TLDR

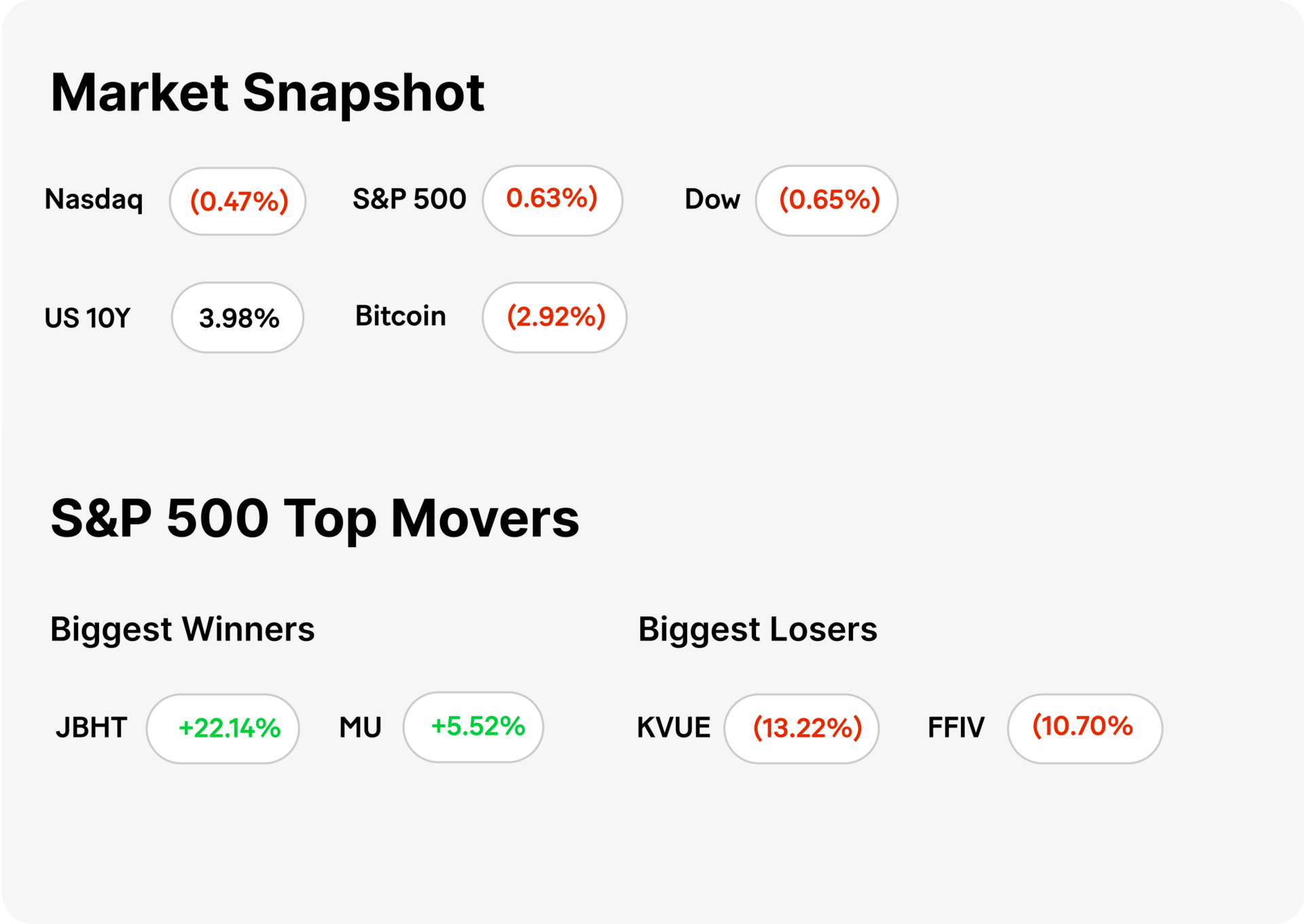

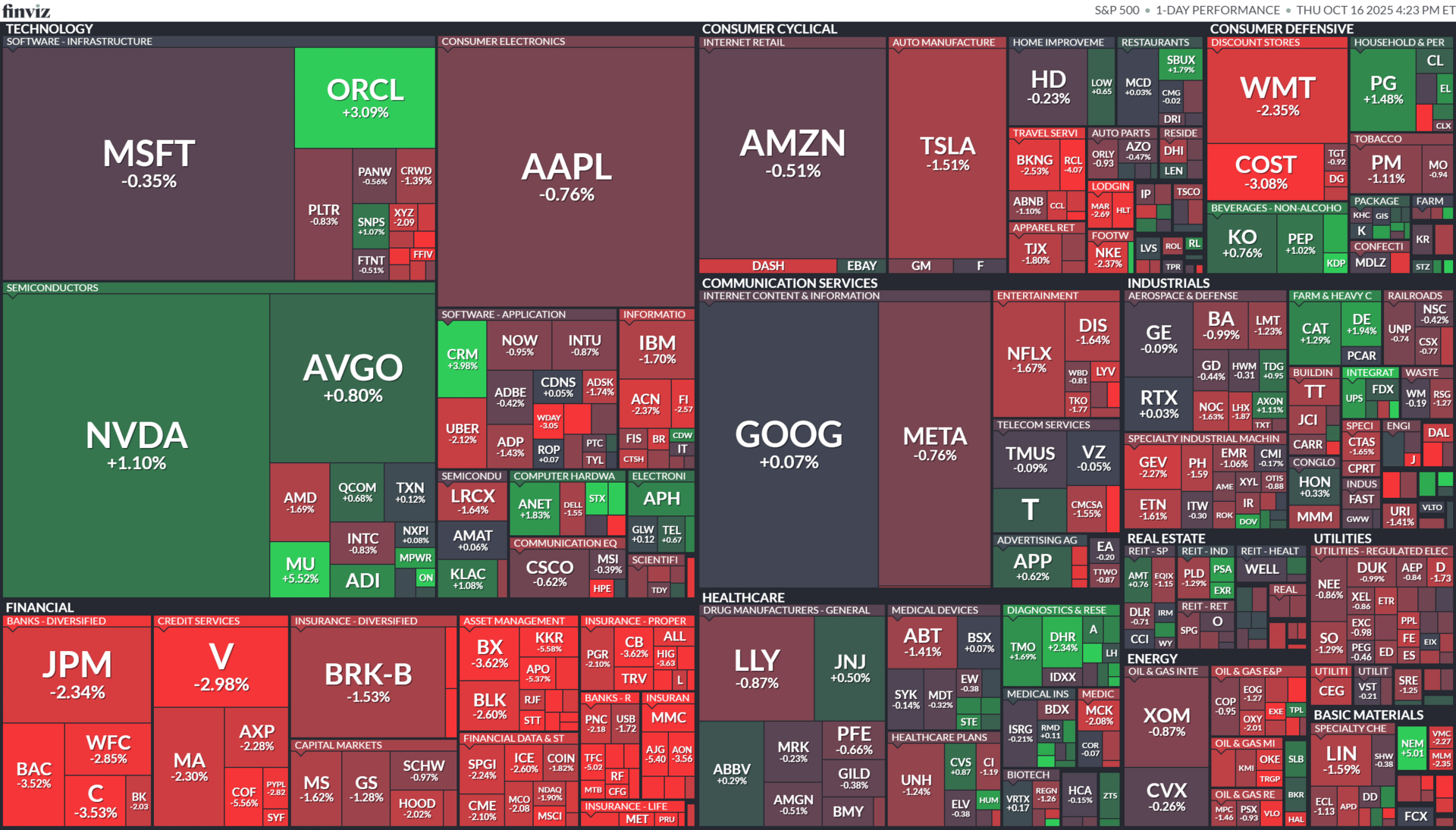

↘ MARKET RECAP → THE S&P 500 (VOO) closed lower Thursday giving up gains as concerns mounted over bad loans and an ongoing government shutdown.

⚖️ SHUTDOWN STANDOFF → Trump pushes his GOP Senate allies toward a shutdown vote over border politics, spooking markets as odds of U.S. government closure climb again.

💥 STABLECOIN GLITCH → PayPal’s (PYPL) crypto partner Paxos accidentally minted 300 trillion PYUSD coins in a technical error, later burned them, and reignited scrutiny over stablecoin infrastructure.

Was this email forwarded to you? Sign up for free here.

POLITICS

Shutdown Standoff

Gemini

⚖️ Trump backs threat. Donald Trump renewed pressure for a government shutdown in protest of border policies, calling for a Senate vote to buckle without new restrictions.

🗳️ Senate reply looms. Senate Republicans are pushing for a procedural vote but may lack consensus—some resist shutting down government over political demands.

📉 Risk reenters markets. Treasury yields ticked higher and short-dated funding rates increased on renewed odds of a shutdown, dragging sentiment and ratcheting uncertainty.

CRYPTO

Stablecoin Glitch

Gemini

💥 $300 trillion whoops. PayPal’s (PYPL) crypto partner Paxos accidentally minted 300 trillion PYUSD stablecoins overnight due to a smart-contract configuration error. The coins were never released into circulation and were quickly burned after discovery.

🪙 No funds lost. Paxos said the glitch occurred during a system update and did not affect customer assets or market stability. Still, the astronomical number briefly appeared on blockchain trackers, causing temporary chaos on X and crypto forums.

⚙️ Trust under the microscope. The incident reignited debates about stablecoin oversight, with critics arguing that even non-circulating errors expose the fragility of automated issuance systems. PYUSD remains fully backed 1:1 by dollar reserves, according to Paxos.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

Retail traders’ incredible support of the stock market continues with biggest options volume day ever (CNBC)

China accuses U.S. of deliberately causing panic over rare earth controls, says it is open to talks (CNBC)

10-year Treasury yield drops below 4%, hits lowest level since April (CNBC)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.