TLDR

⚡ MARKET RECAP → The S&P 500 (VOO) higher on Tuesday as investors rotated out of the beaten-down software stocks and into financials .

📉 CITRONE SHORTS U.S. STOCKS → Veteran macro manager Rob Citrone has Discovery Capital net short U.S. equities, arguing that AI-driven capex, rich valuations and late-cycle risks skew the U.S. market to the downside, while cheaper emerging markets offer better upside — so he’s treating U.S. stocks more as a hedge than a core growth engine right now.

⚖️ WBD REOPENS PARAMOUNT TALKS → Netflix (NFLX) has agreed to a limited waiver that lets Warner Bros. Discovery (WBD) talk with Paramount Skydance over an improved bid, giving Paramount seven days to try to top the current Netflix merger agreement — a major twist in one of the year’s biggest media acquisition stories and a potential bidding war before a planned shareholder vote.

Was this email forwarded to you? Sign up for free here.

MARKETS

Market Snapshot

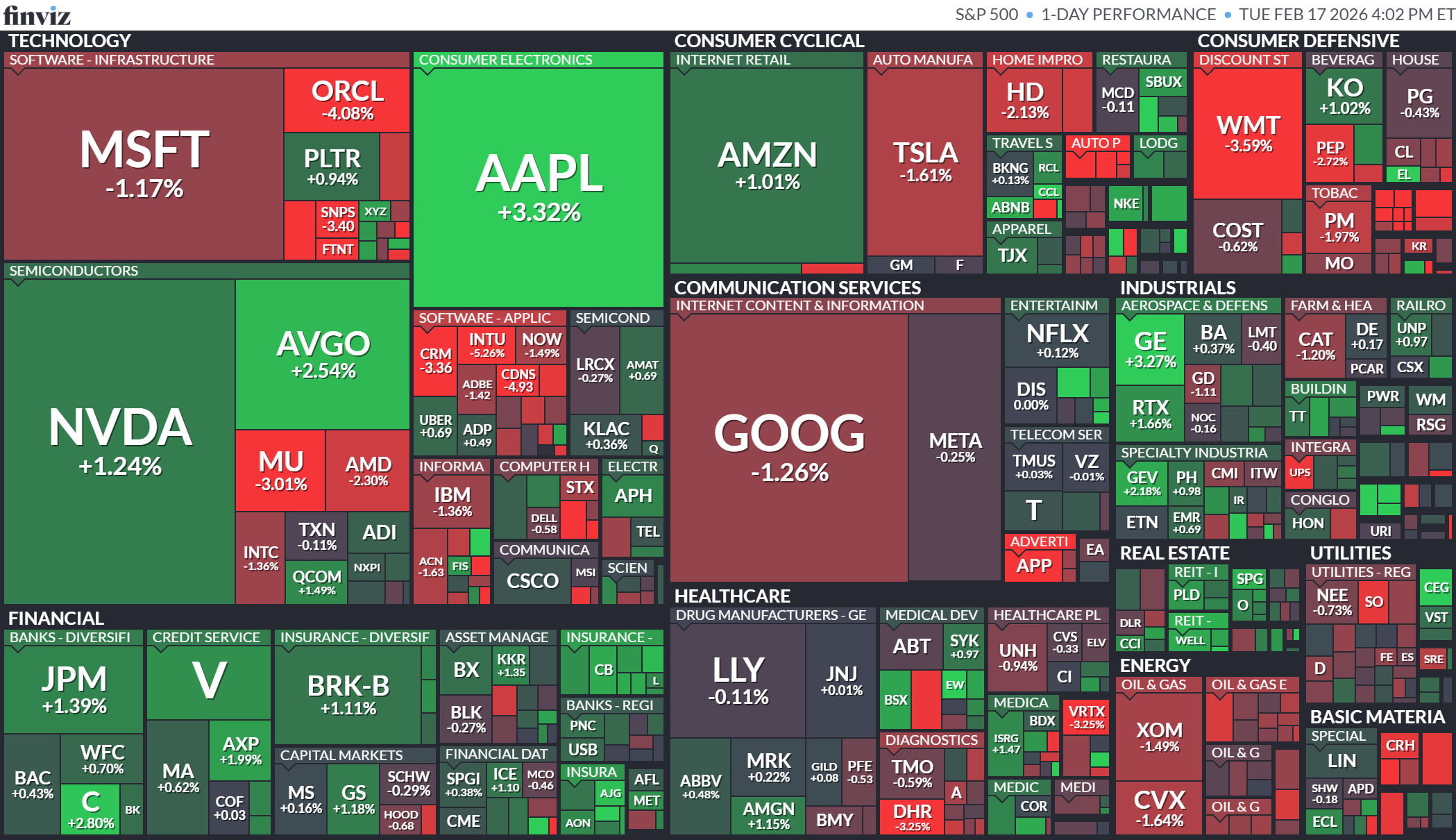

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning February 16, 2026

TECH

Citrone Shorts U.S. Stocks

Gemini

📉 Rob Citrone is now net short U.S. stocks, even after a monster multi-year bull run and huge gains at his Discovery Capital hedge fund. His macro fund has racked up outsized returns in recent years, and he’s turned that credibility into a high-conviction call that the easy money in U.S. equities is over, shifting his focus from chasing upside to protecting capital.

🤖 His core worry is that the AI capex boom becomes an earnings and balance sheet drag for the biggest U.S. winners. He argues that massive spending on data centers, chips and cloud infrastructure will pressure free cash flow and returns on capital, especially layered on top of higher-for-longer rates and already-elevated valuations, leaving U.S. megacaps with very little room for disappointment.

🌍 Instead, Citrone sees better risk/reward outside the U.S., especially in cheap emerging markets. He’s effectively running a barbell: structural shorts in expensive U.S. sectors on one side, and long exposure to what he calls substantially undervalued global EM on the other, positioning Discovery to profit if U.S. exceptionalism fades and leadership rotates toward overlooked regions.

MEDIA

WBD Reopens Paramount Talks

Gemini

📺 Netflix just loosened its grip — briefly. Warner Bros. Discovery (WBD) said Netflix (NFLX) has granted a seven-day waiver that allows the studio to reopen acquisition negotiations with Paramount Skydance (PSKY), even though WBD already has a binding deal to sell its studios and streaming business to Netflix. This short window runs through February 23 and gives Paramount a chance to submit a “best and final” offer for the full company.

💼 Paramount’s bid is catching attention. Paramount has previously submitted a hostile cash offer — including a proposed $31 per share figure and commitments to pay Netflix’s breakup fee — and insists its all-cash proposal could ultimately deliver greater certainty and value for shareholders than Netflix’s ~ $82.7 billion deal for just the studios and streaming assets. Activist investors have even urged WBD shareholders to reconsider Netflix’s offer.

👀 Netflix still has the edge — for now. WBD’s board continues to recommend the Netflix transaction and retains the right to match any higher offers, reaffirming that the current deal remains the most certain path to closing. But the reopened talks and competitive tension have pushed WBD, Netflix, and Paramount shares higher and added drama to an already high-stakes media-industry showdown.

KEEP READING

Iran partially closes Strait of Hormuz, a vital oil choke point, as Tehran holds talks with U.S. (CNBC)

Epstein files fallout: The high-profile people burned by past dealings with a predator (CNBC)

Netflix grants Warner Bros. Discovery 7-day waiver to reopen deal talks with Paramount Skydance (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.