TLDR

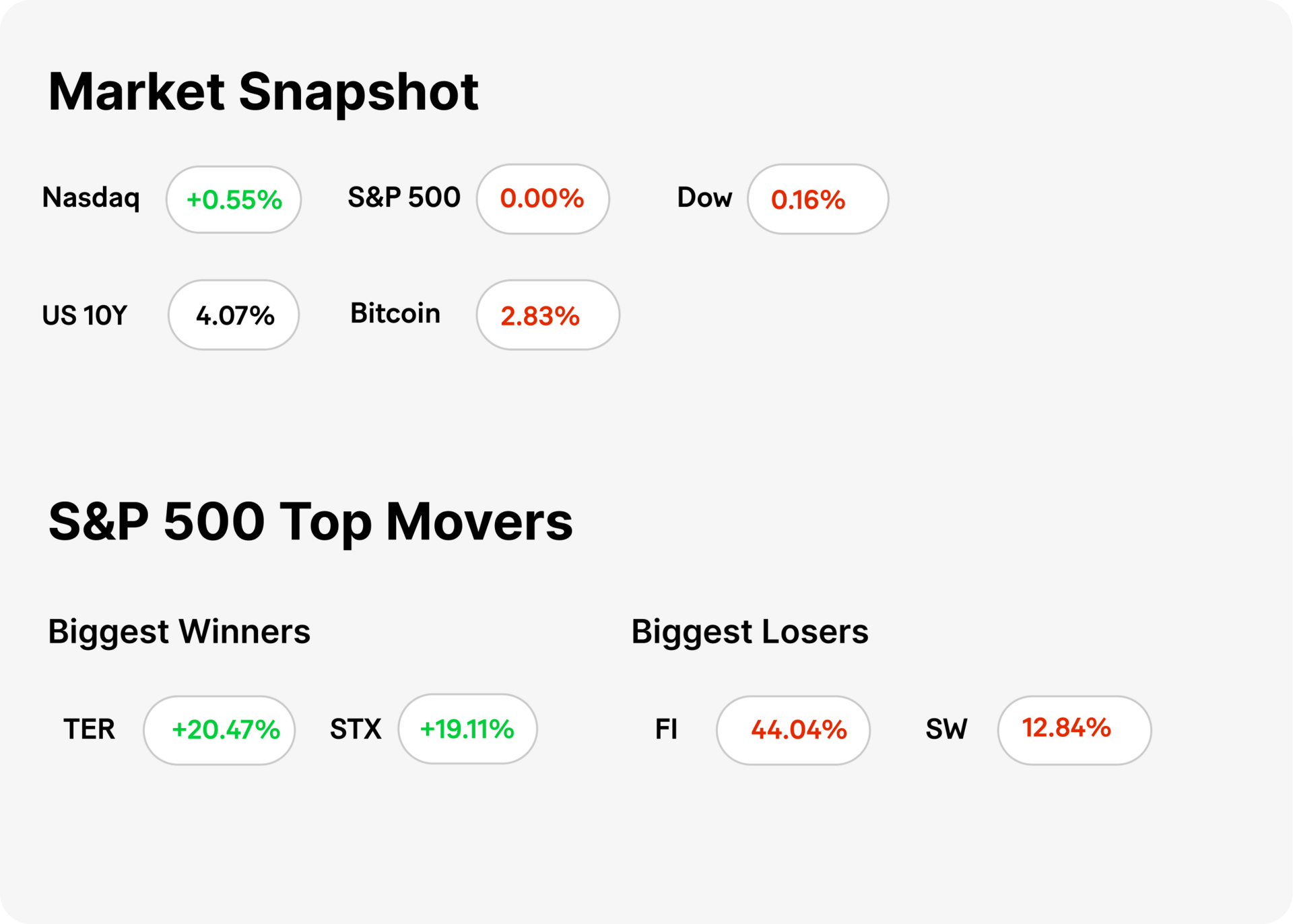

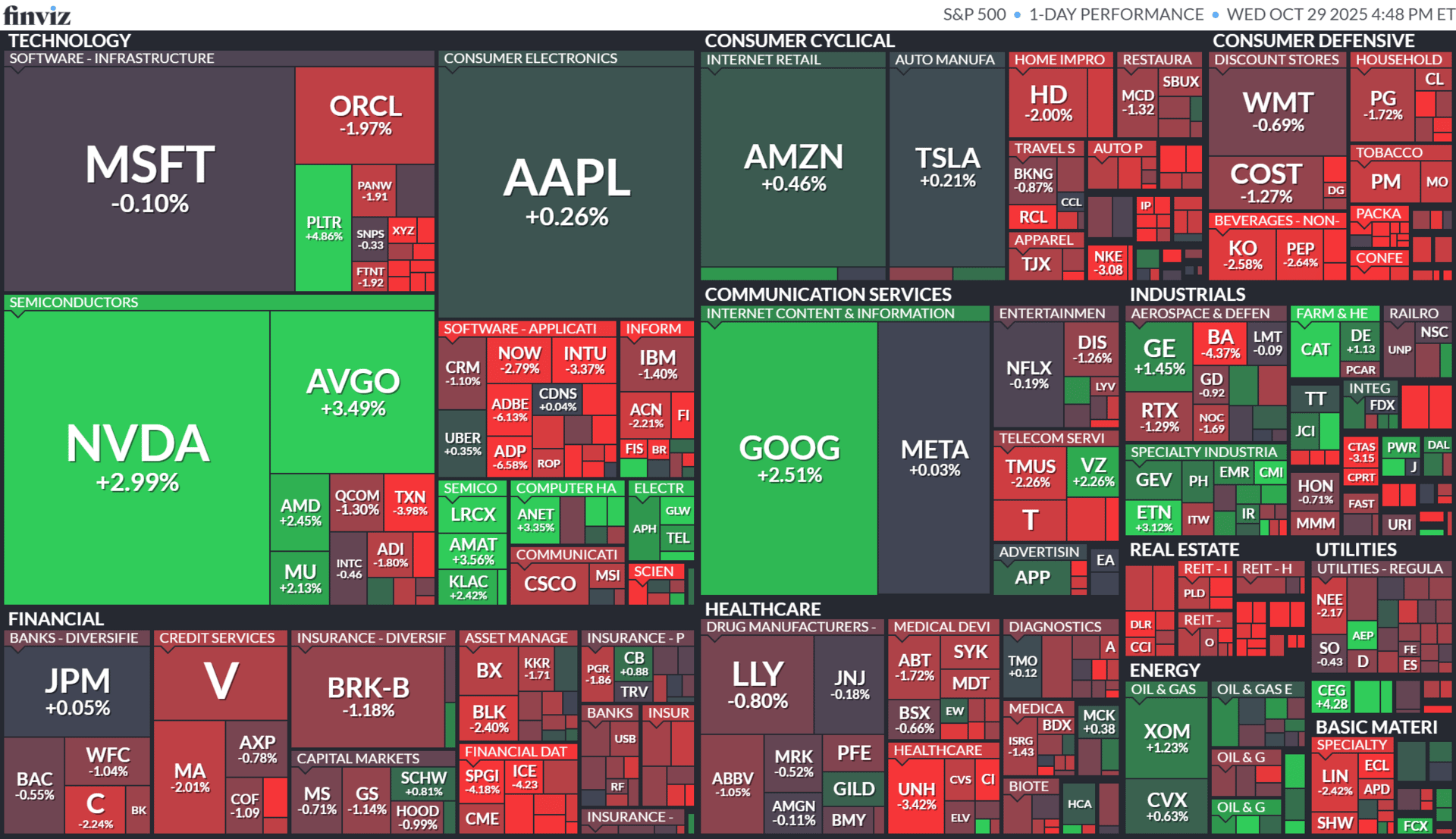

😰 MARKET RECAP → Stocks were not on sturdy footing today as the Fed cut rates but said another one this year is not a “foregone conclusion,” throwing a bucket of ice cold water on the futures traders who placed nearly a 90% chance of just that only yesterday.

📉FISERV SHOCK → Fiserv’s (FI) Q3 miss, coupled with a drastic cut to its 2025 outlook and major executive overhaul, triggered a >40% stock slide. Investors should expect volatility until the turnaround plan earns trust.

🏦 FED CUTS AGAIN → The Fed trimmed rates by a quarter of a percent— or 25 basis points (“bps”)— but Powell denied a December cut is locked in—injecting caution back into markets despite relief from the move.

Was this email forwarded to you? Sign up for free here.

FINTECH

Fiserv Shock

Gemini

💥 Earnings Miss & Guidance Cut. Fiserv Inc. (FI) reported Q3 adjusted earnings of ~$2.04 per share and roughly $4.9 billion in revenue, both well below analyst expectations. The company slashed its full-year guidance: now projecting organic revenue growth of just 3.5–4% (vs ~10% prior) and adjusted EPS between $8.50–$8.60 (vs ~$10.15–$10.30 prior).

🔄 Leadership Shake-Up & Strategy Reset. New CEO Mike Lyons, in office since May, announced a five-point action plan alongside board and executive changes. The firm said performance in Argentina and delayed investments weighed heavily on results, highlighting pressure in its Merchant & Financial Solutions units

📉 Market Impact & Investor Takeaway. Fiserv shares plunged over 40%, marking one of its worst single-day moves ever—and dragging the stock to its lowest in five years. For investors: the sharp reset signals increased risk—any rebound may need strong execution and visible growth recovery to regain confidence.

ECONOMICS

Fed Cuts Again

🏦 Another rate drop. The Federal Reserve cut its benchmark interest rate by a quarter-point (25 bps), responding to growth worries and a cooling labour market.

📉 Rate outlook murky. Chair Jerome Powell signalled that a December rate cut is not a certainty, citing sharp internal division and limited economic visibility amid the government shutdown.

🔍 Markets parse the message. Stocks rallied modestly and Treasury yields fell as the Fed paused tightening—yet mixed signals about the path forward left investors with plenty of questions.

MESSAGE FROM OUR PARTNER

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

KEEP READING

Meta shares drop 9% despite earnings beat as company takes one-time tax charge (CNBC)

Nvidia’s $5 trillion market cap is equivalent to around 25 Disney’s, 50 Nikes and more than 3,000 JetBlue’s (CNBC)

Microsoft hit with Azure, 365 outage ahead of quarterly earnings report (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

SHARE OUR NEWSLETTER FOR SWAG!

OUR FAVORITE TOOLS & RESOURCES

Gamma.app — AI Powerpoint Slide Generator.

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.