TLDR

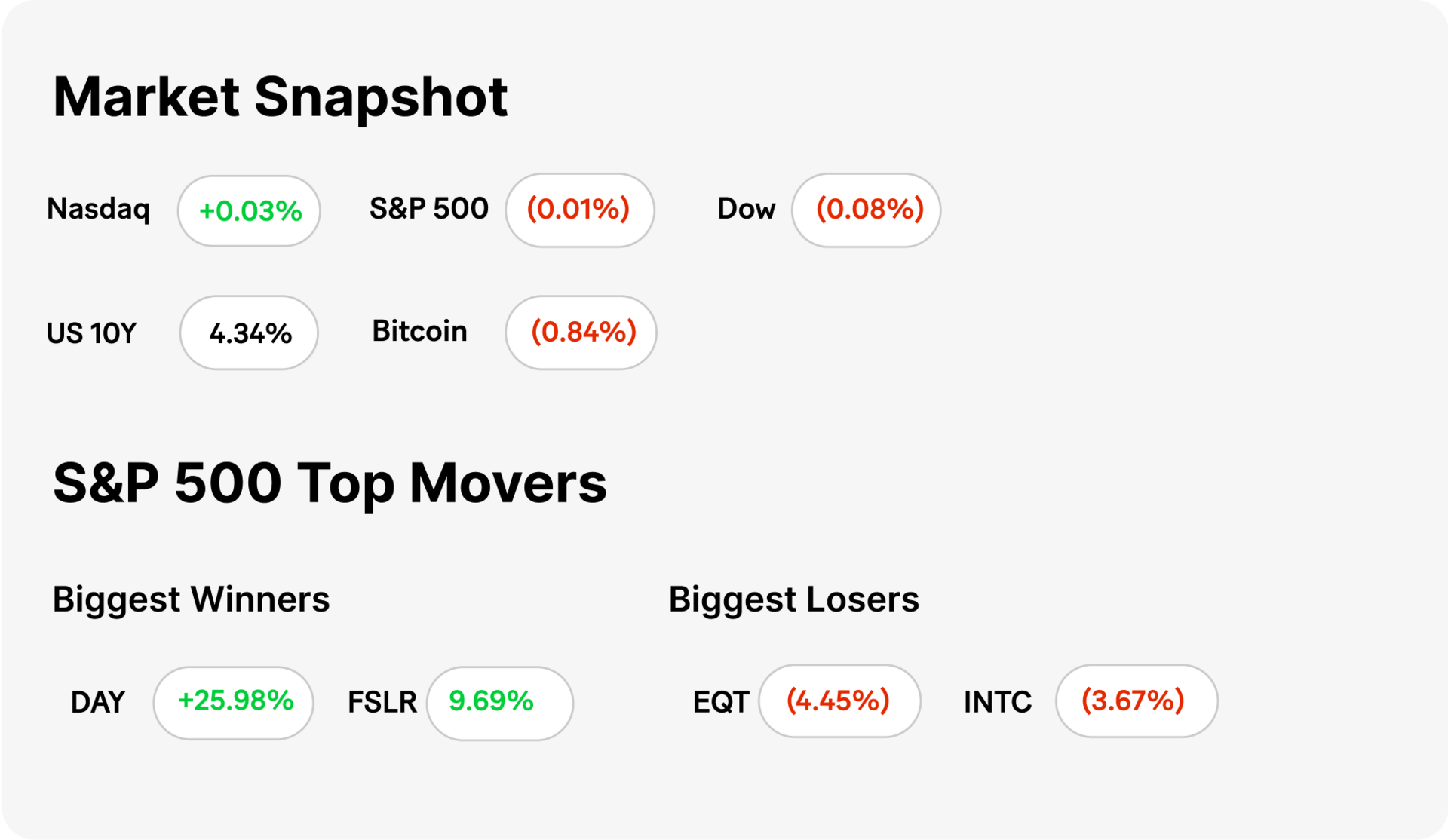

MARKET RECAP → Stocks closed Monday essentially unchanged as investors looked ahead to major retail earnings and Fed Chair Jerome Powell’s upcoming remarks at the Jackson Hole summit.

TRUMP-HOSTED UKRAINE MEETING SPARKED DIPLOMATIC TIGHTROPE→ ⚖️ Trump pressed Ukraine to drop NATO and Crimea ambitions while hinting Putin might free prisoners, leaving Zelensky balancing allies’ demands for real security against a peace plan that looked a lot like Moscow’s wish list.

SOHO HOUSE GOES PRIVATE → 📉 Soho House ditched Wall Street in a $2.7B deal with MCR Hotels, spiking shares and adding Ashton Kutcher to the board—because nothing says “exclusive club turnaround” like celebrity stardust and hybrid financing.

Was this email forwarded to you? Sign up for free here.

WORLD NEWS

Trump-hosted Ukraine Meeting Sparked Diplomatic Tightrope

🤝 A high-stakes summit unfolded at the White House where President Trump, Ukrainian President Zelensky, and several European leaders rallied in support of Ukraine. As Zelensky wooed allies for post-war security guarantees, Trump asserted that a peace deal didn’t hinge on a ceasefire, signaling a shift toward Russia’s preferences.

⚖️ Trump openly urged Ukraine to let go of NATO ambitions and its claim to Crimea before meaningful peace negotiations could begin—an uncomfortable compromise that raised alarm about rewarding Russian aggression.

🔓 In an olive‑branch move, Trump expressed optimism that Putin would imminently release over 1,000 Ukrainian prisoners. Meanwhile, European leaders stood firm in demanding binding security guarantees and pushing for a ceasefire before any concessionary deal.

BUSINESS

Soho House Goes Private

⛽ Soho House ended its turbulent Wall Street stint with a $2.7B take-private deal led by MCR Hotels. Shareholders got $9 per share—a 17.8% premium—and the stock spiked over 15% on the news. The move came less than three years after its IPO, which saw nearly half its value vanish despite steady membership growth.

🎭 Hollywood met hospitality as Ashton Kutcher joined the new board, while Neil Thomson replaced Thomas Allen as CFO. But star power won’t fix everything—analysts noted that rapid expansion and soft consumer spending have diluted Soho’s once-exclusive cachet, making profitability elusive even with packed membership rolls.

💸 Apollo Global Management sweetened the deal with $850M in hybrid debt-and-equity financing, part of a growing playbook to fund complex deals. Founder Nick Jones and billionaire Ron Burkle’s Yucaipa retained majority control, while hedge fund manager Dan Loeb—both investor and club member—gave his stamp of approval to the privatization.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

Novo Nordisk offers diabetes drug Ozempic for less than half the price for cash-paying U.S. patients (CNBC)

OpenAI’s Altman warns the U.S. is underestimating China’s next-gen AI threat (CNBC)

Bitcoin sinks to $115,000 after hitting its newest record, as macro concerns spark liquidation wave (CNBC)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Deribit — Crypto Futures and Options Exchange

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.