TLDR

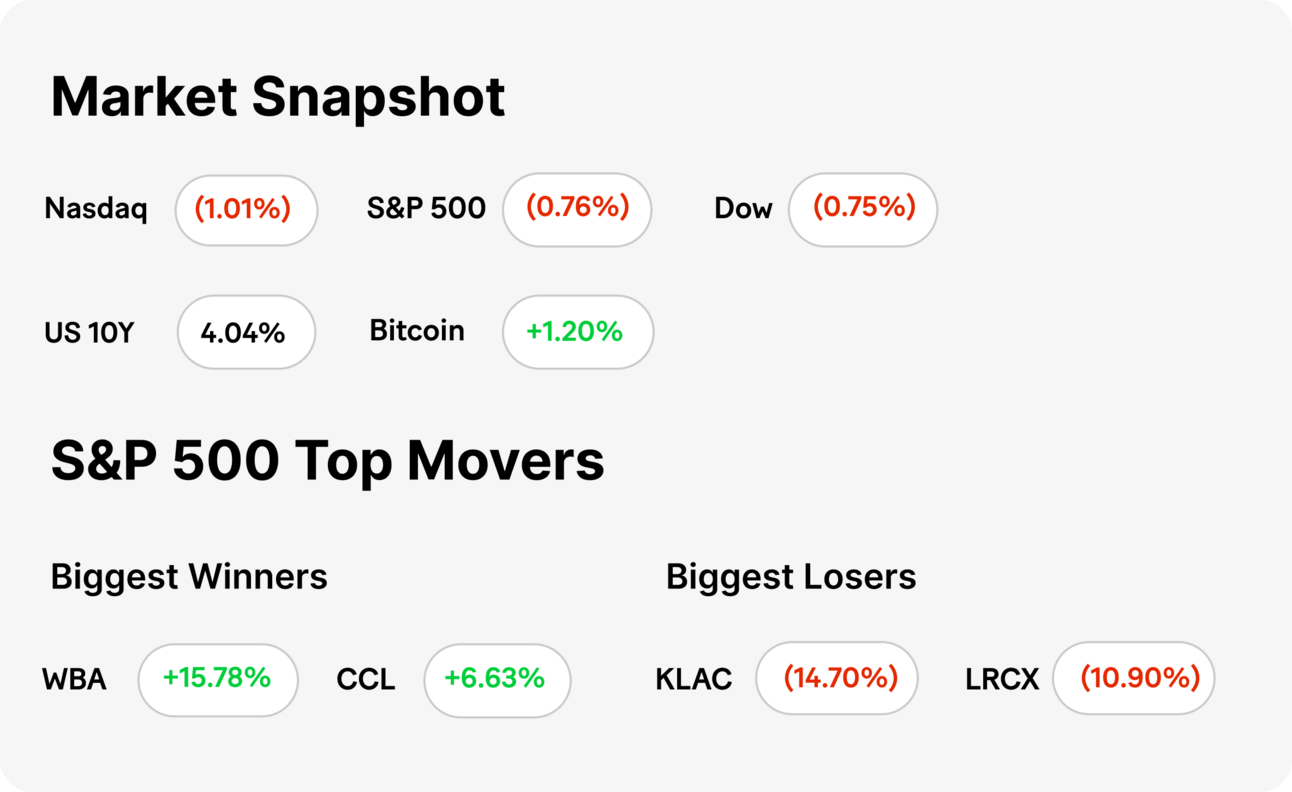

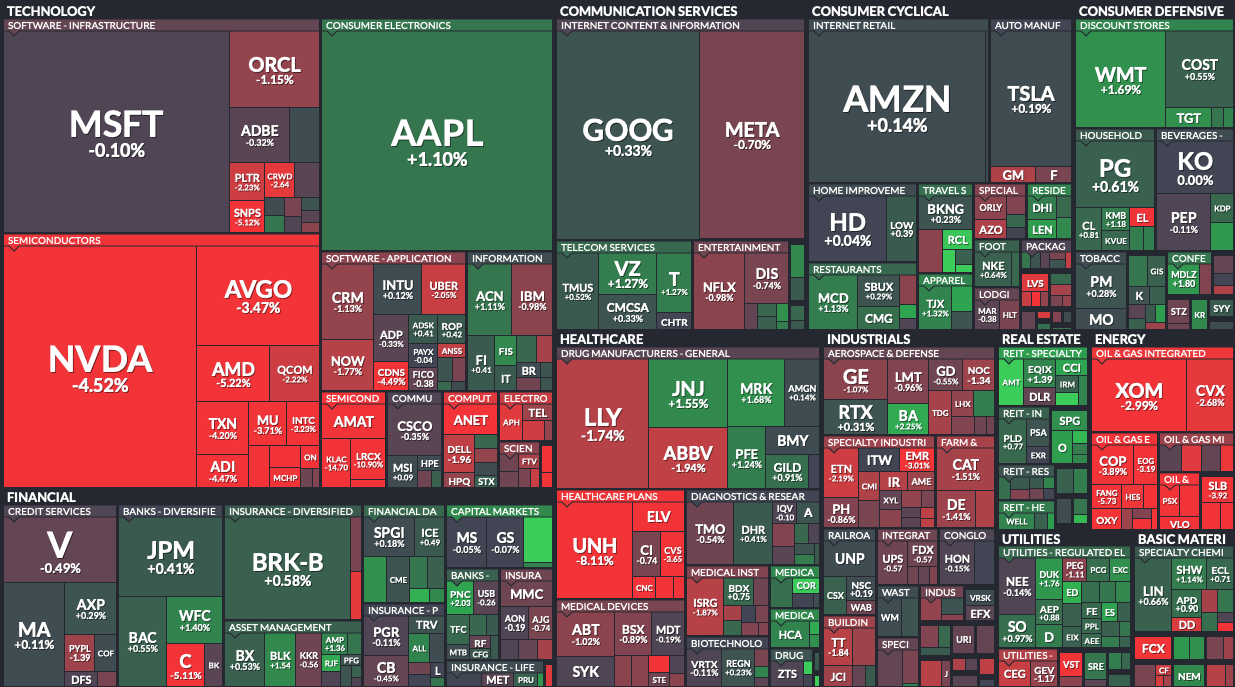

MARKET RECAP → Stocks fell Tuesday as the market paused from its recent rally, with traders digesting the latest round of earnings reports.

WALGREENS TO CLOSE 1,200 STORES BY 2027 → 📉 Walgreens (WBA) plans to close 1,200 stores by 2027 as part of a cost-cutting strategy. Despite challenges, Q4 earnings exceeded expectations with $37.55 billion in revenue, driven by growth in healthcare services.

BOEING TO RAISE $25 BILLION → 💰 Boeing (BA) plans to raise up to $25 billion through shares or debt to boost its balance sheet, while securing a $10 billion credit facility to handle short-term liquidity challenges. The company faces mounting financial pressure, including a machinist strike costing $1 billion a month and potential credit rating downgrades.

Was this email forwarded to you? Sign up for free here.

TOGETHER WITH OUR PARTNER

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

TODAY’S TOP NEWS

Walgreens To Close 1,200 Stores By 2027

📉 Store Closures: Walgreens (WBA) announced plans to close 1,200 stores by 2027, including 500 in fiscal 2025, as part of its cost-cutting measures to improve financial performance.

📊 Strong Earnings: Despite challenges like reimbursement pressure and softer consumer spending, Walgreens exceeded earnings expectations for Q4, reporting $37.55 billion in revenue, up 6% from last year.

🏥 Health Unit Growth: Walgreens saw growth across its U.S. healthcare segment, particularly in specialty pharmacy partnerships, contributing to a positive performance in a challenging retail environment.

TODAY’S TOP NEWS

Boeing To Raise $25 Billion

💰 Capital Raise: Boeing (BA) announced plans to raise up to $25 billion through shares or debt over the next three years to strengthen its balance sheet amid ongoing challenges.

🏦 Credit Agreement: The company secured a $10 billion credit facility from banks, which provides short-term liquidity while Boeing navigates a difficult financial environment.

📉 Financial Strain: Boeing faces potential downgrades from credit agencies due to issues like a machinist strike, costing the company over $1 billion a month, and ongoing program delays.

KEEP READING

Amazon is using tech from a Khosla Ventures-backed startup to run robot warehouses at Whole Foods (CNBC)

Xpeng president says Chinese EV firm remains committed to Europe despite pressure from tariffs (CNBC)

Bank of America tops estimates on better-than-expected trading revenue (CNBC)

Starbucks is scaling back discounts and promotions (CNN)

Trump’s social media stock is making an epic comeback as election nears (CNN)

How to Become Financially Stable: 10 Tips (ML)

What is the Difference Between a Credit Card and a Debit Card? (ML)

What Affects Your Credit Score? 5 Credit Score Factors (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.