TLDR

MARKET RECAP → Stocks closed lower Wednesday off record highs as investors took a breather from the euphoric start of 2026.

🤖 SERVE ROBOTICS BREAKS OUT → Jensen Huang’s CES endorsement reignited Serve Robotics (SERV), with analysts calling it a top physical-AI play and flagging nearly 100% upside as its autonomous delivery fleet scales nationwide.

🛢️ VENEZUELA OIL FLOW RESTARTS → U.S. will import Venezuelan oil on an ongoing basis and ease sanctions, signaling a dramatic pivot in energy and foreign policy with market and geopolitical ripples.

Was this email forwarded to you? Sign up for free here.

MARKETS

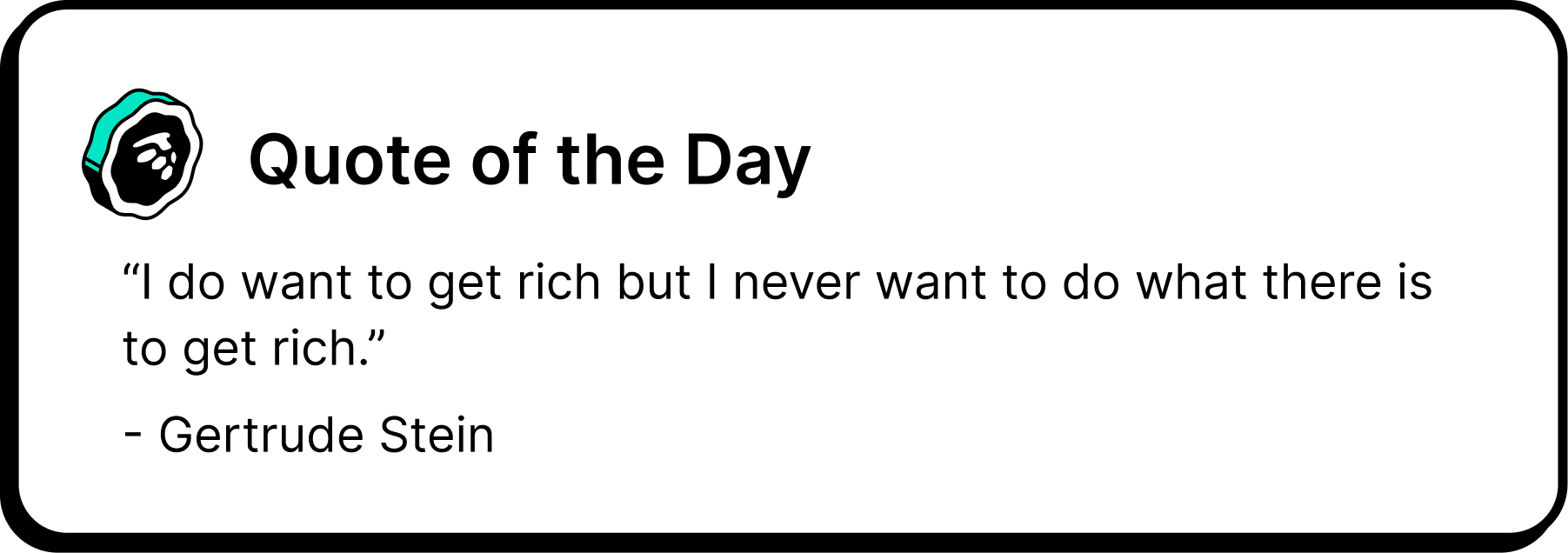

Market Snapshot

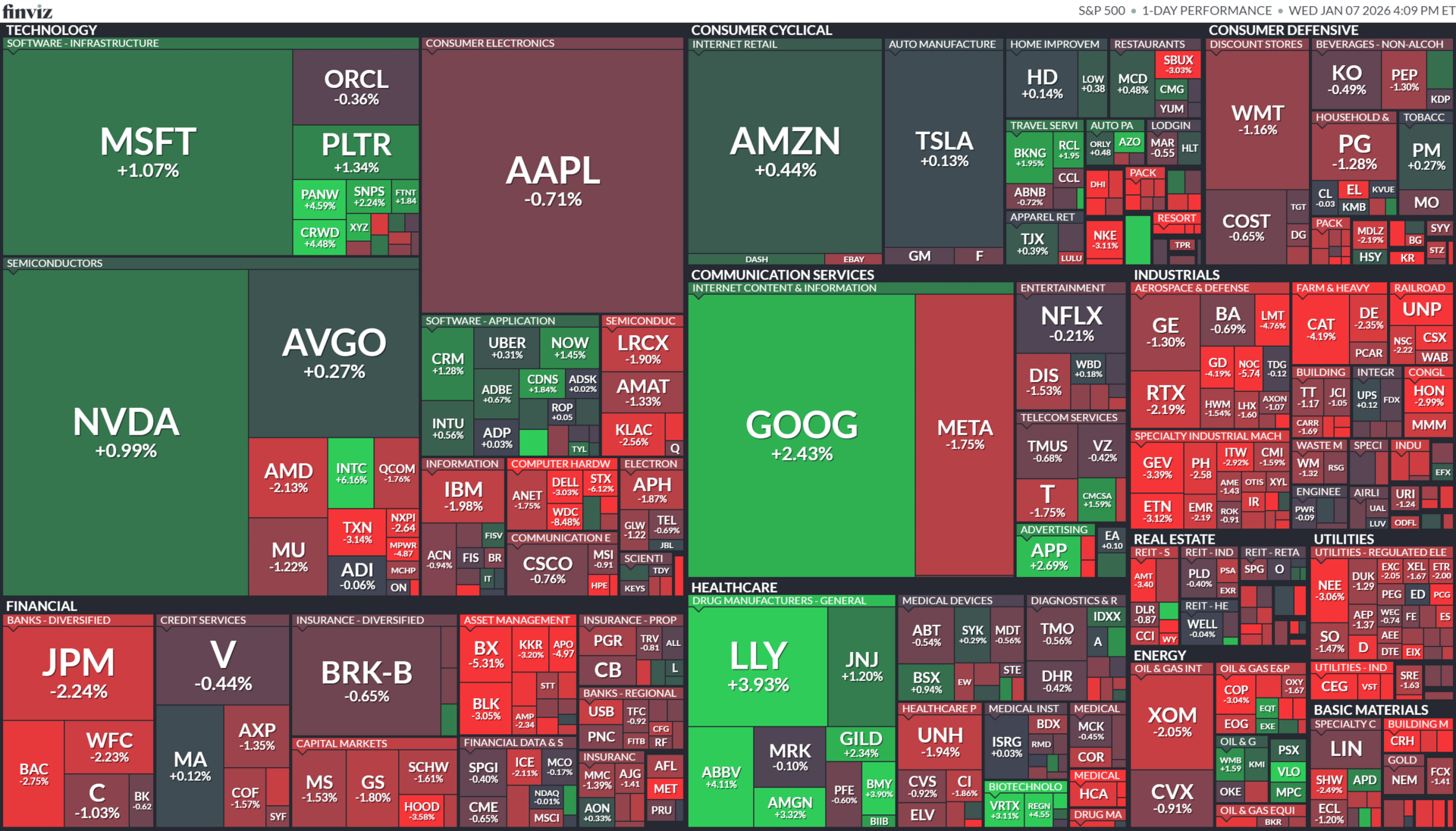

Today’s S&P 500 Heatmap

Notable Earnings

For the week beginning January 05, 2026

STOCK PICKS

Serve Robotics Breaks Out

Gemini

🤖 Jensen Huang’s shoutout lit the fuse. Nvidia (NVDA) CEO Jensen Huang publicly praised Serve Robotics (SERV) at CES 2026, calling out its autonomous delivery robot during his keynote — a rare, high-signal endorsement from the most influential executive in AI hardware. The comment reignited investor focus on Serve as a physical AI pure play.

📈 Analysts see nearly 2× upside. Northland Capital Markets reiterated an outperform rating, calling SERV one of its top 2026 picks with a $26 price target — implying ~98% upside. Bulls argue Serve’s “virtual driver” software delivers strong ROI in real-world environments, making it one of the most compelling physical-AI bets on the market.

🚚 Scale is finally showing up. Serve has deployed over 2,000 autonomous robots across major U.S. cities via Uber Eats (UBER) and DoorDash (DASH), creating the largest sidewalk delivery fleet in the country. Despite extreme volatility tied to Nvidia’s past stake changes, multiple firms now see 2026 as a revenue and margin inflection year driven by fleet expansion, data leverage, and autonomy upgrades.

ENERGY

Venezuela Oil Flow Restarts

Gemini

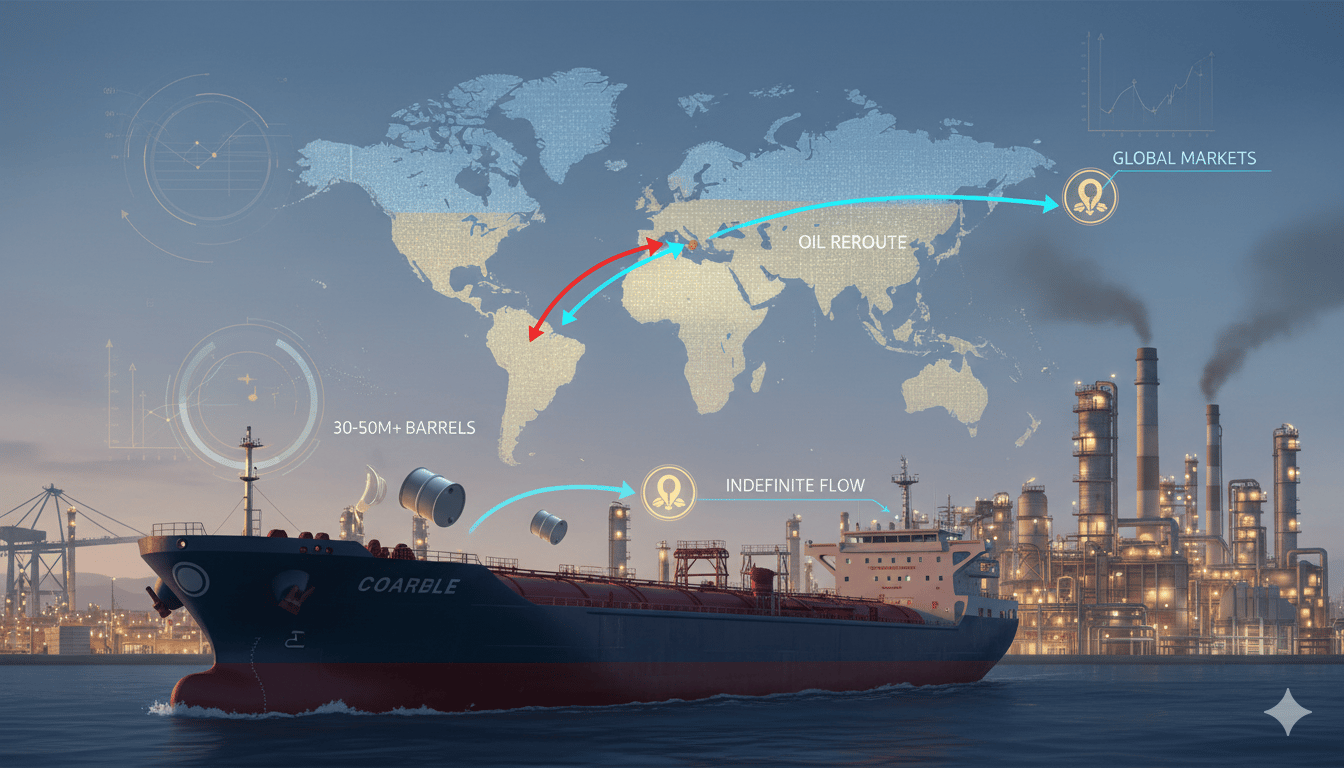

🛢️ Oil sales to U.S. now indefinite: Sources close to the White House tell CNBC that the United States plans to buy Venezuelan crude oil indefinitely, starting with an initial tranche of 30 – 50 million barrels and rolling back select sanctions to make it happen. This marks a major shift in U.S. energy and foreign policy toward Venezuela after years of blockade and sanctions.

🇻🇪 Sanctions easing part of a broader strategy: Under the emerging agreement, U.S. sanctions on Venezuela will be selectively reduced to facilitate oil exports that formerly flowed to China, re-route them to U.S. refiners, and deposit sales revenue into U.S.-controlled accounts. Energy officials believe controlling oil flows gives Washington leverage to influence broader political and economic outcomes in Venezuela.

📉 Market & geopolitical impact: The announcement has already reverberated across markets, with crude prices reacting to the prospect of renewed Venezuelan supply. The move also raises geopolitical tensions, including criticism from China and concerns over legal and regulatory frameworks governing the oil sector’s re-engagement.

KEEP READING

Alaska Airlines buys more than 100 Boeing jets in carrier’s biggest order ever (CNBC)

Netflix co-CEO says he reads this book ‘over and over’—it’s ‘the most powerful leadership story I’ve ever read’ (CNBC)

Why Trump wants Greenland — and what makes it so important for national security (CNBC)

WHAT WE’RE WATCHING

Tools & Resources

OpenBB — AI-powered research and analytics workspace

Earnings Hub — Earnings calendar

Quiver Quantitative — Quiver allows retail investors to tap into the power of big data with insights into things like congressional trades as they are disclosed

Perplexity — Perplexity AI is an AI-chatbot-powered research and conversational search engine

The Market Ear — Live news, analysis and commentary on what moves markets and trading

Coinmarketcap.com — Crypto market data

Finviz — Financial visualizations

Trading Economics — Economic calendar

Dataroma — Track stock picks and portfolios of legendary value investors such as Warren Buffett

AltIndex — Alternative datasets to uncover unique insights

GFR Smart Stock Selector — Filters stocks to help investor choices

WE WANT YOUR FEEDBACK

How would you rate today's newsletter?

Investment advisory services provided by ML Wealth LLC. Investment Accounts Are Not FDIC Insured • No Bank Guarantee • Investments May Lose Value. For important information and disclosures relating to the MoneyLion Investment Account, see Investment FAQs, Form ADV Brochure, and moneylion.com/investing. Funded managed investing accounts are subject to a monthly account fee of $1 (for accounts valued up to $5,000), $3 (for accounts valued over $5,000, and up to $25,000), or $5 (for accounts valued over $25,000).

This advertising email was sent to you because you have a MoneyLion account. If you would like to unsubscribe, please do so using this link. We respect your right to privacy. Please do not reply to this email with sensitive information, such as an account number, Social Security number, date of birth, bank account information, PIN, password, or Online ID. The security and confidentiality of your personal information is important to us. If you have any questions or want to read more, please visit our Help Center.

MoneyLion and Pathward do not provide, nor do they guarantee, any third-party product, service, information, or recommendation. The third parties providing these products or services are solely responsible for them, as well as all other content on their websites. MoneyLion is not liable for any third party’s failure with regard to those advertised products, services, and benefits. These advertised products and services may not be FDIC insured or bank-guaranteed, and may be subject to a different privacy policy than MoneyLion’s. You should check individual offers, products, and services to become familiar with any applicable restrictions or conditions that may apply. MoneyLion may receive compensation from third parties for referring you to the third party, their products or to their website.

The influencer, creator and other content provided in the MoneyLion App (“Content”) is for informational and entertainment purposes only and should not be construed as legal, tax, investment, financial, or other advice. All Content is intended to be of a general nature, does not address the circumstances of any particular individual or entity, and may not constitute a comprehensive or complete statement of the matters discussed. MoneyLion is not a fiduciary by virtue of any person’s use of or reliance on the Content. You should consult an appropriate professional if you require any legal, tax, investment, financial or other advice. Terms and Conditions for our subscriber referral can be found here.