TLDR

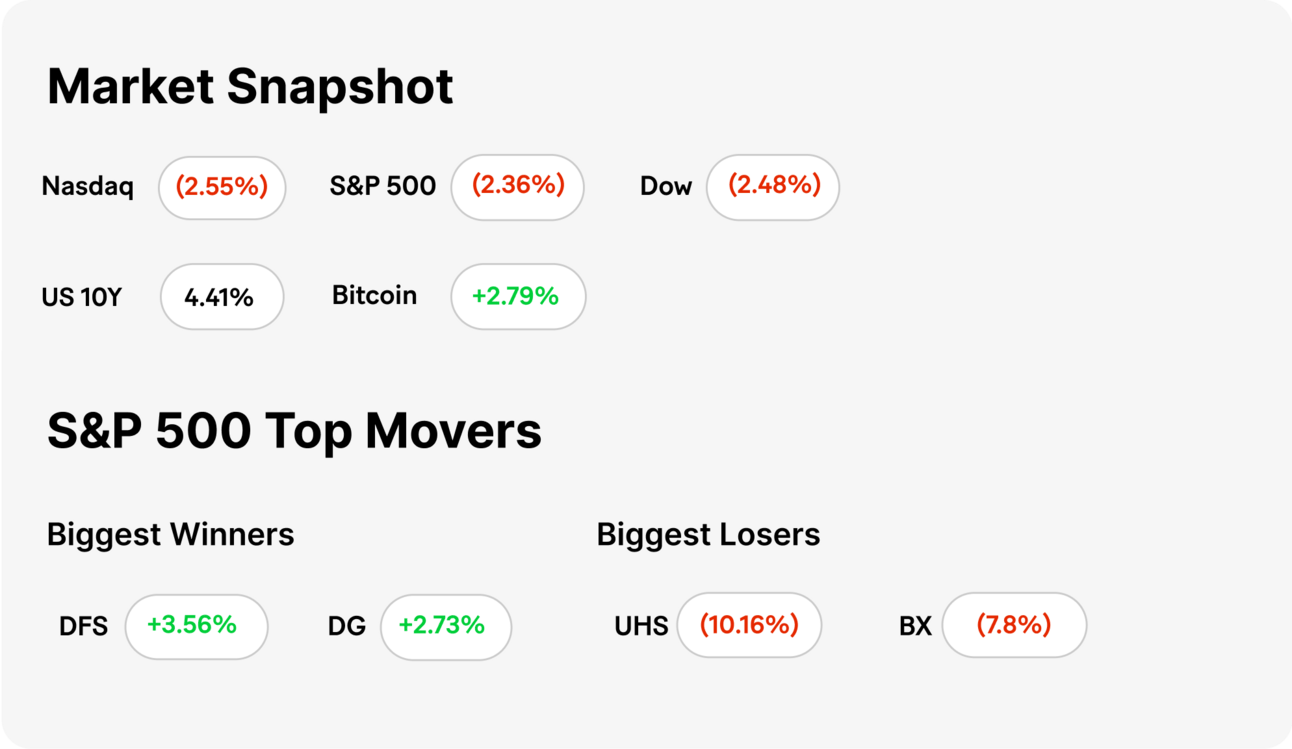

MARKET RECAP → Stocks dropped Monday as President Trump escalated his attacks on Fed Chair Jerome Powell, stoking concerns over central bank independence and offering traders no clear progress on global trade negotiations.

CHIPOTLE HEADS SOUTH OF THE BORDER → 🌯 Chipotle (CMG) is expanding into Mexico for the first time, betting that fresh ingredients and burrito bowls can succeed where Taco Bell flopped—despite rising trade tensions and a side of avocado tariffs.

TRUMP TURNS UP HEAT ON POWELL → 📉 Trump called Powell a "major loser" and demanded immediate rate cuts, spooking markets and reigniting fears over Fed independence.

Was this email forwarded to you? Sign up for free here.

Earn rewards by referring friends. Scroll to the bottom to learn more! 👇

TODAY’S TOP NEWS

Chipotle Heads South Of The Border

🌯 Chipotle (CMG) announced plans to open its first restaurant in Mexico in early 2026 through a partnership with Alsea, the operator behind regional Starbucks (SBUX) and Burger King locations.

🌶️ The move marks a bold step in Chipotle’s international expansion, even as President Trump’s tariff war with Mexico loomed large. Despite avocado tensions, Chipotle still sources about half its supply from Mexico.

🇲🇽 While Chipotle is betting on Mexico’s love for fresh food, U.S.-style Mexican cuisine hasn’t always landed—just ask Taco Bell, which flopped twice trying to enter the market.

TODAY’S TOP NEWS

Trump Turns Up Heat on Powell

🔻 Trump Went Full Caps Lock: President Trump slammed Fed Chair Jerome Powell as a “major loser” and demanded immediate rate cuts, claiming inflation is virtually nonexistent and warning that economic slowdown is imminent if the Fed doesn’t act now.

📉 Markets Flinched Hard: Trump's pressure, paired with uncertainty over whether he can legally fire Powell before 2026, sent markets tumbling—Dow fell over 950 points, Nasdaq dropped 2.6%, and gold hit a record high as investors ran for safety.

⚖️ Fed Independence at Risk: Powell reiterated that the president can't fire him, while economists warned that even attempting to remove him could spook markets further, triggering higher yields, a weaker dollar, and a full-blown investor panic.

KEEP READING

Pope Francis, the first pontiff from the Americas, dies at 88 (CNBC)

Pete Hegseth shared information ahead of Yemen strikes in a Signal chat with wife and brother (CNBC)

Gold surges to a record above $3,400 as Trump threatens Fed independence (CNBC)

Trump Tariffs Explained: Your Complete 2025 Guide (ML)

Why You’ll Love the Money Master Challenge – Your Daily Finance Game! (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.