TLDR

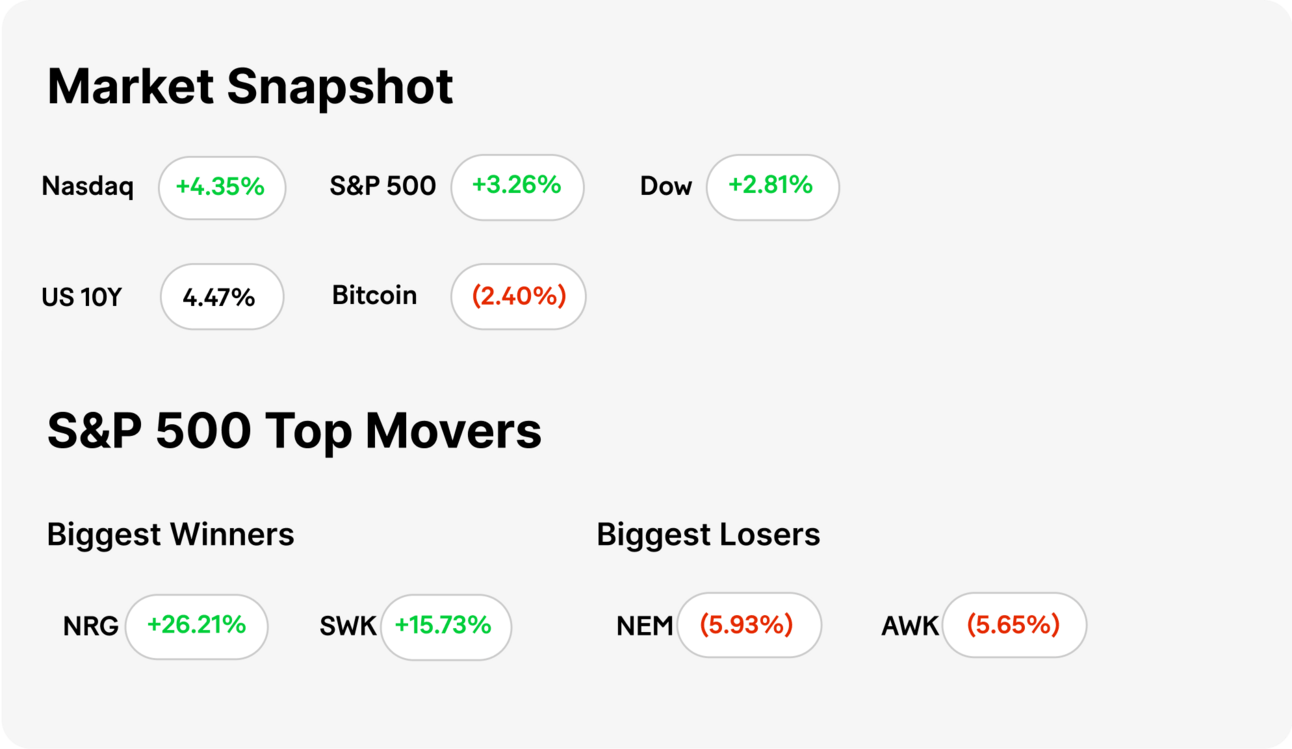

MARKET RECAP → U.S. stocks surged Monday after the U.S. and China agreed to temporarily roll back tariffs during weekend talks in Switzerland, boosting optimism that a full-blown trade war—and potential recession—might be avoided.

U.S. AND CHINA SLASH TARIFFS IN 90-DAY TRUCE → 📉 The United States and China have agreed to a 90-day reduction in tariffs, with U.S. duties on Chinese imports dropping from 145% to 30%, and China's tariffs on U.S. goods decreasing from 125% to 10%.

PERPLEXITY EYES $14B VALUATION → Perplexity AI is closing in on a $500 million raise at a $14 billion valuation—tripling its value in under a year—as it races to out-search Google (GOOG), OpenAI, and anyone else with a chatbot and ambition. 🚀

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

U.S. and China Slash Tariffs in 90-Day Truce

DALL-E

Significant Tariff Reductions Announced: 📉 The United States and China have agreed to a 90-day reduction in tariffs, with U.S. duties on Chinese imports dropping from 145% to 30%, and China's tariffs on U.S. goods decreasing from 125% to 10%. This agreement, reached after negotiations in Geneva, aims to de-escalate ongoing trade tensions and establish a framework for future discussions.

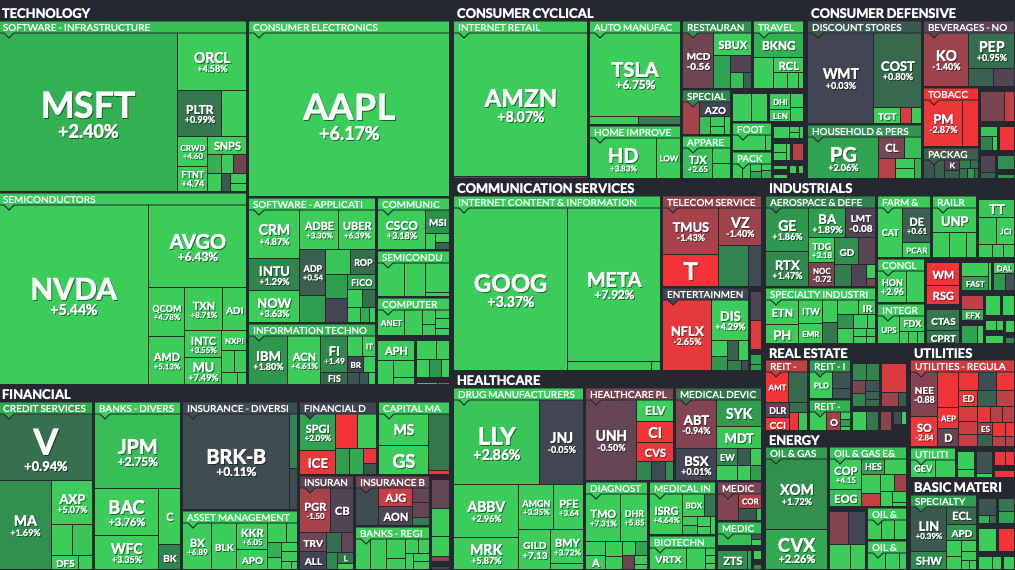

Markets Respond Positively: 📈 The announcement led to a surge in global markets. The Dow Jones Industrial Average (DIA) rose by over 1,000 points, the S&P 500 (VOO) increased by 3.26%, and the Nasdaq Composite (QQQ) climbed 4.35%. Tech and retail sectors experienced notable gains, with companies like Nvidia (NVDA), Meta (META), and Tesla (TSLA) seeing significant stock price increases.

Temporary Relief Amid Ongoing Negotiations: 🤝 While the tariff reductions provide short-term relief, both nations acknowledge that more complex negotiations lie ahead. The 90-day period is intended to facilitate further dialogue and address underlying trade issues, with the potential for more comprehensive agreements in the future.

TODAY’S TOP NEWS

Perplexity Eyes $14B Valuation

📈 Perplexity AI entered late-stage talks to raise $500 million at a $14 billion valuation, with Accel set to lead the round. That figure is below the startup’s original goal of up to $1 billion at an $18 billion valuation.

🔍 The AI search challenger has surged in valuation, tripling from $3 billion to $9 billion in 2024 and now aiming even higher. Its competition includes Google (GOOG), OpenAI, Microsoft (MSFT), and Anthropic—all sharpening their search tools.

🚀 Despite under $100 million in ARR, Perplexity is betting on Comet, its new AI agent web browser, to stand out. But with rivals launching real-time search features, the AI search race is heating up fast.

KEEP READING

Hamas releases American-Israeli hostage Edan Alexander (CNBC)

NBC taps Michael Jordan as NBA contributor (CNBC)

Trump hails Qatar’s ‘nice gesture’ of Air Force One replacement, blaming Boeing delays (CNBC)

Chegg to lay off 22% of workforce as AI tools shake up education tech industry (CNBC)

Crypto in Beast Mode: ETH Melts Faces, BTC Eyes ATH (ZeroHedge)

Tariff receipts topped $16 billion in April, a record that helped cut the budget deficit (CNBC)

Enter for a chance to win 250K (ML)

How to Prepare Your Budget for Tariff Surcharges (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.