TLDR

MARKET RECAP → Stocks rose Friday, reversing a week of brutal down days as investors were spared from a flurry of tariff-related headlines.

TECH SELL-OFF ERADICATES $2.7 TRILLION FROM 'MAGNIFICENT SEVEN' → 📉 Over the past three weeks, leading tech companies, including Alphabet (GOOG), Amazon (AMZN), and Tesla (TSLA), have collectively lost approximately $2.7 trillion in market value due to escalating trade tensions and recession fears.

GOLD HITS RECORD $3,000 AS MARKETS SCRAMBLE FOR SAFETY → Gold surged past $3,000 as Trump’s trade war rattled markets, sending investors fleeing to safe-haven assets. Central banks kept stockpiling gold, hedging against inflation and geopolitical risks.

Was this email forwarded to you? Sign up for free here.

TODAY’S TOP NEWS

Tech Sell-Off Erases $2.7 Trillion from 'Magnificent Seven'

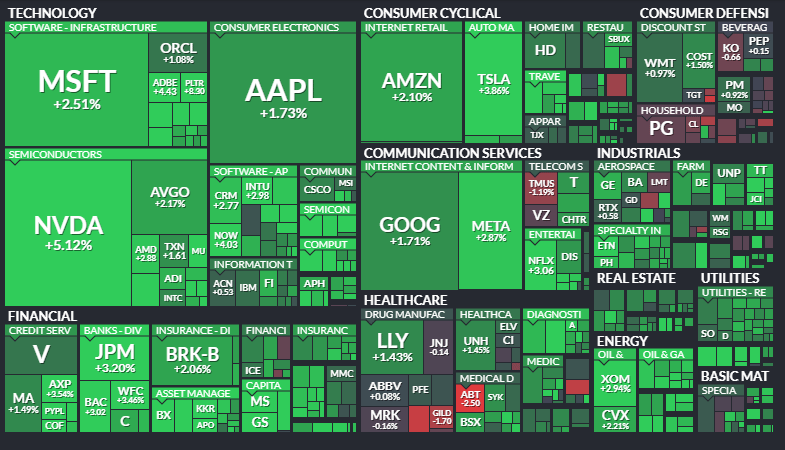

Grok AI / MoneyLion Markets Daily

Market Turmoil: 📉 Over the past three weeks, the 'Magnificent Seven'—Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Meta Platforms (META), Nvidia (NVDA), and Tesla (TSLA)—have collectively lost approximately $2.7 trillion in market value. This decline is attributed to escalating trade tensions and recession fears.

Tesla's Sharp Decline: 🚗 Tesla's stock has been particularly affected, plunging 15% in a single day and marking a 50% drop from its all-time high in December. Factors include reduced shipments to China, declining European sales, and CEO Elon Musk's close association with President Trump, which has sparked consumer backlash.

Investor Sentiment: 💼 The aggressive trade policies of the Trump administration have heightened investor anxiety, leading to a significant market downturn. The S&P 500 (VOO) has fallen over 8% from its February 19 peak, erasing more than $4 trillion in market value.

TODAY’S TOP NEWS

Gold Hits Record $3,000 As Markets Scramble For Safety

$3K: Gold surged past $3,000 per ounce as President Donald Trump’s escalating trade war rattled financial markets, driving investors toward safe-haven assets amid fears of inflation and recession. The U.S. stock market has shed $5 trillion in three weeks.

Banks Want In: Central banks ramped up gold buying, with net purchases of 18 metric tons in January. The People’s Bank of China continued its buying spree, adding to the 1,045 metric tons acquired by global central banks last year.

Safety Net: Investors increasingly viewed gold as a hedge, with 52% of global fund managers telling Bank of America that gold is the best protection against a full-blown trade war. Governments also sought gold as an alternative to the U.S. dollar, wary of potential financial weaponization.

KEEP READING

U.S. consumers are starting to crack as tariffs add to inflation, recession concerns (CNBC)

German parties agree on historic debt deal, Reuters sources say (CNBC)

BMW posts 37% drop in annual net profit, warns of ‘subdued’ Chinese demand (CNBC)

As Social Security faces an uncertain future, some question whether the program should be privatized (CNBC)

Chinese battery giant CATL posts annual revenue drop ahead of Hong Kong listing (CNBC)

Girl Math: Empowering or Exploiting? How to Reclaim It for Financial Success (ML)

Ready to Take 2025 by Storm? (ML)

8 Fun Ways to Maximize Your MoneyLion Experience — and Get Control of Your Finances (ML)

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

RiskReversal Media — Expert-led content redefining financial media

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

REFERRAL PROGRAM

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.