TLDR

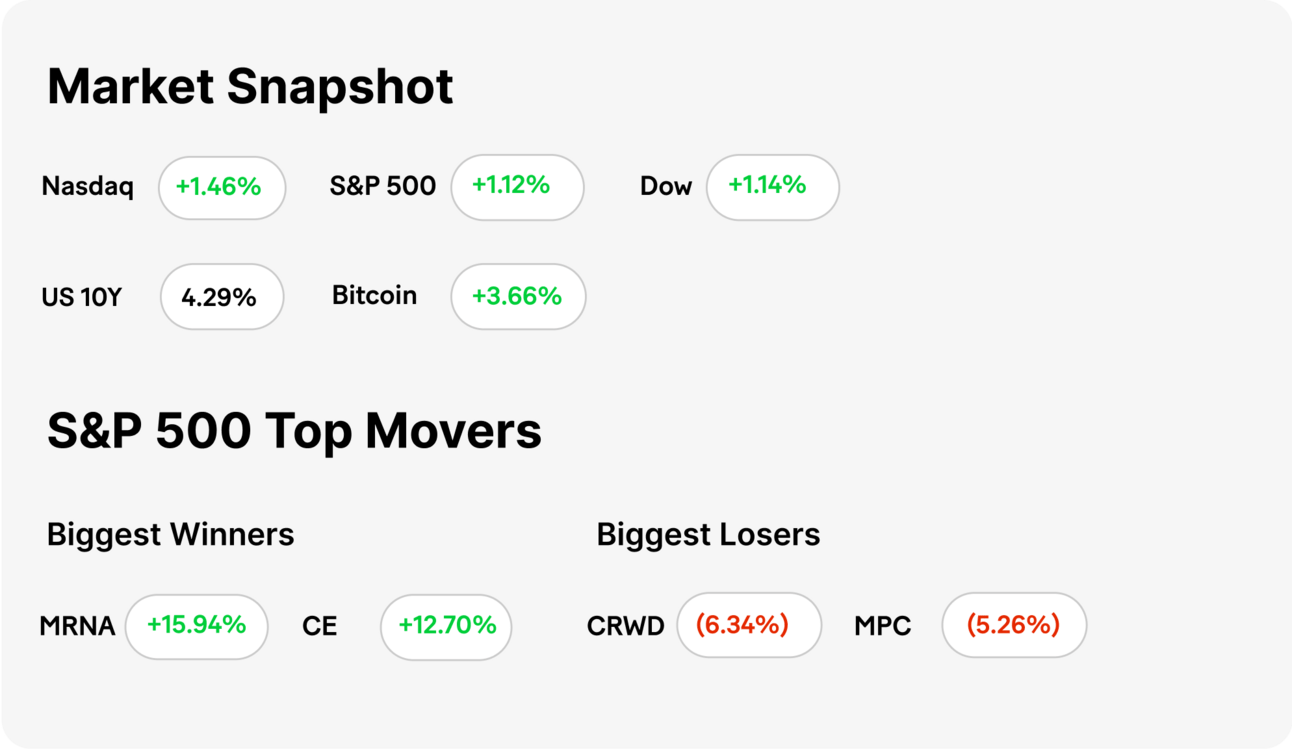

MARKET RECAP → Stocks staged a recovery rally on Wednesday following back-to-back down days incited by fears of a tariff-fueled trade war. The “Trump Put” — or the belief that Trump will ensure that markets are supported — appears firmly in play.

TRUMP GRANTS AUTOMAKERS ONE-MONTH TARIFF EXEMPTION → 🚗 President Trump granted U.S. automakers a one-month exemption from the new 25% tariffs on imports from Canada and Mexico, leading to a 7%+ surge in shares of Ford (F), General Motors (GM), and Stellantis (STLA).

PRIVATE JOB GROWTH SLOWS SHARPLY IN FEBRUARY → Employers added just 77K jobs, the weakest since July, as hiring stalled in key sectors. With tariffs looming and uncertainty rising, businesses hit pause. 📉

KENVUE ENDS PROXY FIGHT, ADDS STARBOARD DIRECTORS → Kenvue settled its proxy battle with Starboard by adding three new directors, including Jeff Smith, as the J&J (JNJ) spinoff aimed to boost strategy and investor confidence. 🤝

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Trump Grants Automakers One-Month Tariff Exemption

Temporary Relief for Auto Industry: 🚗 President Trump has granted U.S. automakers a one-month exemption from the newly imposed 25% tariffs on imports from Canada and Mexico, following discussions with executives from Ford (F), General Motors (GM), and Stellantis (STLA).

Market Reaction: 📈 Following the announcement, shares of Ford, GM, and Stellantis rose by 7% or more, reflecting investor optimism regarding the temporary relief.

Future Implications: ⏳ The exemption is set to expire on April 2, after which the tariffs may be reinstated if no further agreements are reached.

TODAY’S TOP NEWS

Private Job Growth Slows Sharply in February

Lookin’ Light: 📉 Private employers added just 77,000 jobs in February, missing expectations of 148,000 and marking the weakest growth since July. The slowdown raised concerns over economic uncertainty, policy shifts, and the impact of Trump’s tariffs.

Who Did It:⚠️ Trade, transportation, and utilities shed 33,000 jobs, while education and health services lost 28,000. Meanwhile, AI-related industries faced hiring slowdowns, adding to broader market jitters.

On the Bright Side: 💼 Leisure and hospitality added 41,000 jobs, while business services, finance, and construction all posted gains. The ADP report set a cautious tone ahead of Friday’s official jobs data, which is expected to show 170,000 new payrolls.

TODAY’S TOP NEWS

Kenvue Ends Proxy Fight, Adds Starboard Directors

Settlement: 🤝 Kenvue settled its proxy battle with activist investor Starboard Value by adding three new board members, including Starboard’s Jeff Smith, e-commerce expert Sarah Hofstetter, and former Bayer exec Erica Mann.

Shake-Up: 📉 Starboard had built a significant stake in Kenvue and criticized its management and stock performance. The board shake-up aimed to bring expertise in brand strategy, consumer health, and investor relations.

Spinoff: 🏥 Kenvue, a Johnson & Johnson (JNJ) spinoff, owns major consumer brands like Aveeno, Band-Aid, and Tylenol. Despite its independence, J&J still held a stake in the company after its historic 2023 separation.

KEEP READING

Novo Nordisk offers Wegovy for less than half the price through new direct-to-consumer pharmacy (CNBC)

Scale AI announces multimillion-dollar defense deal, a major step in U.S. military automation (CNBC)

CrowdStrike slumps 10% on weak earnings outlook, overhang from outage costs (CNBC)

NHL commissioner says league could be affected by U.S.-Canada tariffs (CNBC)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

A MESSAGE FROM OUR PARTNER

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.