TLDR

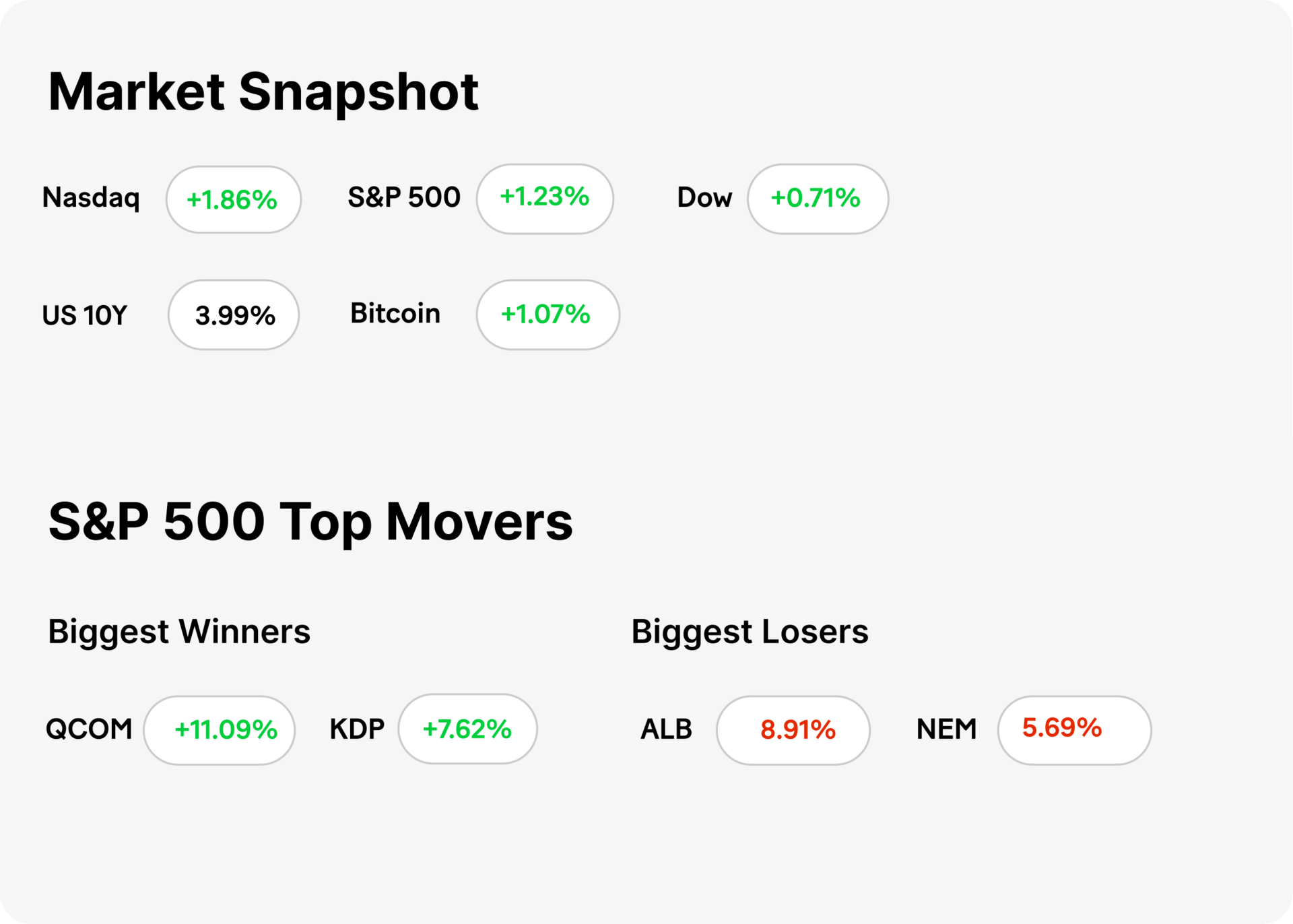

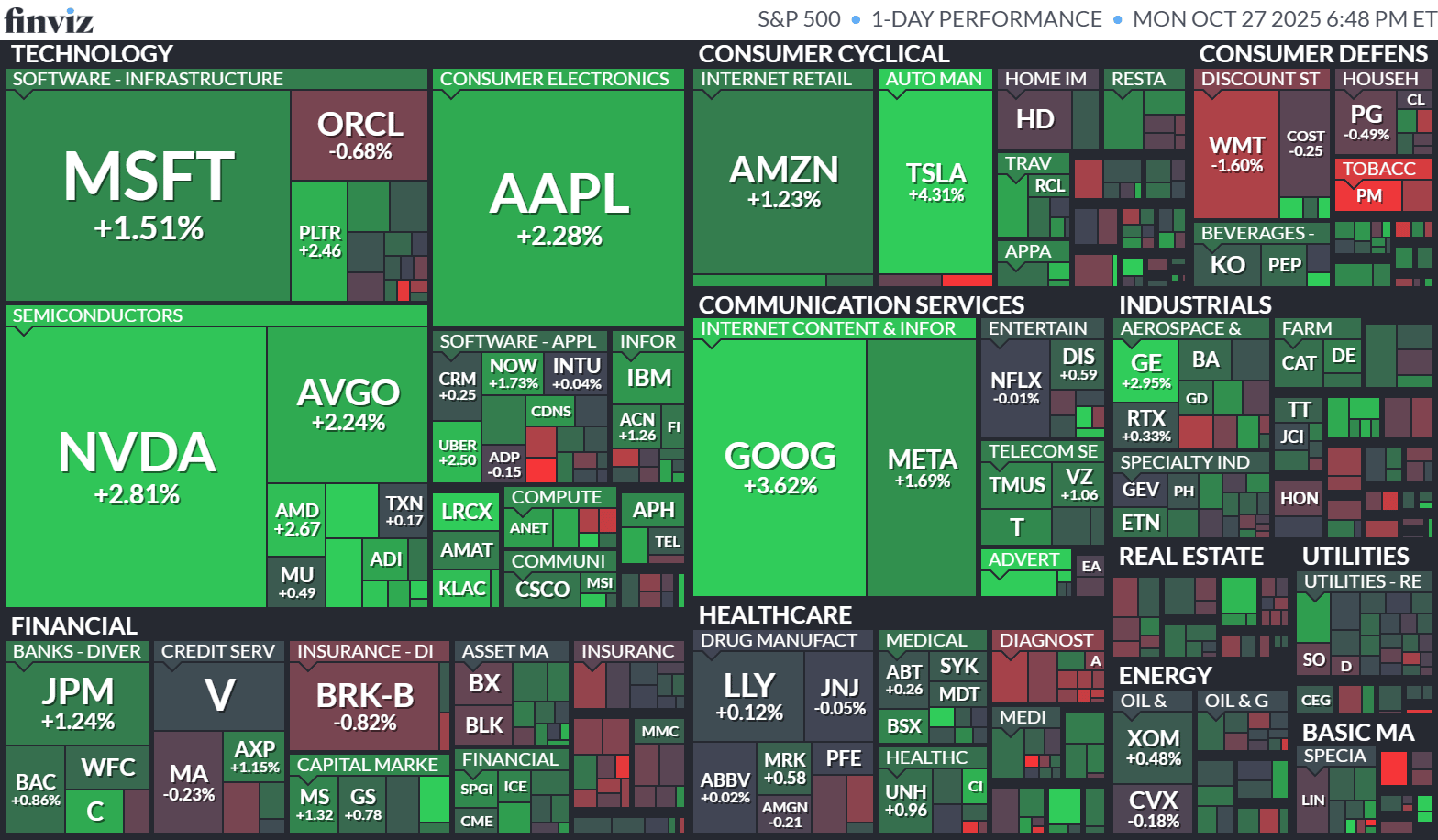

↗ MARKET RECAP → Risk-on ruled as the S&P 500 (VOO, +1.23%) and Nasdaq (QQQ, +1.83%) hit records on trade optimism and Fed rate-cut hopes. Tech mega-caps soared. Safe havens (gold, VIX) got ghosted as investors ditched caution. Bitcoin (BTC) burst past $114.5K. Growth over safety today.

🤖 ROOMBA’S REVENGE → iRobot (IRBT) stock rocketed 40% after a leaner, AI-focused reboot plan gave investors hope the Roomba maker can stand on its own post-Amazon breakup.

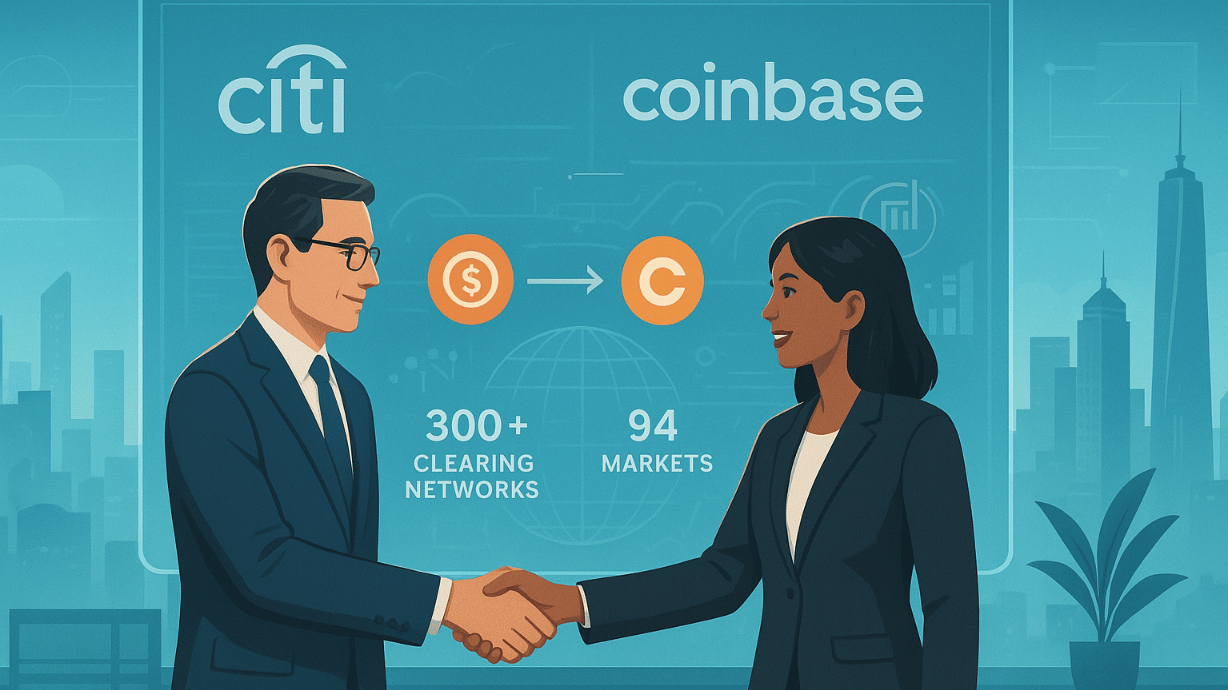

💳 DIGITAL-ASSET PAYMENTS UNITE → Citi (C) partners with Coinbase (COIN) to streamline fiat-to-crypto and crypto payments for institutional clients, exploring 24/7 payment solutions and stablecoin-based payouts.

Was this email forwarded to you? Sign up for free here.

TECH

Roomba’s Revenge

Gemini

🤖 Stock cleans up. iRobot (IRBT) shares soared more than 40% after the company unveiled a turnaround plan focused on premium Roombas, AI-driven navigation, and tighter cost controls following Amazon’s (AMZN) failed acquisition.

🧹 Reset and refocus. CEO Gary Cohen said iRobot will streamline operations, cut non-core projects, and expand into smart home integrations to reignite growth after several quarters of losses.

📈 Investors reengage. The sharp rally signals renewed optimism that iRobot can thrive independently, though analysts caution profitability remains a work in progress amid a competitive robotics landscape.

CRYPTO

Digital-Asset Payments Unite

🌍 Global Banking Meets Crypto. Citi (C) and Coinbase (COIN) are collaborating to bring institutional-grade digital-asset payment solutions to Citi’s global client base. The initial target: streamlining fiat pay-ins and pay-outs and enhancing Coinbase’s on- and off-ramp capabilities to bridge traditional finance (“TradFi”) and crypto.

🔧 What’s Being Built. The partnership focuses first on creating 24/7 payment rails between fiat currency and digital assets, supporting global clients across Citi’s network of over 300 clearing networks in 94 markets. Further efforts include exploring alternative models like converting fiat directly into on-chain stable coins for instant payouts.

📈 Strategic Implications for Investors. For investors in Coinbase, this deepens its alliance with a major bank and signals growing institutional demand for digital-asset infrastructure. For Citi, it’s a push to stay relevant in the evolving “Banking 2.0” world of crypto-enabled payments. It also spotlights increasing regulatory acceptance of digital-asset systems—and the pressure on TradFi to adapt or be sidelined.

MESSAGE FROM OUR PARTNER

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

KEEP READING

S&P 500 rallies 1%, on pace for first close above 6,800 ever on potential China trade truce: Live updates (CNBC)

Stocks making the biggest moves premarket: AMD, Lululemon, GameStop, Nvidia, Five Below and more (CNBC)

PayPal’s crypto partner on $300T minting error: ‘We want to be much better than this’(CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

SHARE OUR NEWSLETTER FOR SWAG!

OUR FAVORITE TOOLS & RESOURCES

Gamma.app — AI Powerpoint Slide Generator.

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.