TLDR

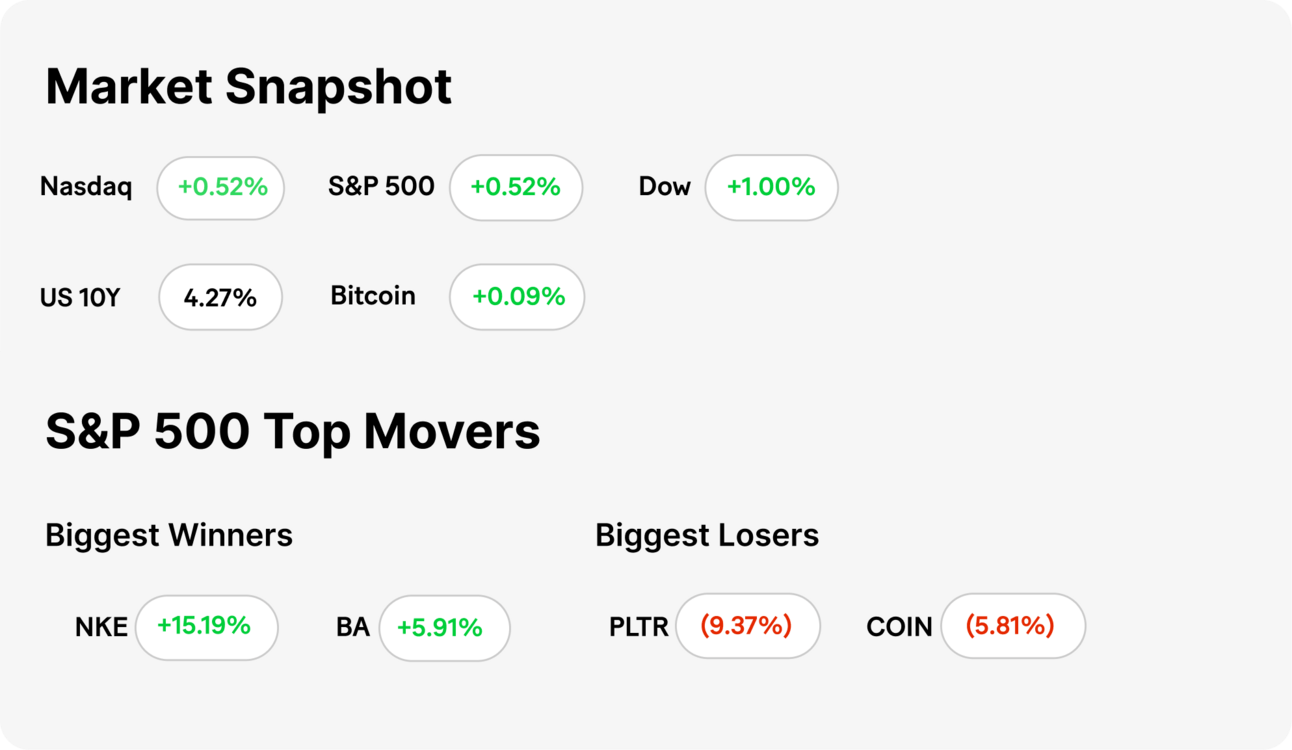

MARKET RECAP → Stocks kept climbing on Friday with the S&P 500 hitting a new record high. The upward movement occurred amongst trade angst, specifically after Trump released comments on tariffs between the U.S. and Canada.

TRUMP HALTS TALKS, THREATENS TARIFFS → Trump pulled the plug on trade talks with Canada after it announced a digital tax on U.S. tech firms. He’s now threatening new tariffs, reigniting tensions that spooked markets and alarmed allies.

COINBASE LEADS THE S&P 500 → Coinbase (COIN) is the S&P 500’s top stock for June, up 30 percent and 400 percent year to date. Analysts still see more upside as crypto trading surges and Coinbase branches into broader financial services.

Was this email forwarded to you? Sign up for free here.

POLL OF THE DAY

If Inflation Comes Back… What Breaks First?

Politics

Trump Halts Talks, Threatens Tariffs

source DALL-E

Canada Tariff Talks Implode: Trump torpedoes U.S.-Canada trade talks over a new Canadian tech tax, calling it a hostile move against American companies like Amazon (AMZN), Meta (META), and Google (GOOG). His abrupt exit from negotiations leaves a proposed economic and security pact in limbo.

Tariff Threats Back On: Trump says steep tariffs on Canadian imports will be reinstated within a week, citing the need to “protect American innovation.” Previous duties on Canadian aluminum, lumber, and autos may return in force, stoking fears of a broader North American trade war.

Markets Shudder, Allies Bristle: Markets dipped slightly as investors digested the breakdown. U.S. tech giants could face retaliatory taxes, while Canadian officials accused Trump of “economic coercion,” signaling that global allies may be rethinking post-2024 diplomatic strategy.

Crypto

Coinbase Leads the S&P 500

source DALL-E

Best Performer On The Street: Coinbase (COIN) is the S&P 500’s best performing stock for June, up over 30 percent. This continues a monster run for the crypto exchange, which has skyrocketed nearly 400 percent over the past year, fueled by the crypto rebound and ETF fueled trading volumes.

More Fuel In The Tank: Analysts say the rally may not be over. Trading activity remains strong, Bitcoin ETF flows are sticky, and regulatory clarity is improving. Oppenheimer just raised its price target to 320 dollars, about 20 percent higher from here.

Not Just About Crypto: Coinbase is not just riding Bitcoin (BTC). It is pivoting into broader financial services including stablecoins, custody, and institutional clients. That diversification could help insulate it from the next crypto winter.

KEEP READING

Quantum computing is having a moment. But the technology remains futuristic (CNBC)

China confirms details of U.S. trade deal (CNBC)

Core inflation rate rose to 2.7% in May, more than expected, Fed’s preferred gauge shows (CNBC)

Trump calls New York Democratic mayoral candidate Zohran Mamdani ‘a communist’ (CNBC)

Apple seeks to avoid a crash with ‘F1 The Movie’ (Morning Brew)

What is a Money Order? How a Money Order Works (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.