TLDR

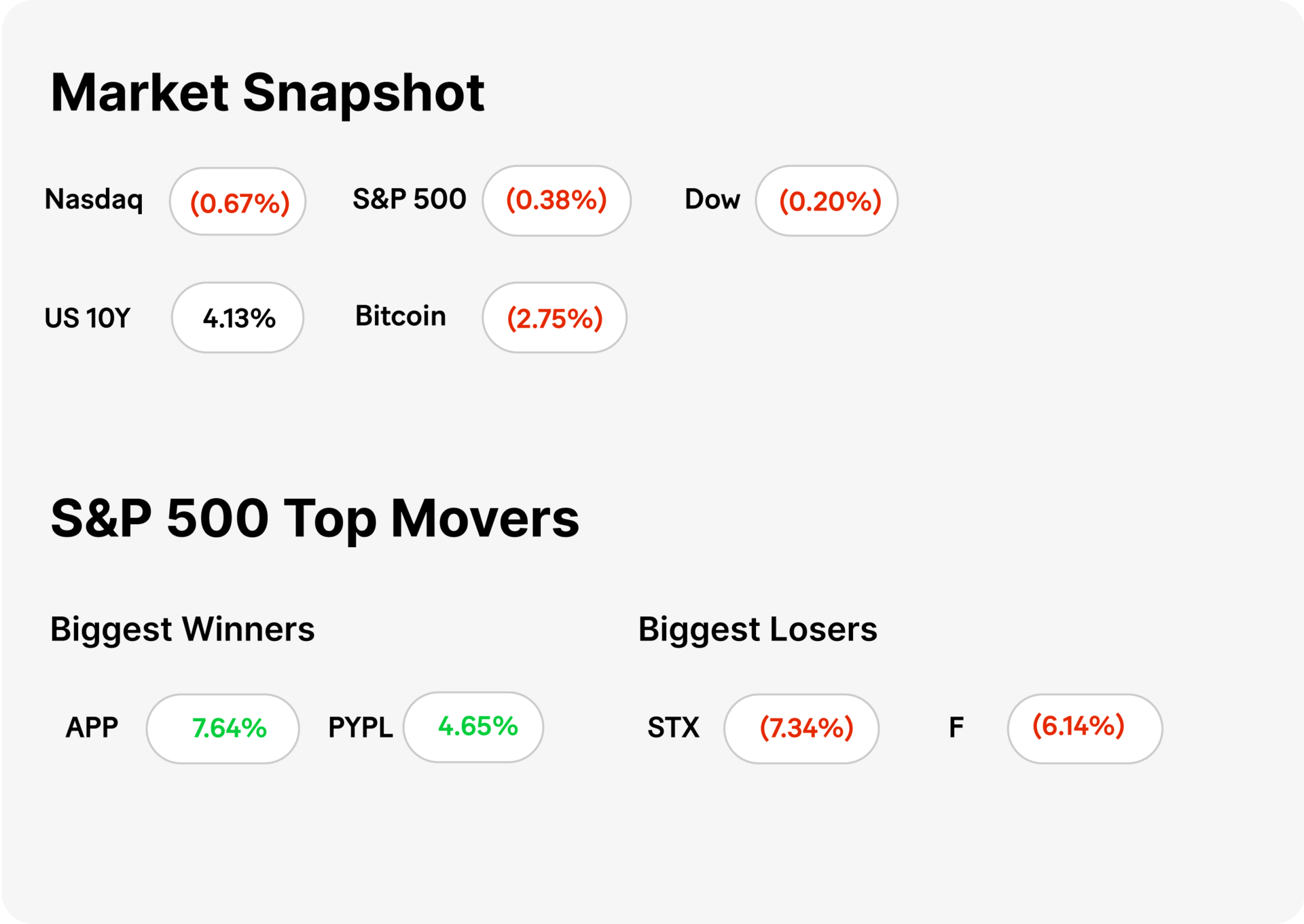

💹 MARKET RECAP → The S&P 500 (VOO) broke a 7-day winning streak on Tuesday as the index was dragged down by Oracle (ORCL) as optimism around AI-fueled profitability waned. It’s an unusual sight to see fear and greed both rising, but in this market that’s what has been developing (see Chart of the Day below).

🥇 DALIO’S GOLD PLAY → Ray Dalio says the U.S. faces 1970s-style instability and urges investors to overweight gold as debt, inflation, and political strains undermine confidence in the dollar.

⚡ TESLA HITS THE BRAKES → Tesla (TSLA) delays its Roadster again to fast-track a low-cost EV under $30K, a strategic pivot that could boost market share but strain margins.

Was this email forwarded to you? Sign up for free here.

A MESSAGE FROM OUR PARTNER

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

MARKETS

Market Snapshot

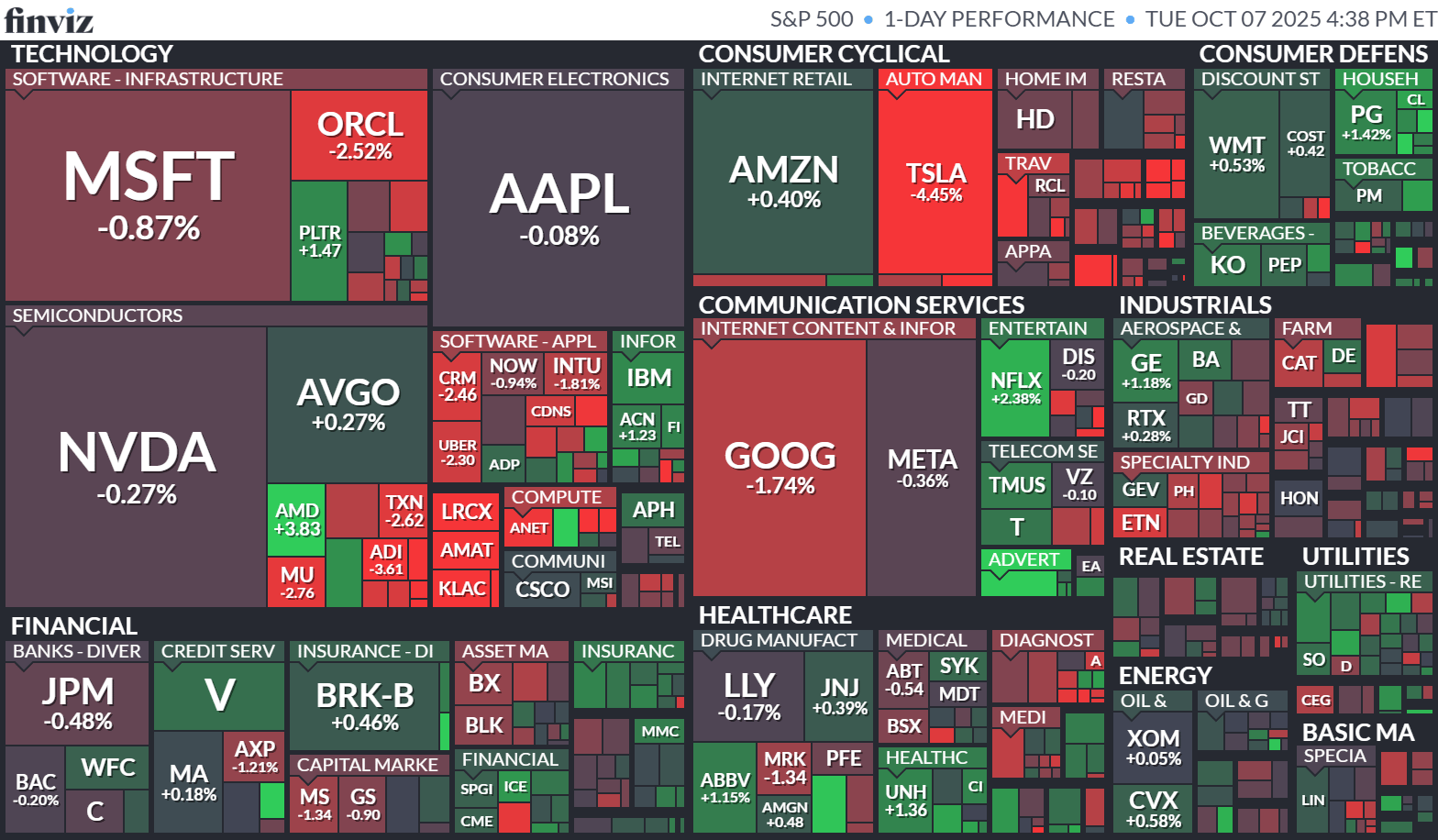

Today’s S&P 500 Heatmap

Notable Earnings This Week

Chart of the Day: Fear & Greed Rise Together

The S&P 500 (“risky” assets), gold prices (a “safe haven” asset) and the VIX (Wall Street’s “fear gauge”) have all been on the rise, reflecting a rare trend that speaks to the wide range of opposing forces that have been impacting investor behavior in recent weeks.

TradingView / MoneyLion Markets Daily

HOT TAKES

Dalio’s Gold Play

Gemini

🥇 Echoes of the 1970s. Bridgewater Associates founder Ray Dalio says today’s economy resembles the early 1970s, marked by high debt, political tension, and “monetary instability.” His advice: investors should hold more gold than usual.

💵 Dollar doubts rising. Dalio warned that ballooning U.S. deficits and growing distrust in government finances could weaken the dollar over time, making hard assets like gold and commodities safer long-term stores of value.

⚖️ Diversify or drift. While not predicting immediate crisis, Dalio says cash and bonds could underperform as central banks wrestle with inflation and debt service costs — conditions ripe for volatility and asset repricing.

AUTO

Tesla Hits the Brakes

Gemini

🚗 Roadster delayed again. Tesla (TSLA) has pushed back its long-awaited Roadster supercar to prioritize development of a more affordable mass-market vehicle, reflecting CEO Elon Musk’s renewed focus on scaling production over flash.

💰 Budget model takes center stage. The new entry-level Tesla—reportedly targeting a sub-$30,000 price tag—is designed to compete directly with Chinese EV makers like BYD and Xiaomi, aiming to reclaim ground in the world’s fastest-growing EV market.

⚙️ Investors mixed. While many applaud the strategy shift toward volume and affordability, others worry about delays, execution risk, and margin pressure as Tesla juggles cost controls with global expansion.

SHARE OUR NEWSLETTER FOR SWAG!

KEEP READING

NYSE parent to invest up to $2bn in prediction platform Polymarket (FT)

Gold prices keep rising, and jewelry companies are sounding the alarm (CNBC)

Consumer outlook sours as inflation expectations rise, New York Fed survey finds (CNBC)

Trump suggests not all furloughed workers will get back pay: ‘It depends’ (CNBC)

NOTABLE POSTS

WHAT WE’RE WATCHING

OUR FAVORITE TOOLS & RESOURCES

Fiscal.ai — Investment research platform combining institutional-grade financial data, analytics, and conversational AI.

Generated Assets — Turn any idea into an investable index

Polymarket — The world’s largest prediction market

Unusual Whales — Companion for uncovering unusual market activity

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

CME FedWatch Tool — Market-implied probabilities of future levels of interest rates

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

ChatGPT — Large language model-based chatbot powered by generative AI

Vimcal — Lightning-fast calendar and AI scheduling assistant

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.