TLDR

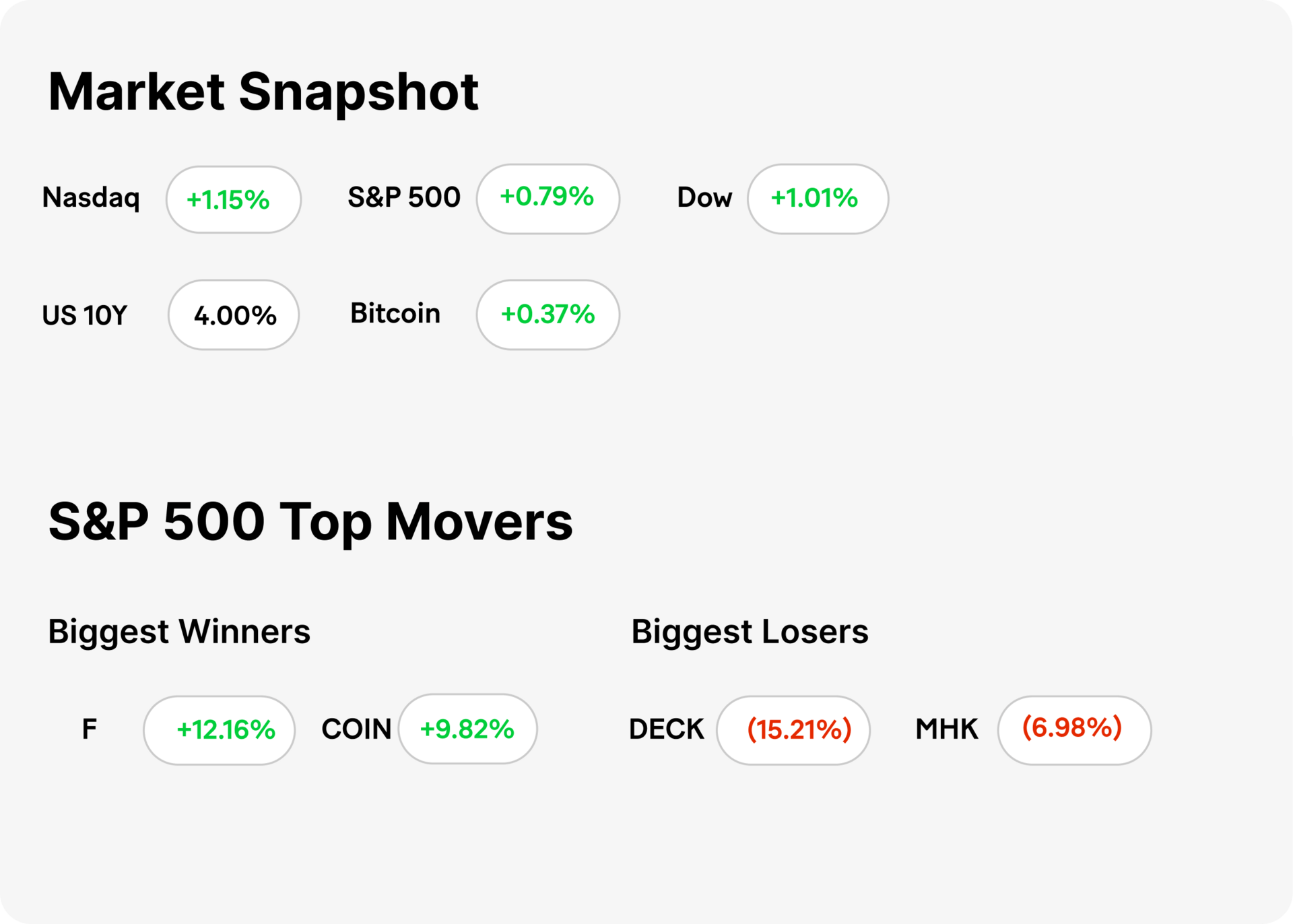

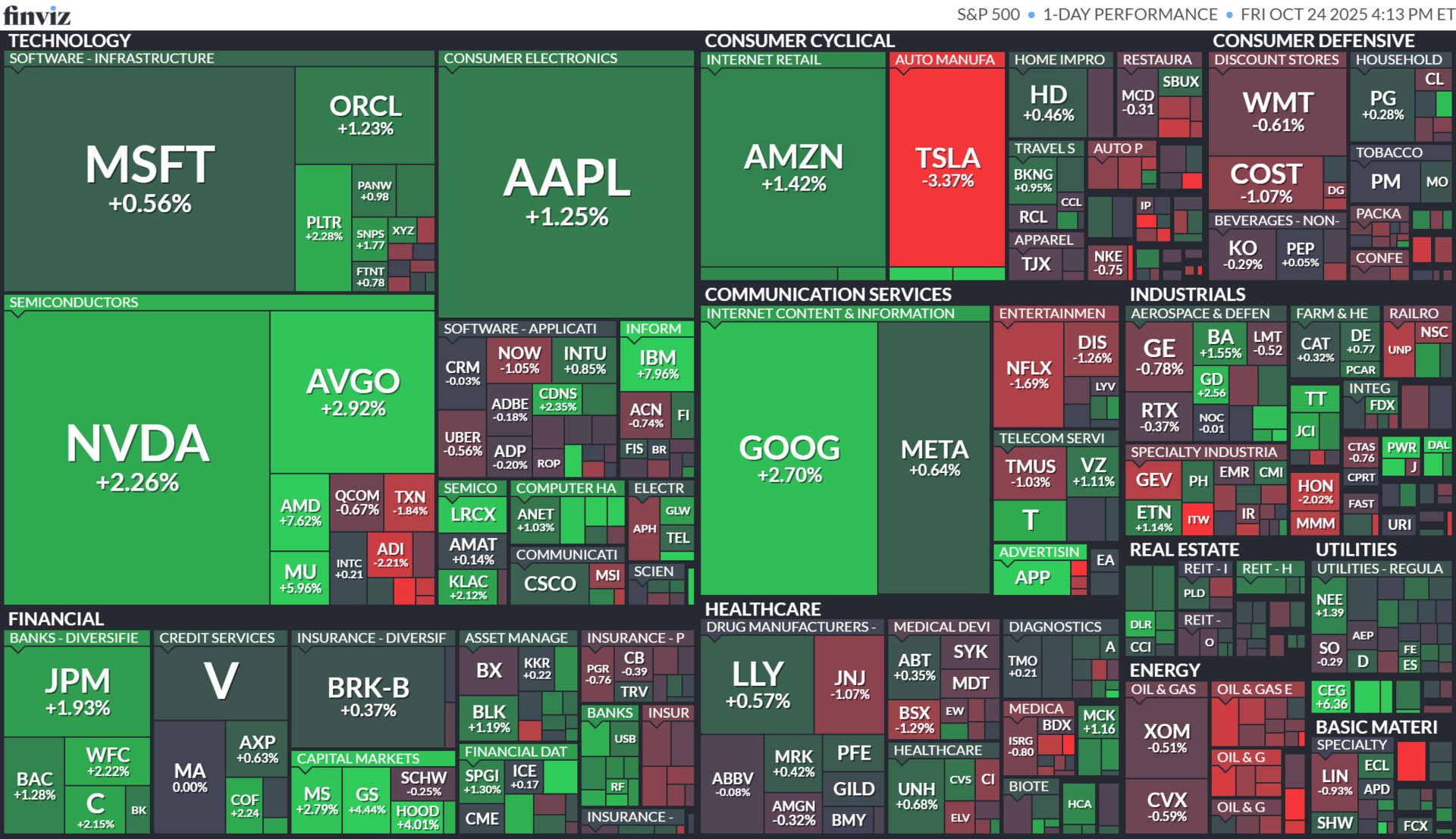

↗ MARKET RECAP → US stocks saw a boost Friday as cool inflation data lifted optimism that the Fed will stay on its rate-reduction path.

🤖 AI BOOSTS THE BANKS → JPMorgan (JPM), Bank of America (BAC), and Goldman Sachs (GS) say generative AI is driving major productivity gains—just as regulators start asking who’s really in control escalating wave of sophisticated cyber threats.

🏦 CRYPTO.COM GOES BANKING → Crypto.com filed for a U.S. national trust bank charter, seeking to merge digital assets with traditional finance and strengthen regulatory credibility.

Was this email forwarded to you? Sign up for free here.

AI, CYBERSECURITY

AI Boosts the Banks

Gemini

🏦 Efficiency pays off. Major U.S. banks are reporting double-digit productivity gains from generative AI tools, using them to automate compliance checks amidst an escalating wave of sophisticated cyber threats, summarize client data, and assist traders with research and risk analysis.

🏦 CRYPTO.COM GOES BANKING → Crypto.com filed for a U.S. national trust bank charter, seeking to merge digital assets with traditional finance and strengthen regulatory credibility.

CRYPTO

Crypto.com Goes Banking

Gemini

🏦 Trust charter filed. Crypto.com announced it has applied for a U.S. national trust bank charter, a move that would let the exchange offer traditional banking services like deposits, lending, and custody under federal regulation.

💳 Bridging crypto and fiat. The proposed “Crypto.com National Trust Bank,” headquartered in Washington, D.C., aims to blend digital asset management with everyday finance—furthering CEO Kris Marszalek’s goal of mainstream crypto adoption.

⚙️ Regulatory signal. If approved, Crypto.com would join Coinbase (COIN) and Paxos in securing federal trust charters, signaling growing alignment between major crypto firms and U.S. financial regulators.

MESSAGE FROM OUR PARTNER

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

KEEP READING

As Netflix dips below its 200-day moving average, Josh Brown says to buy shares here (CNBC)

Goldman Sachs says risks of an equity drawdown are rising as stocks hit another record (CNBC)

Here are Friday’s biggest analyst calls: Nvidia, Apple, Coinbase, Intel, Beyond Meat, Amazon, Microsoft, eBay & more(CNBC)

WHAT WE’RE WATCHING

SHARE OUR NEWSLETTER FOR SWAG!

OUR FAVORITE TOOLS & RESOURCES

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.