TLDR

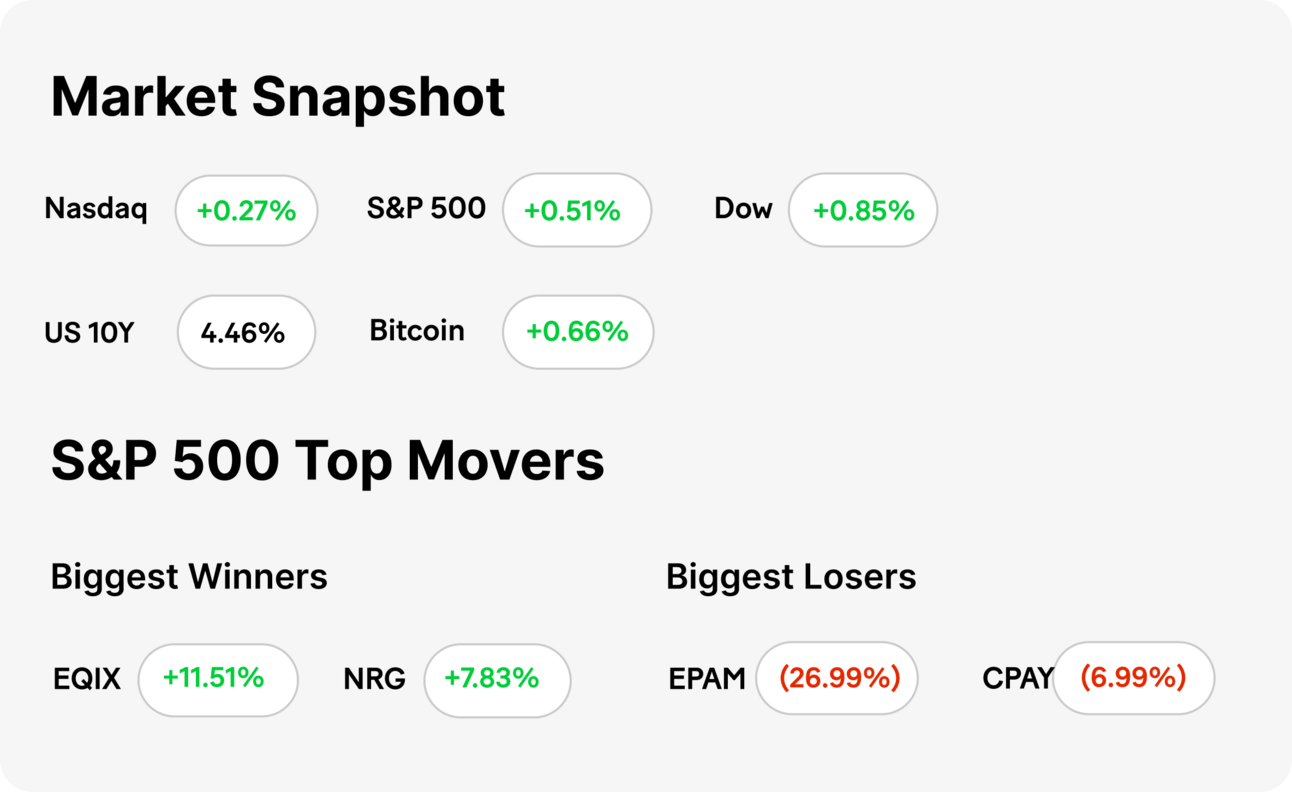

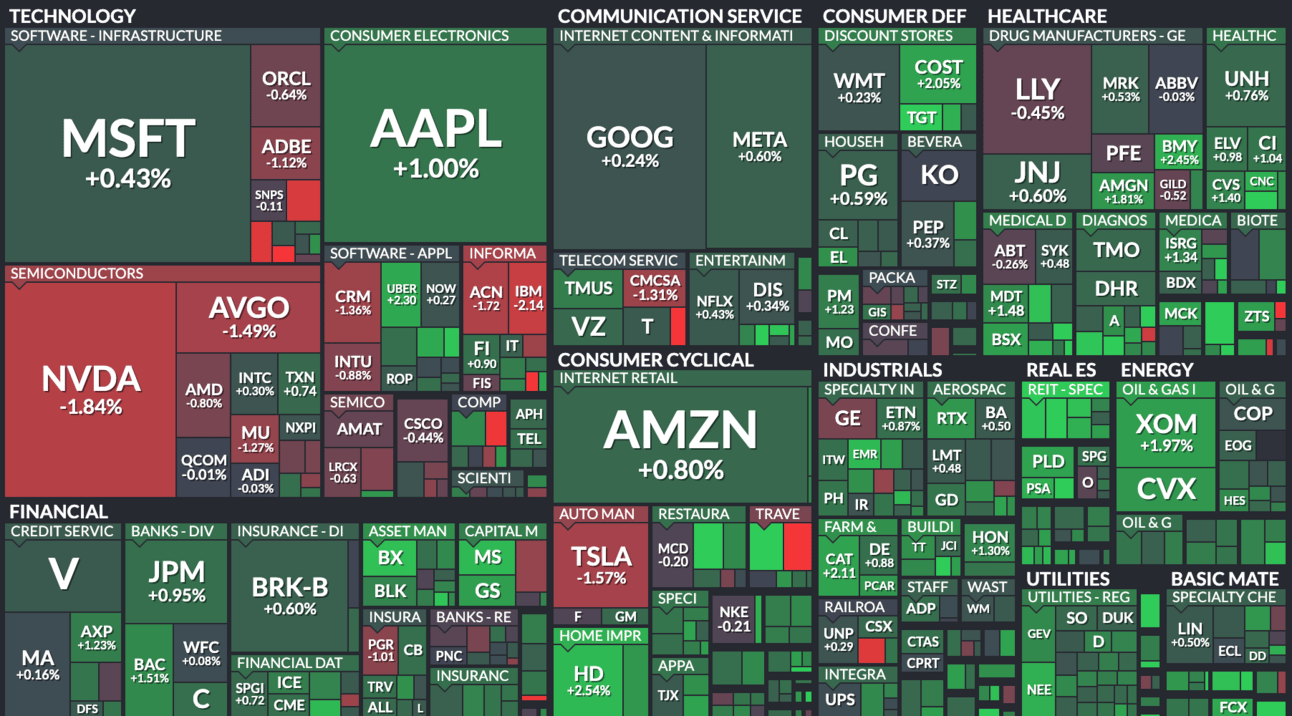

MARKET RECAP → Stocks climbed on Thursday, with the mighty Dow (DIA) marking its seventh consecutive win, as fresh jobless claims data sparked renewed hopes for Federal Reserve rate cuts later in the year.

WARNER BROS. DISAPPOINTS → 🎥 Warner Bros. Discovery (WBD) missed Q1 targets with a $9.96B revenue and strategic shifts towards bolstering streaming growth and revamping studio outputs, despite ongoing network and film segment struggles.

JOBLESS CLAIMS PEAK → 📊 U.S. jobless claims hit a new high since August at 231,000, hinting at labor market shifts amid steady Fed watch, with market reactions subdued and rate cuts expected by September.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Warner Bros. Disappoints

📉 Missed Expectations: Warner Bros. Discovery (WBD) reported a Q1 loss of 40 cents per share on revenues of $9.96 billion, both missing analyst expectations. The company's stock fell nearly 4% in premarket trading as it grappled with a 7% year-over-year revenue decline and continued challenges across its network and studio segments.

📺 Streaming and Sports Strategy: Despite challenges, the streaming service added 2 million subscribers, reaching 99.6 million. Warner Bros. Discovery is also focusing on sports rights, including ongoing NBA negotiations, and has partnered with Disney for a bundled streaming service combining Max, Disney+, and Hulu, aiming to minimize subscriber churn.

🎬 Studio and TV Network Struggles: The TV networks and studio segments saw revenue drops of 8% and 12%, respectively. The company attributed the decline to soft advertising markets and underperforming releases like "Suicide Squad." CEO David Zaslav announced initiatives to revitalize the studio, including a new "Lord of the Rings" film planned for 2026.

TODAY’S TOP NEWS

Jobless Claims Peak

📈 Rise in Unemployment Filings: Weekly jobless claims surged to 231,000 for the week ending May 4, marking the highest level since late August 2023. This increase of 22,000 from the previous week exceeded expectations and signals a potential shift in an otherwise strong labor market.

🔍 Continuing Claims and Market Impact: Continuing unemployment claims also rose to 1.78 million, reflecting an increase of 17,000 from the previous week. Despite this uptick in jobless claims, stock market futures showed minimal reaction, maintaining a slightly negative stance, and Treasury yields were mixed.

🌐 Economic Indicators and Fed Watch: The unexpected jump in unemployment filings, alongside April’s modest payroll increase of 175,000, suggests the labor market might be normalizing. Federal Reserve officials, who have kept a close eye on employment data to guide inflation control measures, anticipate starting to lower interest rates by September.

NOTABLE POSTS

KEEP READING

Roblox shares drop more than 20% as company cuts annual bookings forecast on muted player spending (CNBC)

GM can regain market share in China after hitting 20-year low, executive says (CNBC)

McDonald’s is betting on its mobile business with new franchisee digital marketing fund (CNBC)

Chip designer Arm’s shares drop after lackluster revenue guidance (CNBC)

How Rupert Murdoch quietly helped Mike Johnson survive Marjorie Taylor Greene’s ouster attempt (CNN)

A new Apple ad is sparking backlash from viewers who say it hits the wrong note (CNN)

The Chair of the FDIC is facing calls to resign after a scathing report. The implications for banks could be significant (CNN)

MoneyLion’s First Quarter 2024 Financial Results (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

Notion AI — Notion AI is a writing assistant that can help you write, brainstorm, edit, summarize, and more

How would you rate today's newsletter?

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice.