TLDR

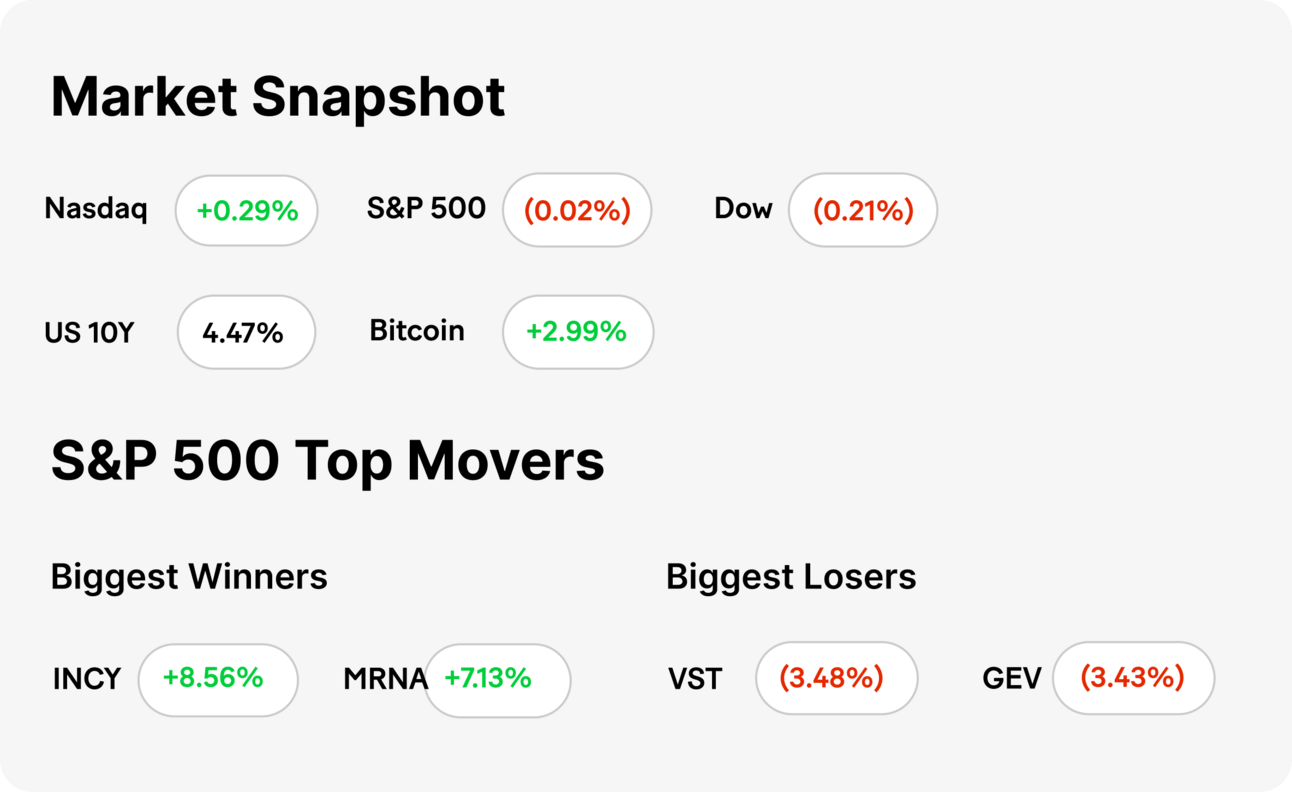

MARKET RECAP → The Dow Jones Industrial Average (DIA) snapped its 8-day winning streak as investors paused in the wake of rising consumer inflation expectations.

GME SURGE TRIGGERS TRADING HALTS → 🎮 GameStop's (GME) stock spiked 74% and faced multiple halts after "Roaring Kitty" re-engaged on social media, rekindling the meme stock mania while highlighting ongoing struggles in GameStop’s core business.

INFLATION EXPECTATIONS RISE → 📊 Rising home costs and persistent inflation fears push consumer expectations to 3.3% for the next year, challenging the Fed's target as broad price increases loom across sectors.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

GME Surge Triggers Trading Halts

🎮 Roaring Kitty Ignites Rally: GameStop's (GME) stock soared up 75%, with trading halted multiple times due to volatility, following a new post from Roaring Kitty—real name Keith Gill. His influence, originating from massive short squeezes in 2020-2021, remains potent as evidenced by the dramatic stock movement from his recent social media activity.

🔥 Meme Stock Frenzy Revisited: The online frenzy began anew, reminiscent of the 2021 chaos that targeted hedge funds like Melvin Capital, causing significant financial upheaval. Gill's post sparked a surge not only in GameStop but also in other meme stocks like AMC (AMC), showcasing the enduring power of social media-driven trading among retail investors.

📉 GameStop’s Recent Performance and Outlook: Despite the recent surge, GameStop's underlying business struggles continue, with a reported revenue drop in the last quarter and ongoing job cuts to stem costs. The stock’s unpredictable swings underscore the ongoing challenges and speculative nature tied to meme stocks.

TODAY’S TOP NEWS

Inflation Expectations Rise

🏠 Housing and Energy Costs Drive Inflation Fears: The New York Fed's latest survey revealed that consumers expect higher inflation rates in the near and longer term, primarily driven by anticipated increases in housing costs and energy prices. On a one-year basis, inflation expectations rose to 3.3%, the highest since November 2023, with housing price growth expectations jumping to 3.3%.

📈 Persistent Inflation Concerns: Despite a significant disinflationary trend in 2023, inflation remains stubborn, with the five-year outlook increasing to 2.8%. This sustained expectation far exceeds the Federal Reserve's 2% target, reflecting ongoing concerns over the stubborn nature of inflation.

📉 Broader Economic Implications: Alongside housing, consumers anticipate significant rises in rents, medical care, food, gasoline, and college education costs over the next year. This broad-based expectation of inflation is worrisome for policymakers, especially as the Fed holds interest rates steady, seeking more evidence of inflation aligning closer to their target.

KEEP READING

OpenAI launches new AI model and desktop version of ChatGPT (CNBC)

Squarespace to go private in $7 billion private-equity deal (CNBC)

Shein’s U.S. charm offensive and IPO could hinge on NRF membership. So far, it’s been rejected (CNBC)

Putin to replace longtime defense minister in surprise move; Russia claims gains as fighting rages in northeast Ukraine (CNBC)

Google’s Demis Hassabis is the man tasked with turning bleeding-edge AI research into profits (CNBC)

An explosive wildfire threatens to overrun a Canadian town as US gets season’s first dose of smoke (CNN)

What to know about New Jersey Democratic Sen. Bob Menendez’s trial (CNN)

Massachusetts takes Uber and Lyft to trial over status of gig workers (CNN)

MoneyLion: On a Mission to Become the Expedia of Financial Services (PYMNTS)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.

\\