TLDR

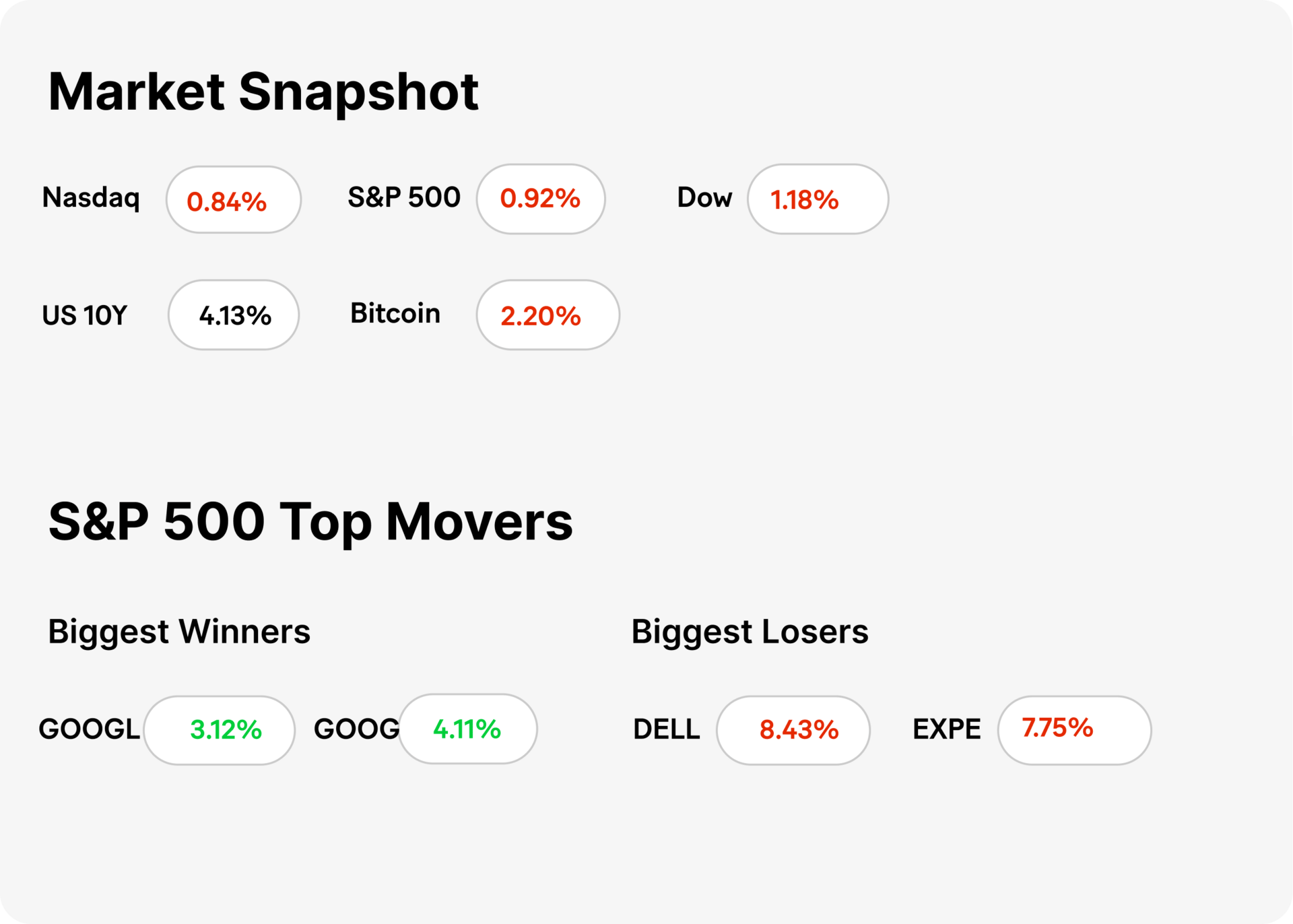

🥵 MARKET RECAP → Stocks closed down again on Monday as investors await big tech earnings and the September jobs report this week.

🆘 HUANG’S $500B TIGHTROPE → Q3 isn’t just about another monster quarter for Nvidia (NVDA); it’s a stress test of whether Huang’s half-trillion-dollar AI order book, capex-heavy partnerships, and strategic equity deals can justify god-mode expectations in a stock already priced like the AI end boss. NVIDIA reports earnings after the close of trading on Wednesday (11/19).

🤝 BUFFETT BLESSES ALPHABET → Berkshire’s big new stake in Alphabet (GOOG) looks like classic late-stage Buffett: trim an overgrown Apple (AAPL) position, roll into the cheapest Mag 7 name just as AI fears fade and Cloud profitability ramps, and leave his successors a boringly excellent, cash-gushing compounder instead of a moonshot.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

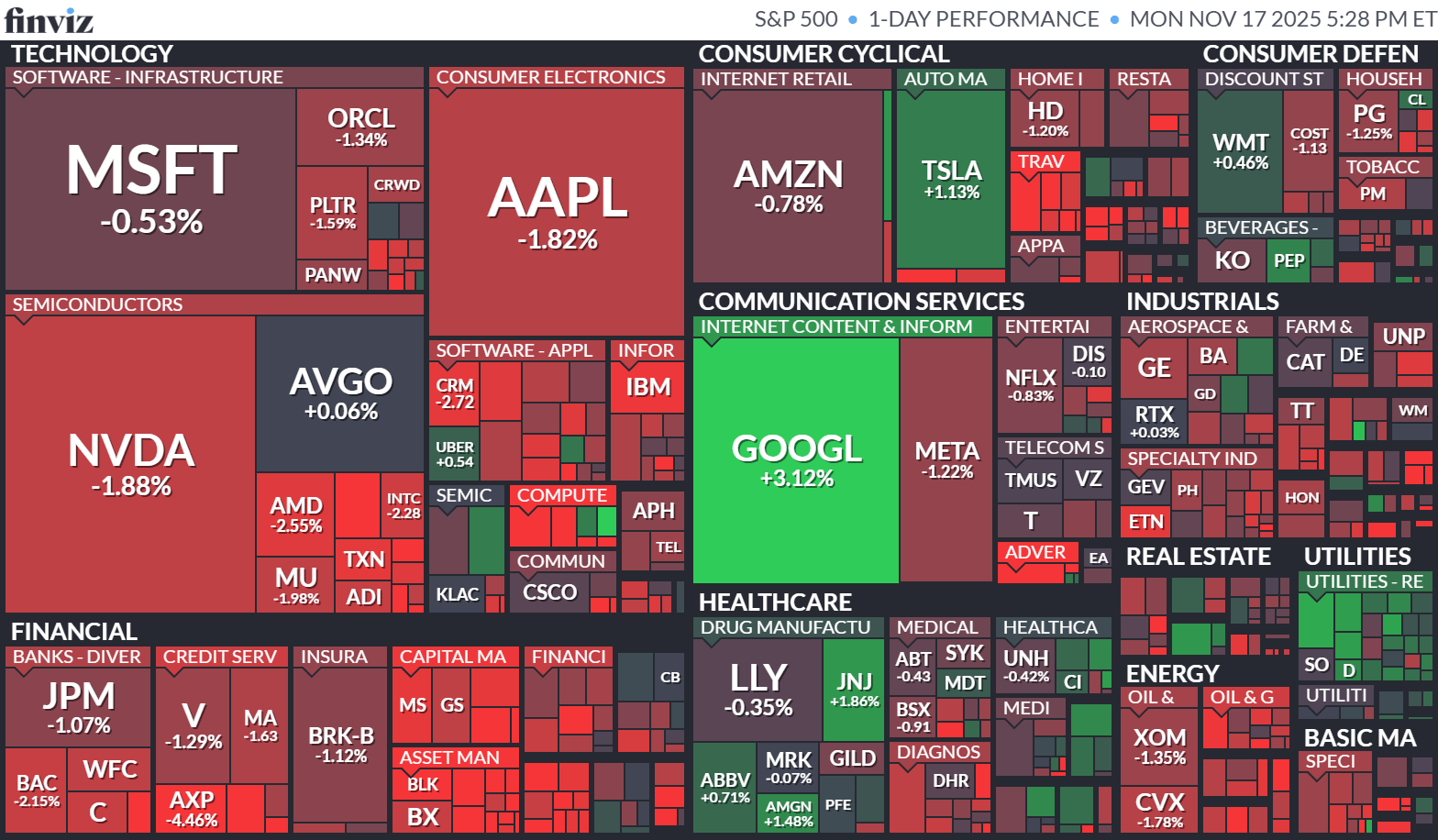

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning November 17, 2025

TECH

Huang’s $500B Tightrope

Gemini

🚀 Huang just pre-announced the future: Jensen Huang says Nvidia (NVDA) has about $500 billion in 2025–26 AI hardware and networking orders “on the books.” That effectively prices in a multi-year AI supercycle, with Street models nudging 2026 data-center revenue sharply higher before the company has even reported Q3.

📊 Now earnings have to catch up: For Q3, investors are looking for enormous numbers and even bigger guidance, not just a simple “beat and raise.” The real tell will be whether commentary on that $500 billion pipeline, capacity, and pricing makes current estimates look conservative or exposes how tight the runway really is.

🤝 Huang is wiring the ecosystem by checkbook: Nvidia is backing up its dominance with equity checks tied to GPU supply and strategic stakes in players like Intel (INTC) and Nokia (NOK). Those bets deepen Nvidia’s grip on AI infrastructure, but they also raise the bar if hyperscaler capex or AI enthusiasm ever cools.

🆘 HUANG’S $500B TIGHTROPE → Q3 isn’t just about another monster quarter for Nvidia (NVDA); it’s a stress test of whether Huang’s half-trillion-dollar AI order book, capex-heavy partnerships, and strategic equity deals can justify god-mode expectations in a stock already priced like the AI end boss.

MARKETS

Buffett Blesses Alphabet

Gemini

🚀 Buffett takes a rare fresh tech swing: Alphabet (GOOG) jumped after Berkshire Hathaway (BRK.B) revealed a new multibillion-dollar stake that instantly lands in its top holdings. It’s one of the more significant portfolio moves as the Buffett era transitions to Greg Abel, and a loud endorsement of Google’s AI, ads, and Cloud cash machine.

💸 Why Berkshire likely bought: Alphabet came into 2025 as the “cheap” Magnificent Seven name, trading at a discount to Microsoft (MSFT) and Nvidia (NVDA) despite dominant Search, YouTube, and rapidly improving Google Cloud economics. Berkshire is effectively trimming an outsized Apple (AAPL) win and rotating into another durable, high-cash-flow compounder with cleaner upside from AI and cloud than its sticker price suggests.

📈 Investor takeaway: piggyback, but don’t pretend it’s undiscovered: Alphabet is already one of 2025’s standout Mag 7 performers, so you’re not front-running Omaha — you’re joining a trend with fresh validation. The Buffett stamp helps de-risk the narrative, but from here the trade is about accepting “quality at a fair price” growth, not hoping for a magical value rerating from neglected levels.

KEEP READING

Jeffrey Epstein victims’ ad calls for files to be released, Trump urges GOP to vote for House measure (CNBC)

Nvidia CEO Jensen Huang surprised investors with a ‘half a trillion’ forecast. It’ll come up at earnings (CNBC)

Judge hints at Comey indictment dismissal, orders DOJ to release grand jury material (CNBC)

AI boom is fueling a memory chip shortage that could hit cars and phones (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.