exceeds wireless subscriber estimates on demand for premium plans (CNBC)

Mortgage demand drops to its lowest level since July, as interest rates return to summer highs (CNBC)

Inside the fall of 23andMe (CNBC)

Walmart’s new threat to CVS: 30-minute prescription deliveries (CNN)

Target is cutting prices on 2,000 items ahead of the holiday shopping season (CNN)

How to Become Financially Stable: 10 Tips (ML)

What is the Difference Between a Credit Card and a Debit Card? (ML)

What Affects Your Credit Score? 5 Credit Score Factors (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.