TLDR

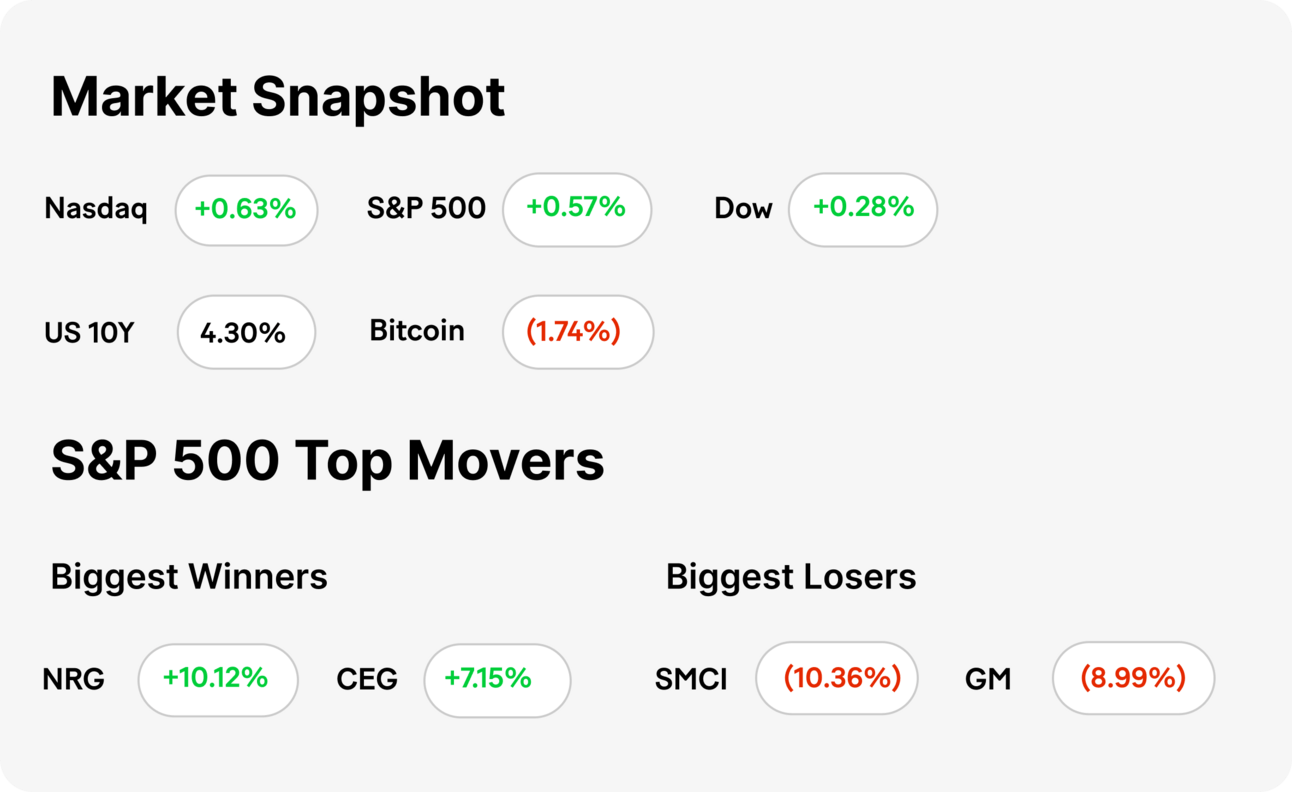

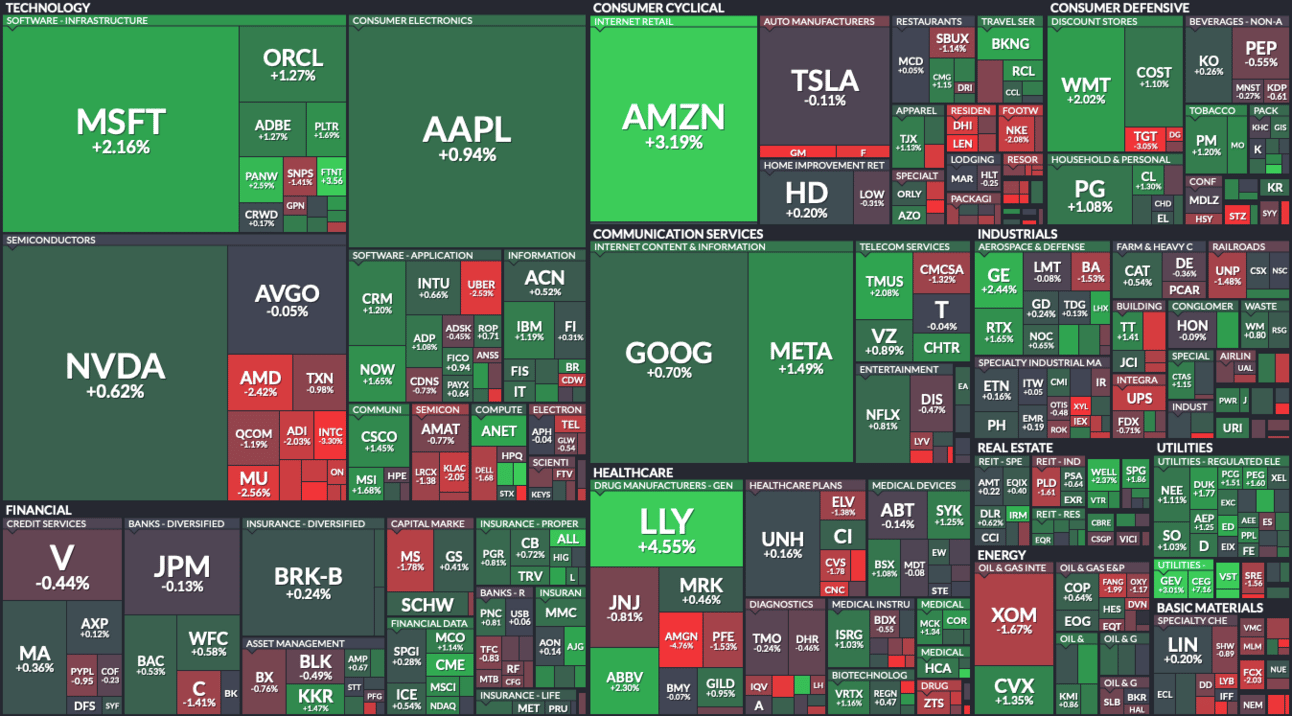

MARKET RECAP → Stocks rallied on Tuesday, with the S&P 500 (VOO) and Dow Jones (DIA) hitting new highs as investors shrugged off President-elect Trump's tariff threats.

AUTOMAKER SHARES DROP ON TARIFF THREAT → 🚗 Auto stocks slid as Trump threatened 25% tariffs on Mexico and Canada imports, shaking manufacturing giants like GM (GM) and Stellantis.

BEST BUY CUTS FULL-YEAR SALES FORECAST → Best Buy (BBY) slashed its sales outlook after weaker Q3 results, citing sluggish demand and cautious holiday expectations despite new tech launches. 📉

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Automaker Shares Drop On Tariff Threat

🔧 Automaker stocks tumbled after President-elect Trump threatened 25% tariffs on imports from Mexico and Canada, targeting key manufacturing hubs. General Motors (GM) and Stellantis, heavily reliant on these countries for production, saw significant losses in early trading.

🚚 The automotive sector, responsible for over a quarter of Mexico-to-U.S. imports, braced for disruption. Analysts viewed Trump’s move as a negotiation tactic to revise the U.S.-Mexico-Canada Agreement rather than a definite policy.

💼 While tariffs remain uncertain, analysts expect Canada and Mexico to engage in talks to avoid economic fallout. Meanwhile, foreign automakers with U.S. production footprints also saw declines in share prices.

TODAY’S TOP NEWS

Best Buy Cuts Full-Year Forecast

Best Buy (BBY) reduced its full-year sales forecast and reported weaker-than-expected Q3 revenue, with net sales falling to $9.45 billion. Comparable sales declined by 2.9%, driven by slower demand in home theater systems, gaming, and appliances.

CEO Corie Barry cited muted September and October sales due to macroeconomic uncertainty, election distractions, and customers waiting for discounts. Recent weeks showed slight improvements with holiday shopping, but the company expects uneven sales patterns.

Despite new AI-enabled devices and fresh product lines like Apple (AAPL) iPads, sales growth in computing and services categories couldn’t offset declines elsewhere. Best Buy remains cautious, citing inflation and potential tariff impacts as looming challenges.

A MESSAGE FROM OUR PARTNER

Novaxidil Triple Action Hair Regrowth Treatment

Stop Hair Loss, AND Stimulate ReGrowth

Only Clinically Proven Ingredients

Minoxidil, K-Conazole, Nicotinamide, Vitamin-K, Biotin, and Collagen Peptides.

KEEP READING

Abercrombie expects a strong holiday quarter as growth run continues (CNBC)

Walmart pulls back on DEI efforts, removes some LBGTQ merchandise from website (CNBC)

Billionaire Jersey Mike’s CEO still gets behind the counter to slice deli meat like he did at age 14: I do it ‘every time I’m in a store’ (CNBC)

Dictionary.com has named its word of the year, and it isn’t ‘brat’ (CNN)

Hong Kong is becoming a hub for financial crime, US lawmakers say (CNN)

How Much of a Personal Loan Can I Get? Top Factors (ML)

When Were Credit Cards Invented? Unpacking The History (ML)

17 Credit Card Facts You Should Know (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

The Bull vs. Bear Merchandise Promotion is a limited time campaign that begins on December 1, 2023 at 12:00 AM ET and ends on the date that there are no more Rewards. This Promotion is available to any registered MoneyLion user who is a legal resident of the 50 United States or the District of Columbia and who has reached the age of majority in their state as of the beginning of the Promotional Period. See terms and conditions here.

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.