TLDR

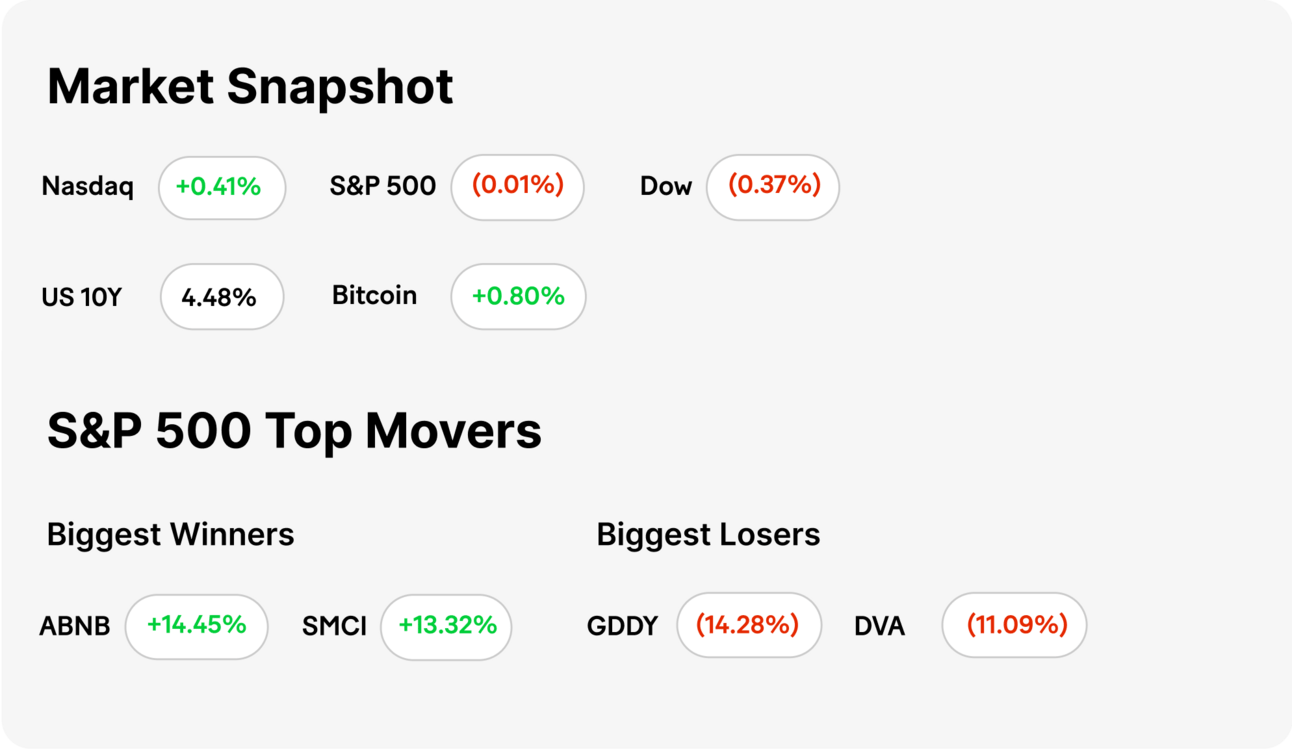

MARKET RECAP → Stocks closed little changed on Friday but the major averages eked out a gain for the week as investors continued to mull over inflation and global trade implications.

ELON MUSK CRITICIZES OUTDATED FEDERAL RECORD-KEEPING → 🏢 Elon Musk's Department of Government Efficiency highlights the antiquated manual processing of federal retirements in a Pennsylvania limestone mine, calling for modernization to improve efficiency.

ZUCKERBERG'S RIGHTWARD SHIFT SPARKS INTERNAL DISCONTENT AT META →🤝 Meta's (META) CEO Mark Zuckerberg aligns company policies with President Trump's administration, leading to internal employee concerns and strategic moves targeting competitors like Apple.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Elon Musk Criticizes Outdated Federal Record-Keeping

Manual Processes in Limestone Mine: 🏢 Elon Musk's Department of Government Efficiency (DOGE) has highlighted that federal employee retirements are processed manually in an old limestone mine in Boyers, Pennsylvania. This antiquated system relies on paper records and manual labor, leading to significant inefficiencies.

Musk's Call for Modernization: 🚀 Musk criticized this outdated method, emphasizing the need for modernization to improve efficiency and reduce government waste. He noted that the speed of the mine's elevator limits the number of retirements processed monthly, underscoring the system's obsolescence.

Potential Boost for Iron Mountain: 📈 Despite Musk's criticism, Iron Mountain, the company managing the storage facility, may benefit from increased attention. The spotlight on outdated government processes could lead to contracts for digitizing records, potentially boosting Iron Mountain's business prospects.

TODAY’S TOP NEWS

Zuckerberg's Rightward Shift Sparks Internal Discontent at Meta

Alignment with Trump Administration: 🤝 Meta (META) CEO Mark Zuckerberg has initiated policy changes to align more closely with President Donald Trump's administration, including ending the company's fact-checking program and relaxing content moderation to emphasize free speech. These moves aim to reduce perceived political bias and censorship on platforms like Facebook and Instagram.

Internal Employee Concerns: 🛑 Within Meta, employees have expressed unease over the company's political pivot and recent policy changes. Reports indicate that staff members voicing dissent are being cautioned that negative comments about the company or its leadership could impact their performance evaluations, leading to a culture of self-censorship.

Targeting Competitors: 🎯 Zuckerberg's strategy appears to include diverting regulatory scrutiny toward competitors, notably Apple (AAPL). Meta has criticized Apple's restrictive ecosystem and policies, which have previously impacted Meta's advertising revenue. This approach suggests an effort to shift antitrust attention away from Meta by highlighting Apple's market practices.

KEEP READING

OpenAI rejects Musk’s takeover offer, says it was ‘not a bid at all’ (CNBC)

Google AI Chief tells employees company has ‘all the ingredients’ to hold AI lead over China’s DeepSeek (CNBC)

MoneyLion has teamed up with Beast Games to give MoneyLion users a chance at game-changing cash (ML)

Ready to Take 2025 by Storm? (ML)

How to Financially Prosper this Chinese New Year: Year of the Wood Snake (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

REFERRAL PROGRAM

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.