TLDR

MARKET RECAP → The tech-heavy Nasdaq Composite (QQQ) came under pressure Thursday as investors exited their positions in some of the high-flying AI darlings like Nvidia (NVDA) and Oracle (ORCL).

🤖 SENATE CHECKS TRUMP → The Senate advanced a war powers resolution 52–47 to require congressional approval for any future U.S. military action in Venezuela following the Maduro raid. A rare bipartisan group of Republicans joined Democrats, but the measure faces significant hurdles ahead.

⚖️SUPREME COURT TARIFFS RULING → The Supreme Court may soon decide whether Trump’s emergency tariff powers are lawful—something that could trigger substantial tariff refunds and market shifts, recalibrate the balance of trade authority, and materially affect equity, bond, and fiscal outlooks.

Was this email forwarded to you? Sign up for free here.

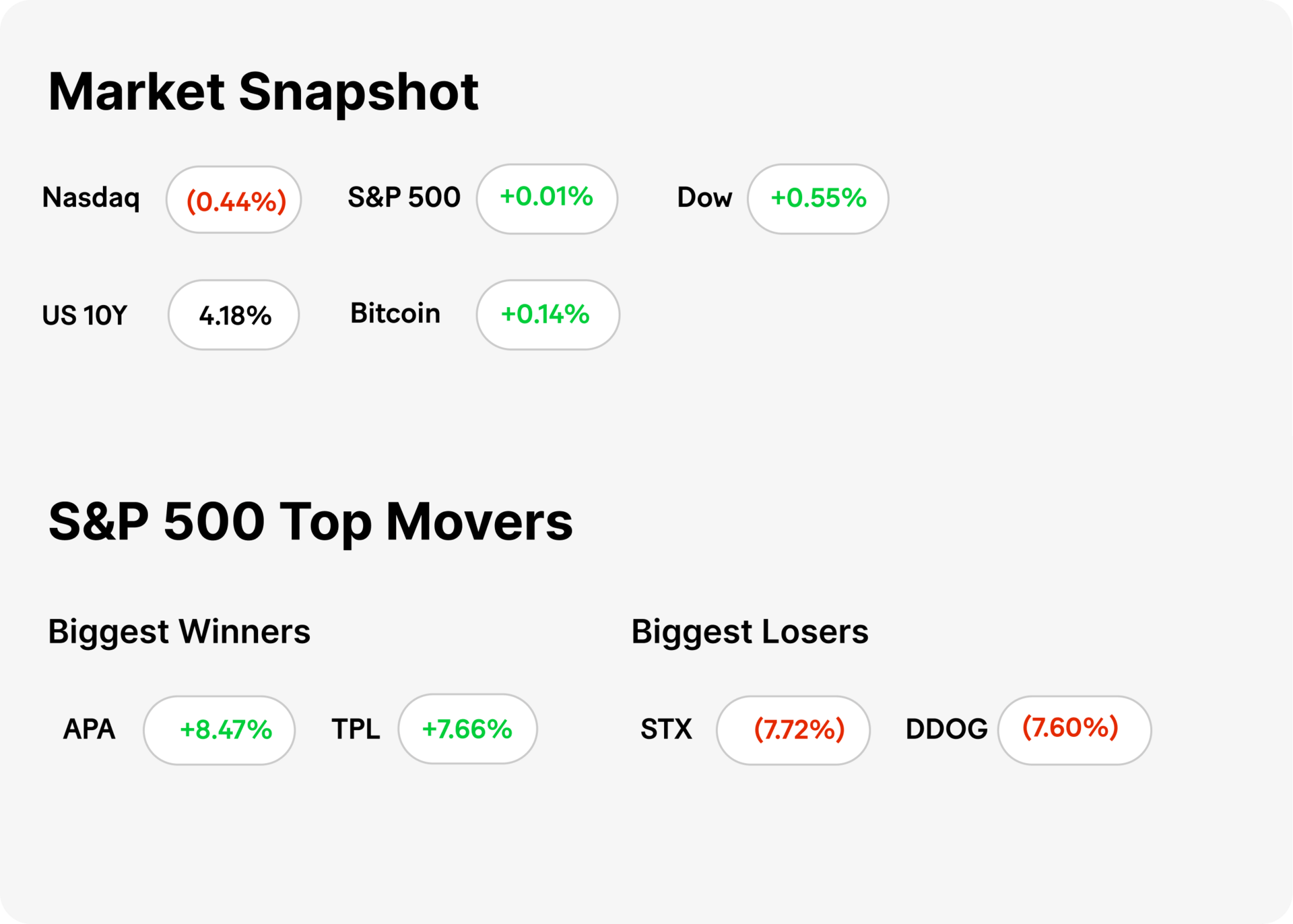

MARKETS

Market Snapshot

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning January 05, 2026

POLITICS

US War Powers Clash

Gemini

🏛️ Senate Advances War Powers Resolution: The U.S. Senate voted 52–47 to advance a resolution aimed at limiting President Trump’s ability to conduct further military action against Venezuela without Congress’s approval. The move comes days after U.S. forces captured Venezuelan President Nicolás Maduro in a daring raid, sparking debate over executive authority and congressional oversight.

🤝 Bipartisan Unease Over Military Scope: A small group of five Republican senators joined all Democrats, signaling rising discomfort within Trump’s own party about unilateral military operations. Supporters argue this measure reasserts constitutional checks and balances, even as its final passage faces steep odds in the House and against a likely presidential veto.

⚖️ Political and Legal Debate Intensifies: Lawmakers on both sides continue to argue whether the Maduro capture was a legitimate law-enforcement action or an unauthorized act of war, with Republicans defending the administration’s actions and critics warning that extending U.S. military involvement without oversight sets a dangerous precedent.

ECONOMICS

Supreme Courts Test Tariffs

Gemini

🏛️ High-Stakes Supreme Court Decision Looms: The U.S. Supreme Court is poised to rule as soon as Friday on the legality of former President Donald Trump’s broad tariffs imposed under the International Emergency Economic Powers Act (IEEPA). Analysts say justices showed skepticism during November arguments about whether a president can use a 1977 emergency law to levy tariffs without congressional approval.

📉 Market & Economic Impact at Risk: If the Court strikes down the tariffs, importers could seek refunds of up to ~$150 billion, and markets might react strongly—boosting retail and consumer stocks while spiking Treasury yields amid fiscal uncertainty. Conversely, upholding the tariffs could continue trade policy unpredictability and suppress stocks sensitive to import costs.

💼 Broader Policy Implications: The case tests executive power vs. congressional authority over trade policy and could reshape how presidents use emergency powers in economic policy. A ruling against the tariffs might not end protectionism entirely, as officials could pursue alternative legal paths, but it would significantly reshape the administration’s signature trade approach.

KEEP READING

First vetoes of Trump’s term survive override vote in Congress (CNBC)

Musk, OpenAI lawyers trade barbs as lawsuit heads to trial (CNBC)

This Blackstone options trade could yield profits after Trump blasts Wall Street owning single-family homes (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.