TLDR

MARKET RECAP → Stocks rose on Friday boosted by a strong rise in shares of Amazon (AMZN) after a blowout earnings report.

☁️ AMAZON’S AI EDGE → Amazon (AMZN) smashed earnings and reignited AWS growth as AI demand powered revenue and margins, sending shares up 7% after hours.

🥚 SNAP Benefits Continue Despite Shutdown → Courts ordered the USDA to keep food stamps running during the shutdown, but funding shortfalls still threaten timely aid for 42 million Americans.

Was this email forwarded to you? Sign up for free here.

MARKETS

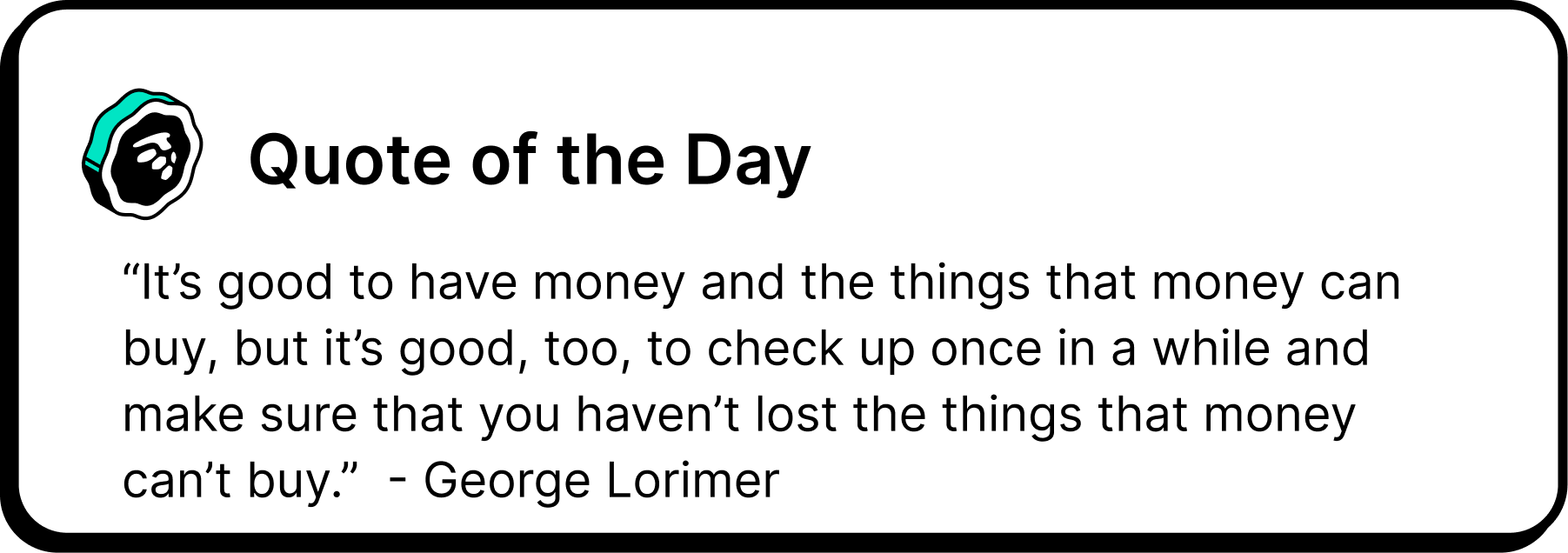

Market Snapshot

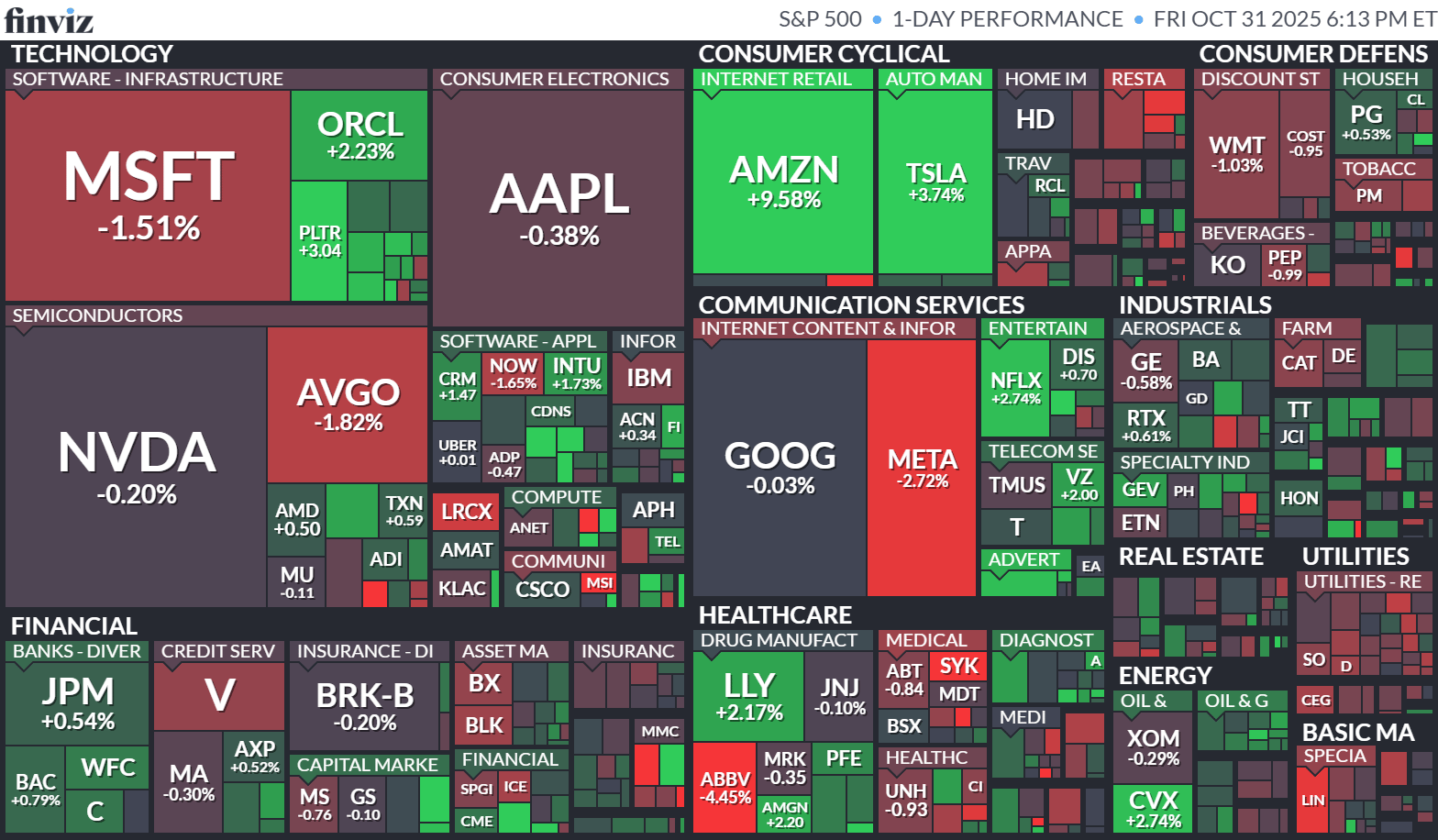

Today’s S&P 500 Heatmap

Notable Earnings Next Week

For the week beginning November 3, 2025

TECH

Amazon’s AI Edge

Gemini

💵 Earnings crush expectations. Amazon (AMZN) delivered Q3 revenue of $172.4 billion, up 14% year over year, handily beating estimates as AWS growth and AI integration drove strong performance across the board.

☁️ Cloud comeback. AWS sales surged 19%, its fastest growth in nearly two years, fueled by enterprise demand for generative AI tools and chip-optimized infrastructure. CEO Andy Jassy called AI “the next trillion-dollar opportunity” for Amazon.

📈 Investors reward results. Shares rose more than 7% after hours, with analysts cheering cost discipline in e-commerce and margin gains in advertising—proof that Amazon can scale AI while still printing profits.

GOVERNMENT

SNAP Benefits Continue Despite Shutdown

🥦 Food stamp freeze averted. Two federal judges ruled that Supplemental Nutrition Assistance Program (SNAP) benefits must continue during the government shutdown, ordering the USDA to use contingency funds to keep food aid flowing to more than 42 million Americans.

📉 Emergency funding gaps. While the ruling averts an immediate crisis, SNAP’s contingency reserves—roughly $5 billion—cover just over half of monthly program costs, raising fears of delays or reduced benefits if the shutdown drags on.

⚠️ Safety net strain. The decision underscores how political gridlock is hitting low-income households hardest, with food insecurity climbing even as Washington’s fiscal standoff shows no sign of resolution.

KEEP READING

Cramer says Amazon CEO Andy Jassy just sent a very expensive message to the bears(CNBC)

Nasdaq rises on the back of Amazon, but S&P 500 gives up gain: Live updates (CNBC)

Treasury Department announces new Series I bond rate of 4.03% for the next six months (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

SHARE OUR NEWSLETTER FOR SWAG!

OUR FAVORITE TOOLS & RESOURCES

Gamma.app — AI Powerpoint Slide Generator.

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.