TLDR

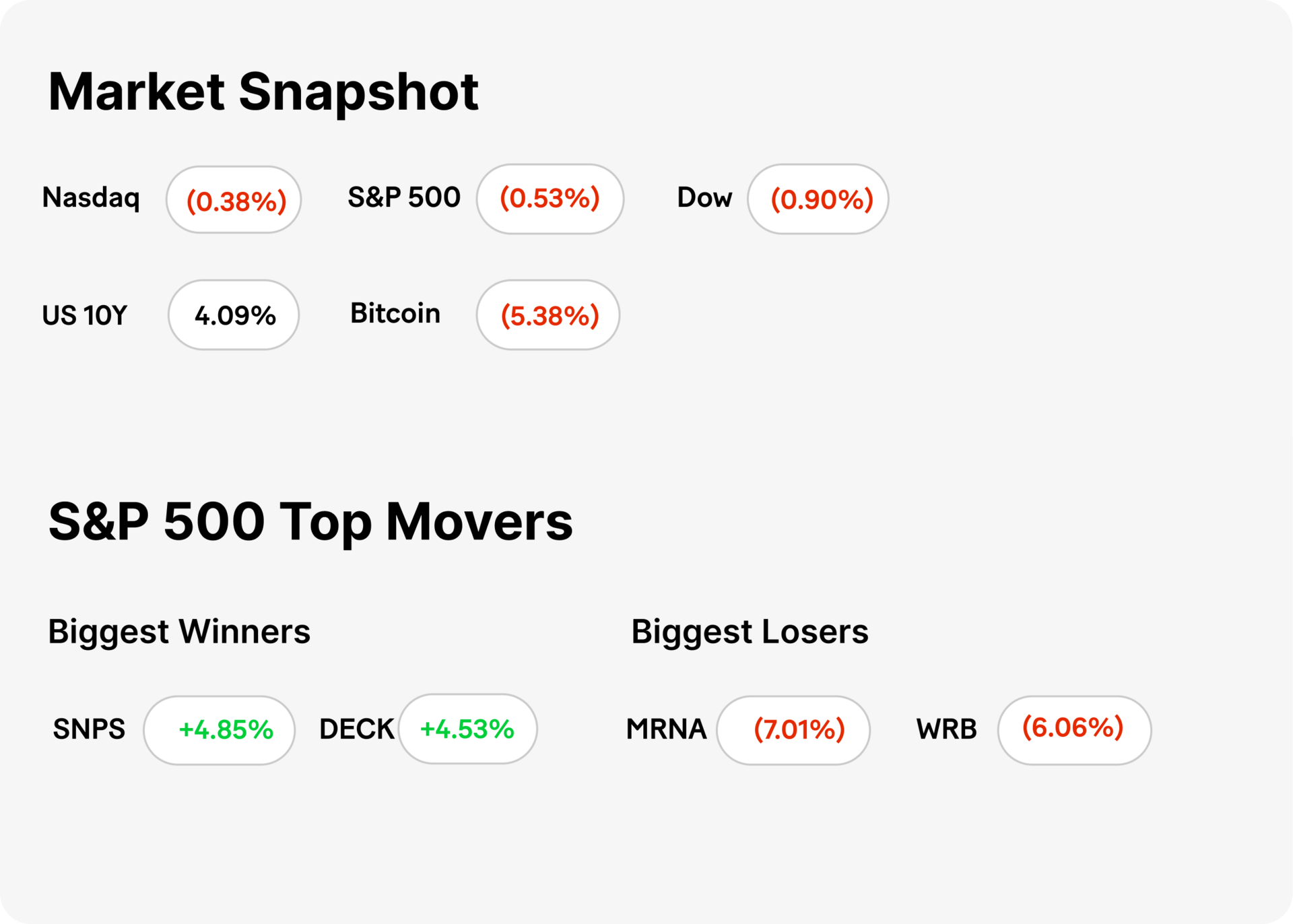

🧾MARKET RECAP → Stocks fell on Monday, following cryptocurrencies lower, as volatility continued into December’s trading month.

⚡GOLDMAN EXPANDS ETF EMPIRE → Goldman Sachs (GS) is buying Innovator for $2 billion, instantly bulk-ing up its active ETF platform with $28 billion in defined-outcome funds — a clear bet that buffer-style ETFs are gaining big traction.

📌 KALSHI GOES CRYPTO → Kalshi is rolling out Solana-based tokenized event contracts — bringing prediction markets on-chain. A fusion of regulated finance and crypto infrastructure, but with added complexity and regulatory watchfulness.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

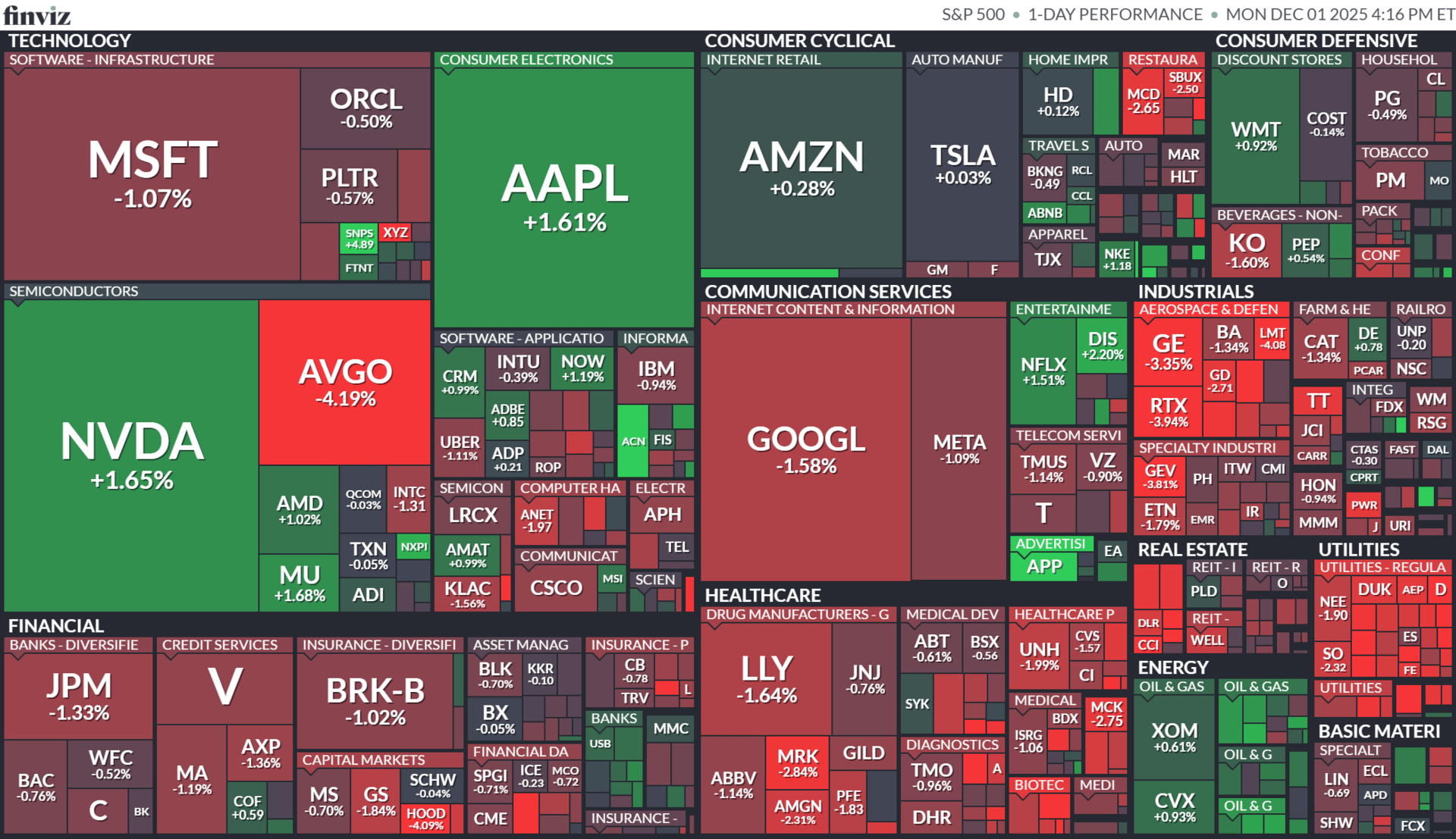

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning December 01, 2025

M&A

Goldman Expands ETF Empire

Gemini

💼 Big Deal on the Table: Goldman Sachs (GS) is acquiring Innovator Capital Management in a ~$2 billion cash-and-stock deal. The agreement brings to Goldman roughly $28 billion in assets under supervision, spanning 159 defined-outcome ETFs.

📈 Strategic Shift Toward Active ETFs: The acquisition dramatically boosts Goldman’s active-ETF offerings and positions it as a top-10 player in that space. With the addition of Innovator’s lineup, Goldman + Innovator will oversee more than 215 ETF strategies globally, giving investors access to income, buffer, and growth-focused funds in one of the fastest-growing corners of the market.

🎯 Why It Matters for Investors: For the average investor, this signals growing institutional confidence in structured—and possibly safer—ETF strategies. Defined-outcome ETFs offer downside protection and may appeal in volatile markets with uncertain macroeconomic conditions. As Goldman rolls out these funds under its brand, expect increased distribution, liquidity, and possibly new product innovations.

CRYPTO

Kalshi Goes Crypto

Gemini

🔗 Blockchain Bet: Kalshi — the CFTC-regulated U.S. prediction-market platform — is launching “tokenized event contracts” built on the Solana (SOL) blockchain. This gives crypto-native traders a way to buy and sell event-outcome contracts on-chain, bridging traditional regulated markets with blockchain ease.

⚠️ What’s New — and Risky: It’s not just “yes/no bets” anymore — now outcomes live on the blockchain, which means new regulatory and technical unknowns. While Kalshi is regulated under the U.S. derivatives framework, blockchain-based delivery shifts part of the trading experience into crypto-native territory — a space regulators are still watching closely.

📊 What This Means for Investors/Traders: For investors comfortable with crypto — this could be a fast-lane to prediction markets. The fusion of regulated contracts + blockchain accessibility could attract a new wave of traders. But for cautious or traditional investors, this adds a layer of complexity (and potential volatility), so due diligence is more important than ever.

KEEP READING

White House releases more details on Trump’s October MRI, says results were ‘perfectly normal’ (CNBC)

As regime change looms at the Fed, one candidate emerges as frontrunner for chair (CNBC)

Bitcoin, ether fall sharply as crypto sell-off resumes (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.